Markets: Clocks

I have my great grandmother’s clock from Vienna. It doesn’t work, but I remember the chime and its loud tick-tock from my childhood where my Nana kept it safely out of my grasp on the mantle and dutifully wound it weekly. Today it’s a mess, even when it’s working, its too fast or too slow and the ring is mute but the frame is grand and the carvings ornate with worn gold leaf bringing back great memories of tea and cookies. The sparkle holds. For anyone that trades or invests, the clock is the perfect analogy of the last week. We are all pushed to believe in future expectations driving the present crisis of volatility where confidence cracks under the weight of earnings outlooks and growth doubts even as the Fed promises to be data reactive. The OECD Business Cycle Clocks for the US and China are worth thinking about here - where one points up and the other down.

There is a fond memory of the QE and ZIRP days with little recognition that the value of the broken policy clock still has some purpose other than tired sentiment. Financial Conditions become everything in such an environment and the washout of risk last week puts into doubt the hope for a holiday rally let alone any happy new year.

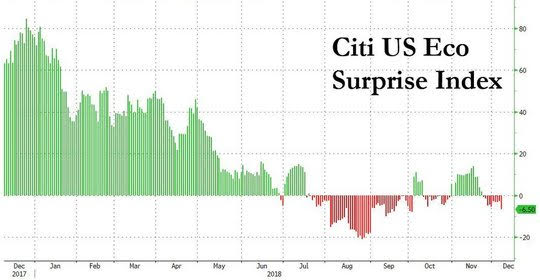

The economic data becomes that much more important in such a world with the US surprise index justifying the present price worry. Whether this sentiment can last another week without a bounce back looks important. Remember even broken clocks are right twice a day.

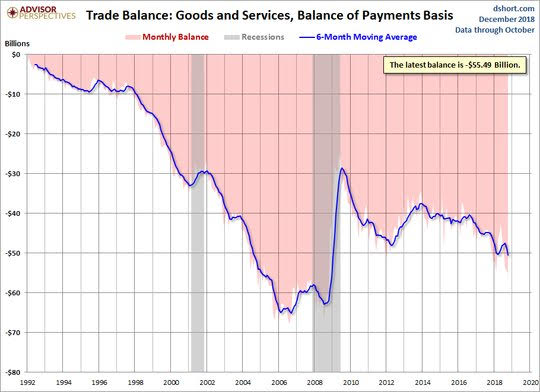

Question for the Week Ahead: Is trade a tool for a broader rethinking of US policy? The focus on US and China trade talks and their importance to the 2019 global growth story remains the central driver for markets in December. Forget any Santa Claus rally – this is about Trump and Xi actualizing their truce into real outcomes. The US trade deficit was worse as reported through October. The role of China in this deficit is significant and this harkens back to the Japan/US issues of the 1980s.

The China November trade surplus that came out this weekend shows an even larger gap for the US at $35.5bn – some of which maybe the stockpiling effect of tariffs. China exports rose 9.7% y/y to $46.2bn while imports fell 25% to $10.6bn. For the year-to-date China total trade with the US is up 7.2% to $557bn which is 13.7% of the total China trade story. The overall China trade surplus was weaker with exports slowing to 5.4% and imports slowing to 3%. In particular, imports of soybeans plunged by 38 per cent, while iron ore, coal and steel imports also fell.

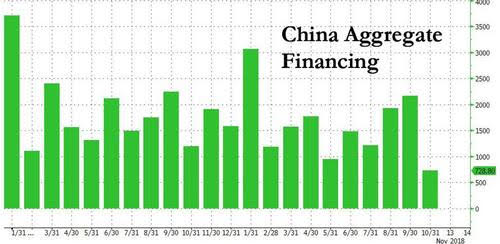

The problem with trade pressures on China from the US is the effect it has on global growth. The hit to capex globally is the concern. Cheaper money from the PBOC maybe a solution but credit growth is more than just about supply, its also about demand. Government support for growth to offset the trade tensions hasn’t yet shifted sentiment.

