Markets: Losing

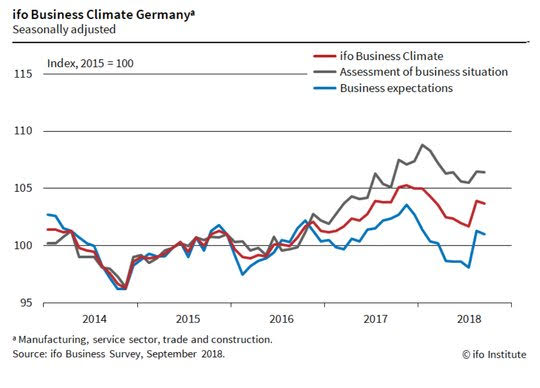

Knowing how to lose is an essential part of success. If timing is the key for getting into a trade, risk management, or cutting your losses, is the key for getting out. The overnight mood has been one about losing as the US seems to not be winning the trade war. Paradoxically, neither does China. Anyone exposed to global trade suffered last night as China calls off the trade talks with the US ahead of the tariffs and watching to see further US retaliation for their new reactionary tariffs. The ability to reflect all of this headline news was further complicated by the lack of markets as both Japan and China are closed today. This is how losing begins, slowly, then quickly, just like bankruptcy. The focus this morning is on Europe and its lower equities, higher oil prices thanks to OPEC ignoring Trump’s push for more output and the USD is stable thanks to the FOMC meeting later this week. Oil at 4-year highs matters – it will push inflation fears and focus on pass-through risks along with margin compression. Growth also remains a concern as trade wars erode confidence. The German IFO was the key economic report overnight and it slipped again, but not as much as feared. The future outlook is still below the current condition indicating slowing momentum. The Italian budget debate rages on and its enveloped the fragile coalition leading to a pain trade in BTPs. The Brexit debate rages on and its led to a plan B for UK May – talk of a snap election. The push for a Canada style free trade deal is next. Of course, today in the US brings more about the US debt and its risks for future trouble as the Treasury sells bills and 2Y notes. The USD focus is on US rates being higher and it’s just not mattering like it did earlier this year. The focus on 93.90 and risk for 92.50 seems obvious and whether that correlation matters to stocks.

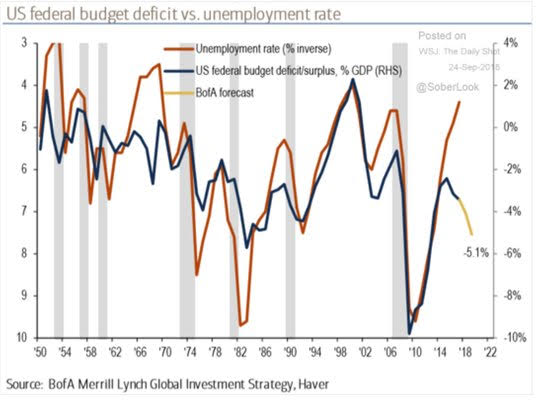

Question for the Day: Does the US deficit drive? The pro-cyclical budget of the President leaves the FOMC watching higher growth, lower employment and waiting for the inflation to happen. At the beginning of the year, the FOMC was expected to hike faster because of the tax reform and the risk for faster growth driving up inflation. The lack of such has been the Goldilocks story for equities in the US and left many scratching their heads for how to outplay the passive money flows. For the rest of the world, higher US rates, higher oil prices, and more trade barriers means trouble for anyone leveraged. US government spending means funding from the rest of the world and that leaves the USD as a key measure for how much the rate and risk premium matter.

What Happened?

- German September IFO business climate 103.7 from 103.9 – better than 103.2 expected. The current situation fell to 106.4 from 106.5 – better than the 106.1 expected. The expectations fell to 101 from 101.3 – also better than the 100.2 forecast. In manufacturing, the index fell. This was due to far poorer assessments of the current business situation, which nevertheless remain way above their long-term average. Business expectations, by contrast, climbed to their highest level since February. Manufacturers plan to ramp up production in the months ahead. In the services sector, the business climate remained almost unchanged. While service providers were more satisfied with their current business situation, they were less optimistic about their six-month business outlook. In trade, the index rose again this month. Traders upwardly revised their assessments of both the current business situation and their expectations. The main driver behind these developments was retailing while wholesaling lagged behind slightly. In construction, the business climate index continued to rise this month. The business climate and its sub-components hit new record highs. Contractors reported a steady stream of incoming orders.

Market Recap:

Equities: The S&P500 futures are off 0.2% after losing 0.04% Friday. The Stoxx Europe 600 is off 0.3% with autos and miners suffering. The MSCI Asia Pacific was only partially open, off 1% while the MSCI all-country World fell 0.2% the first drop in a week and the EM index fell 0.7%.

- Japan Nikkei closed for holiday

- Korea Kospi closed for holiday

- Hong Kong Hang Seng off 1.62% to 27,499.39

- China Shanghai Composite closed for holiday

- Australia ASX off 0.09% to 6,299.50

- India NSE50 off 1.58% to 10,967.40

- UK FTSE so far off 0.1% to 7,482

- German DAX so far off 0.3% to 12,392

- French CAC40 so far off 0.2% to 5,483

- Italian FTSE so far off 0.7% to 21,392

Fixed Income: The EU bonds catch up to US moves Friday, reflect oil moves as well – UK Gilts hit hardest on Brexit issues – 10Y yields up 2.5bps to 1.575%, German Bunds up 1bps to 0.47%, French OATs up 1.7bps to 0.792%. The periphery reflects the Italy political issues around the budget – BTPs up 6.5bps to 2.89%, Spain up 0.5bps to 1.495%, Portugal up 0.5bps to 1.865%, Greece up 3.5bps to 4.06%.

