Markets: Opposition

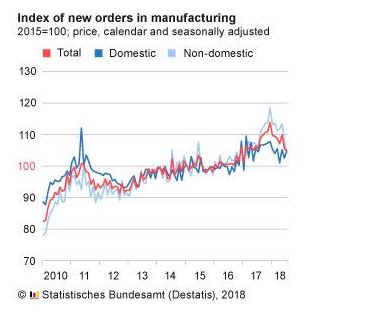

There is a bit of a Hamlet moment for trading markets this week, some want to take arm against a sea of troubles and by opposing end them. Others are less courageous. The US divergence theme isn’t going away but its meeting up with ugly politics in the US with the net result that the relentless USD bid has cracks today and the emerging markets are less scary. The urge to buy the dip and argue we have seen the capitulation seems a bit too simple. There are other themes at play mixed with the headlines of the Swedish Riksbank on hold at -0.5% but promising to hike in December or February still. SEK is the weakest of the G10 off 0.3% to the USD. Germany saw weaker factory orders but the EUR is up 0.1% on the day.

The point is growth just doesn’t always matter. There are 3 other themes at play today: 1) Global real rate spreads driving flows. Inflation data in EM and DM matter to present divergence trade. 2) EM US borrowing rates are so wide to local yields that USD bids aren’t going to go away even in the face of “value” buying. 3) US tech and the risk of regulation. Trump warned Facebook, Google and Twitter last week and the hearings this week make clear the risks. The point being that the moderation in fear of EM today is modest at best and the new themes beyond divergence are countering any feel-good-buy-the-dip ideas. So back to watching the safe-havens with gold, bonds and JPY all up. The barometer that seems most correlated to EM pain and stock wobbles is the EUR/CHF and its still flashing yellow.

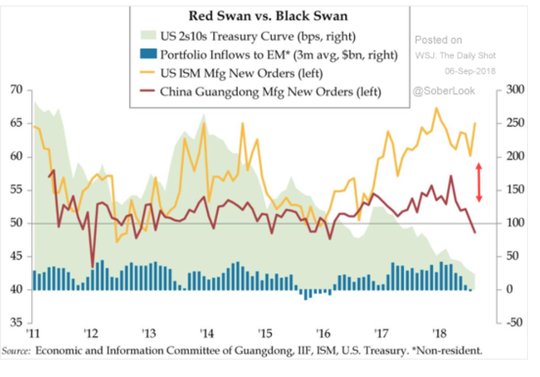

Question for the Day: Is Trade the key to risk now? The larger US trade deficit with China yesterday sent many macro types to risk-off as they figured this will spur more Trump action on tariffs and promote a harder line to China and others ahead. The split of US growth vs. Chinese moderation is notable and blamed on trade policy first. The fact that trade is a constant headline means few other stories matter unless there is a shift – which puts the Canadian talks as crucial for risk moods into the month. As for China, the squeeze up in rates there overnight is worth watching as it’s the key for CNY support in the short-term, but its not helping EM or equities much.

What Happened?

- Australia July trade surplus A$1.551bn from A$1.937bn – better than A$1.0bn expected. Exports fell 1% after 2.5% gain while imports were 0% after -0.8%.

- German July factory orders -0.9% m/m after -3.9% m/m – worse than +1.8% expected. The breakdown showed domestic orders up 2.4% m/m while foreign fell 3.4% and non-EU foreign off 4%. Capital goods -2.7% m/m, consumer goods -0.5% m/m and basic goods up 1.5% m/m. The July q/q average -2.7% from -1.6% in 2Q.

- Sweden Riksbank leaves key repo rate at -0.5% as expected. Economic activity in Sweden is strong and inflation is close to the target of 2 per cent. Rapidly rising energy prices have helped to push up inflation. If energy prices are disregarded, inflationary pressures are still moderate. As it is important for economic activity to continue to be strong and have an impact on price growth, monetary policy needs to remain expansionary. The Executive Board has therefore decided to hold the repo rate unchanged at -0.50 per cent. If the economy develops as expected, there will soon be scope to slowly reduce the support from monetary policy. The forecast for the repo rate indicates that it will also be held unchanged at the monetary policy meeting in October and then raised by 0.25 percentage points either in December or February.

Market Recap:

Equities: US S&P500 futures are up 0.1% after losing 0.28% yesterday. The Stoxx Europe 600 is flat. The MSCI Asia Pacific is down 0.4% with focus still on EM.

- Japan Nikkei off 0.41% to 22,487.94

- Korea Kospi off 0.18% to 2,287.61

- Hong Kong Hang Seng off 0.99% to 26,974.82

- China Shanghai Composite off 0.47% to 2,691.59

- Australia ASX off 1.13% to 6,267.80

- India NSE50 up 0.19% to 11,498.75

- UK FTSE so far flat at 7,386

- German DAX so far flat at 12,041

- French CAC40 so far up 0.2% to 5,271

- Italian FTSE so far up 0.4% to 20,670

Fixed Income: Too early to speak about the supply but EU bonds open mixed again with Italy and Greece leading and core wobbly despite weaker data. UK Gilt 10-year yields up 0.5bps to 1.445%, German Bunds flat at 0.378%, French OATs flat at 0.715% while Italy off 4.5bps to 3.04%, Greece off 10.5bp to 4.387% but Spain up 0.5bps to 1.447% and Porutal up 1bps to 1.865%.