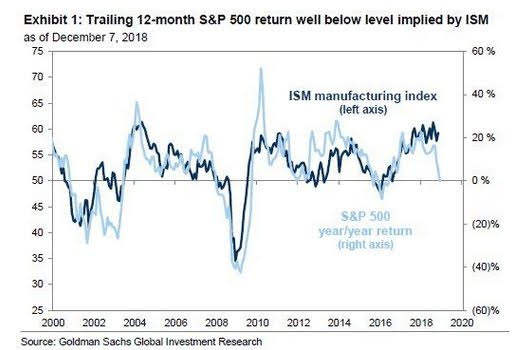

Market Recap: Even with a Trump/Xi trade truce after a dinner at the G20, even with better ISM reports and a Wednesday day of mourning for George HW Bush the US markets fell apart with fears about a growth slowdown and geopolitics all driving.

Equities: The MSCI all-country World Index fell 4.98% on the week to 473.88. The MSCI EM index fell 1.36% to 981.37 on the week. The pain trade in US/Europe led the global weakness while China squeaked out a gain.

- The S&P500 fell 3.82% to 2633.08 on the week. The DJIA fell 3.75% to 24,388.95 on the week and the NASDAQ fell 4.18% to 6,969.25 on the week. The Cboe VIX rose 5.16pp to 23.23 up 28.56% on the week.

- The Stoxx Europe 600 fell 3.37% to 345.45 on the week. The German DAX fell 4.17% to 10,788.09 on the week. The French CAC40 fell 3.81% to 4,813.13 and the UK FTSE fell 2.9% to 6,778.11. The Italian FTSE MIB fell 2.33% to 18,741.98.

- The MSCI Asia Pacific Index fell 1.80% to 150.86 on the week. The Japan Nikkei fell 3.01% to 21,678.68 on the week. The Hong Kong Hang Seng fell 1.67% to 26,063.76 on the week. The China Shanghai Composite rose 0.68% to 2,605.89 on the week. The Korea Kospi fell 1.01% to 2,075.76 on the week. The Australia ASX 200 rose 0.15% to 5,757.90 on the week. The India Nifty50 fell 1.68% to 10,693.70 on the week.

Fixed Income: Global bond markets rallied led by the US as it unwound some of the Fed rate hikes built into December and beyond. This followed an inversion of the 2Y-5Y yield curve which sparked talk of a 2019-2020 recession risk. Some of the focus on inversion relates to US deficits and the way the US Treasury funds itself with the auctions next week a key focus. The equity market weakness and the doubts about growth drove the moves along with geopolitical doubts. The Trump/Xi trade truce was not seen as sustainable nor is Brexit or the Italian Budget issue seen as easily resolved.

- US bonds rallied with focus on curve flattening/inversion– For the Week: 2Y off 9bps to 2.72%, 3Y off 11bps to 2.72%, 5Y off 14bps to 2.70%, 10Y off 16bps to 2.857%, 30Y off 16bps to 3.15%

- Canadian 10-year bond yields fell 19bps to 2.08% on the week– despite a winning jobs report, Canada saw a dovish BOC decision.

- Japan JGB yields fell 3bps to 0.058% on the week– with growth signals mixed, BOJ still main driver.

- Australian 10-year bond yields fell 20bps to 2.44% on the week with weaker data, trade doubts driving.

- UK Gilt yields fell 9bps to 1.27% on the week– Brexit dominates still with Dec 11 seen as a political mess for May.

- German Bund yields fell 6bps to 0.25% on the week– at the edge of support with ECB next key, data mostly weaker supporting

- French OAT yields rose 1bps to 0.70% on the week– with the yellow vest crisis forcing budget mess and doubts

- Italian BTP yields fell 8bps to 3.13% on the week– hope for an EU budget deal higher.

- Spain Bono yields fell 5bps to 1.47% on the week– watching politics more closely after PM’s party lost provincial election

- Portugal 10-year bond yields fell 3bps to 1.80% on the week– tracking Spain more than Italy now.

- Greek 10-year bond yields flat on the week with politics/growth in doubt.