- US Bonds are lower despite the equity mood, focus is on supply, FOMC – 2Y up 0.9bps to 2.809%, 3Y up 1.1bps to 2.90%, 5Y up 1.4bps to 2.962%, 10Y up 1.7bps to 3.08% and 30Y up 1.7bps to 3.217%

- Japan JGBs on holiday.

- Australian bonds modestly curve steepen, watching US/China. 3Y off 0.5bps to 2.10%, 10Y up 0.5bps to 2.70%.

- China PBOC on holiday.

Foreign Exchange: The US dollar index is off 0.1% to 94.08 with GBP leading moves – range 94.06-94.36. In EM, USD mixed – EMEA is USD offered: ZAR up 0.7% to 14.218, RUB up 0.8% to 65.93 and TRY up 1.3% to 6.21; ASIA is USD bid: TWD flat at 30.688, INR off 0.6% to 72.62, KRW off 0.4% to 1119.

- EUR: 1.1765 up 0.15%. Range 1.1724-1.1775 with focus on 1.1820 and 1.1680 for breakouts – with higher oil driving up ECB focus vs. FOMC.

- JPY: 112.60 flat. Range 112.29-112.71 with EUR/JPY 132.50 up 0.15% - equities may matter here but not yet – Abe and Trump meeting in NY focus with 112 base for 113.40 still.

- GBP: 1.3140 up 0.5%. Range 1.3056-1.3142 with UK May battling back and EUR/GBP .8955 off 0.3% reflecting EU loss with Canada style deal risk.

- AUD: .7275 off 0.2%. Range .7248-.7282 with focus on China but holiday leaves market stuck. NZD .6670 off 0.25% - RBNZ key.

- CAD: 1.2945 up 0.2%. Range 1.2911-1.2949 with NAFTA focus and oil ignored.

- CHF: .9590 flat. Range .9579-.9606 with EUR/CHF 1.1285 up 0.25% - despite Italy noise, less fear? Market watching .9550 still.

- CNY: 6.8560 up 0.15%. Range 6.8308-6.8620 with holiday noise.

Commodities: Oil up, Gold off, Copper off 0.6% to $2.8330.

- Oil: $71.93 up 1.6%. Brent up 2.2% to $80.54 with the break out of $80 in Brent opening $87 targets while $72.50 in WTI opens $76 next. OPEC refutes Trump leaving US inventories as key for the week along with global demand questions.

- Gold: $1199 off 0.1%. Watching USD and inflation with $1183-$1215 prison. Silver up 0.25% to $14.34 with $14.50 pivot. Platinum up 0.4% to $831 and Palladium up 0.6% to $1060.

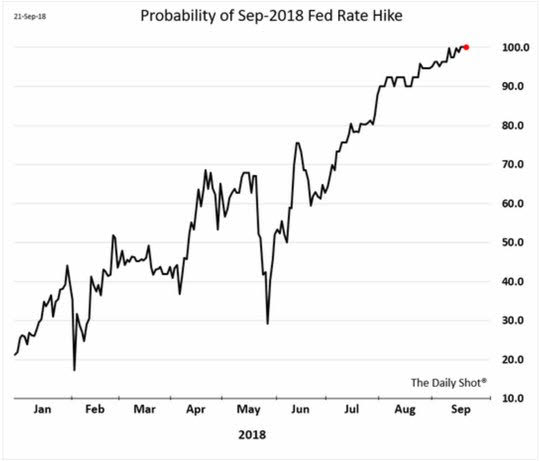

Conclusions: Does a FOMC hike have any surprises? The risk for markets in the week maybe in a dovish hike. While many worry about inflation risks to the upside driving an FOMC overreaction, others fear a recession as the current recovery gets old and trade worries hit confidence. The fact is that neither story holds and that the middle path is for a gradualist Powell Fed, one that recognizes the role of tightening too much and so will be reluctant to hike faster until they see inflation clearly overshooting. The implication is that the US yield curve should steepen as they will be late to responding. The FOMC clearly wants to gain some control over the uncertainty of future growth and inflation with the risk of a December hike over 50%, some will want to see that lower and noisy, like the history of this hike.

A dovish Fed hike would spell trouble for the USD as many see the normalization for the rest of the world intact. The RBNZ is the canary in the coal mine of such arguments this week as they are expected on hold but the new Governor Orr could tweak views on the future rate hike path up given the surprisingly strong GDP. Growth and rates seem to be key still to understanding all markets, and more directly, to understanding the central banking reaction functions.

Economic Calendar:

- 0830 am US Aug Chicago Fed National Activity Index 0.13p 0.02e

- 0830 am Canada July wholesale sales -0.8%p 0.4%e

- 1030 am US Sep Dallas Fed Manufacturing Index 30.9p 31e

- 1130 am US 3M $48bn and 6M $42bn Bill Sale

- 0100 pm US 2Y $37bn note sale

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.