- US Bonds are bid watching risk mood in EM. 2Y off 2bps to 2.647, 5Y off 0.5bps to 2.763%, 10Y off 0.4bps to 2.899% and 30Y off 0.2bps to 3.073%.

- Japan JGBs still bid watching Typhoon and BOJ – 2Y up 0.1bps to -0.126%, 5Y flat at -0.081%, 10Y off 0.4bps to 0.10% and 30Y off 0.6bps to 0.831%.

- Australian bonds see curve steeper with focus on trade, EM – 3Y off 1bps to 1.988%, 10Y up 1.5pb to 2.56%.

- China PBOC skips open market operations again, with net neutral liquidity still. Money market rates jumped with O/N up 33bps to 2.49% and 7-day up 20pbs to 2.60%. 10Y bond yields were flat at 3.62%.

Foreign Exchange: The US dollar index is off 0.15% at 95.05 with 94.94-95.20 range and focus on 94.70 after 94.95 pivot with 95.10-20 resistance then 95.50 – watching rates, trade and Trump. In EM FX USD still mostly bid, ASIA: KRW off 0.25% to 1123.80, INR off 0.3% to 71.96, TWD up 0.1% to 30.79; EMEA: TRY off 0.2% to 67.6085, RUB off 0.05% to 68.25, ZAR up 0.6% to 15.325.

- EUR: 1.1630 flat. Range 1.1614-1.1659 with US politics vs. weaker data vs. rates in play. 1.1550-1.1720 holding pattern.

- JPY: 111.35 off 0.15%. Range 111.17-111.53 with EUR/JPY off 0.1% - focus is on data ahead, US rates, politics and Typhoon damage to economy in Japan. 110-112 still.

- GBP: 1.2920 up 0.1%. Range 1.2897-1.2929 with EUR/GBP .8995 off 0.15% - focus on anything but Brexit – meaning no news is good for GBP.

- AUD: .7185 off 0.1%. Range .7211-.7166 with better trade not enough to matter like GDP, focus is on EM and rates. NZD flat at .6595

- CAD: 1.3175 flat. Range 1.3165-1.3200 with 1.32 pivot for 1.3350 but NAFTA deal hopes remain and 1.3050 seems more likely.

- CHF: .9695 off 0.2%. Range .9690-.9724 with safe haven status returning – GDP shows no pain from stronger CHF, EUR/CHF 1.1280 off 0.2% with 1.1250 pivot for 1.10 risks.

- CNY: 6.8217 fixed 0.08% stronger from 6.8266, trades weaker at 6.8385 from 6.8381 close yesterday, now flat at 6.8330 with 6.8188-6.8428 range.

Commodities: Oil up, Gold up, Copper up 1.35% to $2.6990.

- Oil: $68.75 flat. Range $68.41-$68.74 API reported at 1.2mb draw in line with expectations. The unwind of Gordon was yesterday’s story with focus on supply next.

- Gold: $1202 up 0.45%. Range $1196.50-$1204. Silver up 0.65% to $14.28. Platinum up 0.9% to $791.50 and Palladium up 0.8% to $982.50.

Conclusions: Treason or Freedom of the Press? The Wednesday afternoon news bomb of the NY Times Editorial – where a senior administration official admits to blocking the President from his worst impulses and raises the specter of Article 25 of the US Constitution removing Trump – all that matters. It matters as it highlights the fragility of the US policy and it reignites the real political risks into the mid-term elections. It matters because any reminder of US policy risks unwinding fast spook investors. The win of a Mexico trade deal is woefully insufficient to calm more centrist voters. The USD and the US S&P500 are not immune from pain in the rest of the world and trade policy, supporting dictators like Putin and deprecating allies like Merkel and May all hurt longer-term US investments.Trump didn’t rise to power in isolation. He has supporters and they are not going away.Much of the policy that has been achieved – tax reform, deregulation, stronger military – are tenants of the more traditional Republican Party that the President as overrun. The other headline against Trump that dominates the US press is the Bob Woodward book on the Trump White House. The book is released September 11. He has a host of quotes from players in the White House damning the President. The book and the editorial come at a time when the mid-terms matter – where public support for the President balances against the best economy and job market in a decade.

Economic Calendar:

- 0815 am US Aug ADP employment change 219k p 190k e

- 0830 am US weekly jobless claims 213k p 215k e

- 0830 am US 2Q productivity 0.3%p 3%e / unit labor costs 3.4%p -0.9%e

- 0830 am Canada July building permits -2.3%p +0.7%e

- 0945 am US Aug final Service PMI 56p 55.2e / Composite 55.7p 55.0e

- 1000 am US NY Fed Williams speech

- 1000 am US Aug Service ISM 55.7p 56.5e

- 1000 am US July Factory Orders (m/m) +0.7%p -0.5%e

- 1100 am US weekly EIA crude oil stocks 2.56mb p -4.21mb e

- 1230 pm SNB Zurbrugg speech

- 0230 pm BOC Wilkins speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.