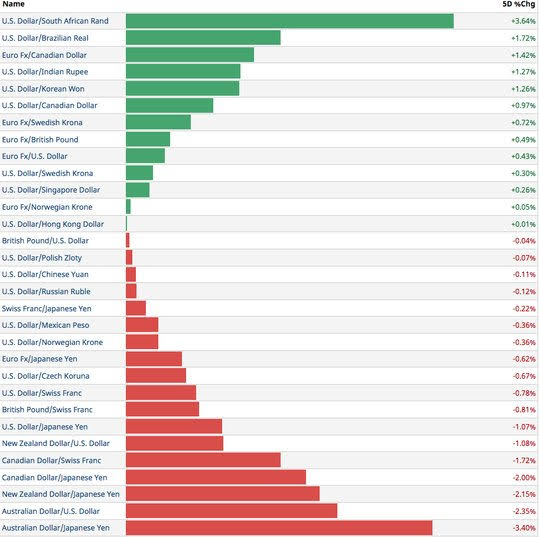

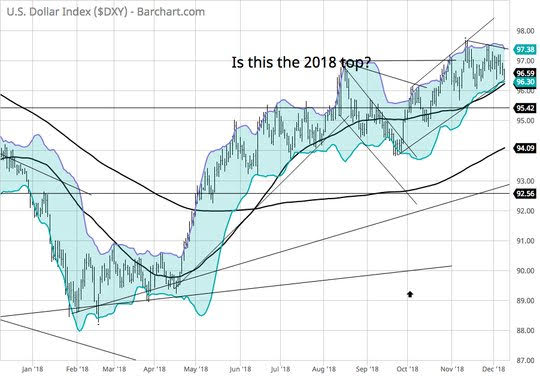

Foreign Exchange: The US dollar index fell 0.78% to 96.51 on the week – with 97.60 double top fears rising. In EM the USD was mixed– EMEA: RUB up 0.1% to 66.384, ZAR off 3.6% to 14.17; ASIA:CNY off 0.35% to 6.898, KRW off 0.4% to 1123.8, INR off 1.75% to 70.85; LATAM: MXN up 0.45% to 20.271, BRL off 1.05% to 3.906.

- EUR: 1.1405 up 0.75% on the week with focus on 1.13-1.15 again and ECB as key driver and risk along with Brexit next.

- JPY: 112.45 off 1.05% on the week with focus on equities hurting and US basis supporting - 112 key pivot still. EUR/JPY off 0.6% to 128.20

- GBP: 1.2720 off 0.3% on the week with Brexit fears fully priced into Dec 11 with most seeing no deal. EUR/GBP up 0.5% to .8965

- CHF: .9900 off 0.8% on the week with equities/Brexit countered by Italy hopes. 1.00 key for $ momentum.

- AUD: .7185 off 1.75% on the week with A$ unwinding trade truce highs and .7350 now key resistance for .7050 again. NZD off 0.2% to .6865 with RBNZ seen moving well before RBA.

- CAD: 1.3325 up 1% on the week with dovish BOC key and better jobs not enough to cancel equity risk off/geopolitical fears with China

Commodities: The S&P/GSCI rose 2.4% to 2,446.55. NatGas led the gainers while coffee and platinum retreated while oil was mixed.

- Oil: $52.36 up 2.8% on the week. Brent flat at $61.45 on the week – OPEC cut output and helped steady market but equities, growth doubts nag. USD weakness and $50 bids in WTI key.

- Gold: $1256 up 1.3% on the week– with breakout due to USD weakness and equity risk-off with $1248 key pivot for $1268 next. Silver up 1.5% to $14.72 with $14.50 base for $14.92 retest. Platinum off 2% to $794.60 with auto fears, Palladium up 0.1% to $1166.60 – both on the week.

- Corn: $385.40 up 2.05% on the week with trade hopes and weather key. Soybeans rose 2.45% to $916.60. Wheat rose 1% to $581.40.

- Copper: $2.7275 off 2.8% on the week– tracking equities, home building doubts, China fears. Iron Ore bounced on trade hopes, better data with Jan up 2.9% to $65.09.

Calendar for the Week Ahead:This week brings SNB, ECB decisions and forecasts, US auctions,

Monday, December 10: Japan GDP revision, German Trade, UK IP

- 0745 am BOC Lane speech

- 0815 am Canada Nov housing starts 206kp 196ke

- 1000 am US Oct JOLTS job openings 7.009m p 7.2m e

- 1130 am US 3M $39bn and 6M $36bn bill auction

Tuesday, December 11: UK Brexit vote, UK jobs report, German ZEW, US PPI

- 0730 pm Australia Nov NAB business confidence 4p 5e/ conditions 12p 11e

- 0730 pm Australia 3Q house price index (q/q) -0.7%p -1.5%e

- 0100 am Japan Nov machine tool orders (y/y) -1.1% p +0.5%e

- 0430 am UK Nov claimant count 20.2kp 13kp/ Oct 3M ILO rate 4.1%p 4.1%e / 3M avg earnings 3%p 3%e / ex bonus 3.2%p 3.2%e

- 0500 am German Dec ZEW economic sentiment -24.1p -25e / conditions 58.2p 55.6e / EU sentiment -22p -23.2e

- 0540 am German 2Y Schatz sale

- 0600 am US Nov NFIB business optimism 107.4p 107.3e

- 0830 am US Nov PPI (m/m) 0.6%p 0%e (y/y) 2.9%p 2.6%e / core 2.6%p 2.5%e

- 1200 pm US WASDE report

- 0100 pm US 3Y $38bn and 10Y $24bn note sales

- 0200 pm UK Brexit vote expected

- 0430 pm US weekly API oil inventory 5.36mb p 2.1mb e

Wednesday, December 12:Eurozone IP, US CPI, Brazil COPOM

- 0630 pm Australia Dec Westpac consumer confidence 104.3p 104e

- 0650 pm Japan Nov corporate PPI (m/m) 0.3%p -0.1%e (y/y) 2.9%p 2.4%e

- 0650 pm Japan Oct machinery orders (m/m) -18.3%p +10.5%e (y/y) -7%p +5.9%e

- 0500 am Eurozone Oct industrial production (m/m) 0.9%p 0.8%e (y/y) -0.3%p +0.2%e

- 0545 am Italy 12M BOT sale

- 0830 am US Nov CPI (m/m) 0.3%p 0%e (y/y) 2.5%p 2.2%e / core 2.1%p 2.2%e

- 1030 am US weekly EIA oil inventory -7.322mb p +2mb e

- 0100 pm US sells $16bn of 30Y bonds

- 0200 pm US Nov budget statement -$100bn p -$188bn e

- 0300 pm Brazil COPOM interest rate decision – no change from 6.5% expected.

Thursday, December 13: SNB, ECB rate decisions, OPEC monthly report

- 0700 pm RBA Kohler speech

- 0730 pm RBA Bulletin

- 0800 pm Australia Dec consumer inflation expectations 3.6%p 3.5%e

- 0200 am German Nov final HICP (m/m) 0.1%p 0.1%e (y/y) 2.4%p 2.2%e / CPI 2.5%p 2.3%e

- 0230 am SNB policy decision – no change expected from -0.75% 3M Libor

- 0245 am French Nov final HICP (m/m) 0.1%p -0.2%e (y/y) 2.5%p 2.2%e / CPI 2.2%p 1.9%e

- 0445 am Spanish 3-5-10Y Bono sale

- 0545 am Italy 3-7-30Y BTP sale

- 0745 am ECB interest rate decision – no change from 0% and -0.4% policy expected

- 0830 am ECB Draghi news conference

- 0830 am US weekly jobless claims 231k p 230k e

- 0830 am US Nov import prices (m/m) 0.5%p -0.5%e / exports 0.4%p 0.2%e

- 0830 am Canada Nov ADP employment change -23k p +75k e

- 0830 am Canada Oct new housing prices (m/m) 0%p 0%e

Friday, December 14: Japan Tankan, China retail sales, IP, flash global PMIs, US retail sales, IP

- 0430 pm New Zealand Nov Business NZ PMI 53.5p 53e

- 0650 pm Japan 4Q Tankan large manufacturing 19p 17e / services 22p 20e / Large Capex 13.4p 12.7e

- 0730 pm Japan Dec flash manufacturing PMI 52.2p

- 0900 pm China Nov retail sales (y/y) 8.6%p 9%e

- 0900 pm China Nov industrial production (y/y) 5.9%p 5.9%e

- 0900 pm China Nov ytd fixed investment 5.7%p 5.8%e

- 1130 pm Japan Oct revised industrial production (m/m) -0.4%p +2.9%e (y/y) -2.5%p +4.2%e

- 0130 am India Nov WPI (y/y) 5.28%p 4.7%e

- 0230 am German Bundesbank semi-annual forecasts

- 0300 am Spain Nov final HICP (m/m) 0.7%p -0.2%e (y/y) 2.3%p 1.7%e

- 0315 am France Dec flash manufacturing PMI 50.8p 50.7e / services 55.1p 54.7e / composite 54.2p 54e

- 0330 am German Dec flash manufacturing PMI 51.8p 51.9e / services 53.3p 53.4e/ composite 52.3p 52.6e

- 0400 am Eurozone Dec flash manufacturing PMI 51.8p 51.9e / services 53.4p 53.5e / composite 52.7p 52.8e

- 0400 am China Nov M2 8%p 8%e / New Loans CNY697bn p CNY1.12trn e / TSF CNY728.8bn p CNY1.334trn e

- 0400 am Italy Oct industrial sales and orders

- 0500 am Italy Nov HICP (m/m) -0.2%p -0.2%e (y/y) 1.7%p 1.7%e

- 0500 am Eurozone 3Q labor cost index 2.2% p 2.3%e / wages 1.9%p 2%e

- 0530 am Russian central bank decision – no change from 7.5% expected.

- 0830 am US Nov retail sales (m/m) 0.8%p 0.2%e / ex autos 0.7%p 0.3%e / control 0.3%p 0.4%e

- 0915 am US Nov industrial production (m/m) 0.1%p 0.3%e / cap utils 78.4%p 78.5%e

- 0945 am US Dec flash manufacturing PMI 55.3p 55.2e / services 54.7p 55e/ composite 54.7e 54.5e

- 1000 am US Oct business inventories 0.3%p 0.5%e

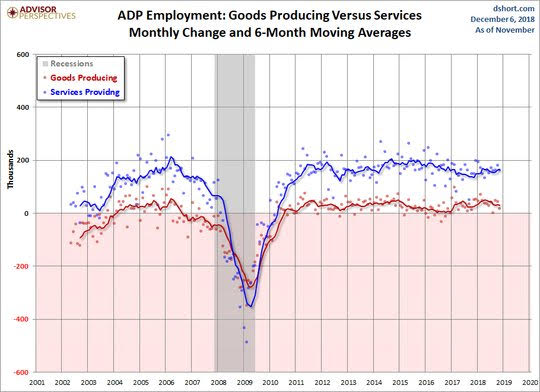

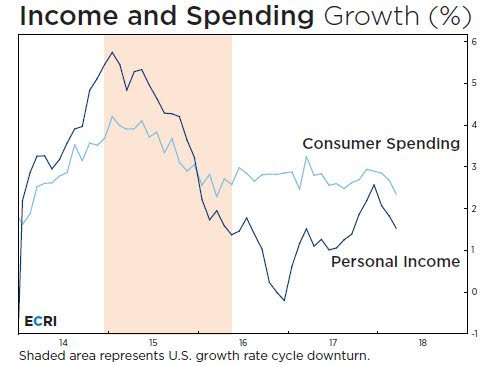

Conclusions: Does employment matter to the FOMC? The rise in weekly claims, the slowing rate of jobs growth from the US November report Friday, the lack of significant acceleration in wage pressures – all that puts the Fed into a wait-and-see mode according to the market perception of their reaction function to financial conditions. The common view is that jobs are insufficient to help or hurt the present uncertainty over US growth and policy. Yet, the US jobs report does show stability and a robust economy – things that usually mean the FOMC should continue to march to neutral policy – the question is whether jobs inform them of that level. The connection of trade concerns to jobs begins to show up in hours as goods production slows. It also showed up in the ADP report.

The key point about the labor report maybe less about the inflation fear and more about the growth fears. Hours worked, sector job growth, the pass-through of prices and its effect on final demand – all those show up. The ECRI research as reported by CNBC drove many to rethink the equation last week.

The mixing of jobs and trade and growth shows up in the USD index. This is the barometer for present and future expecations for the US vs. the rest of the world. So far in December, its pointing to a grim retest of 96 rather than any bounce to new highs. The fate of the USD maybe a foil for whether the clock chimes again for risk.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.