Markets: All Clear

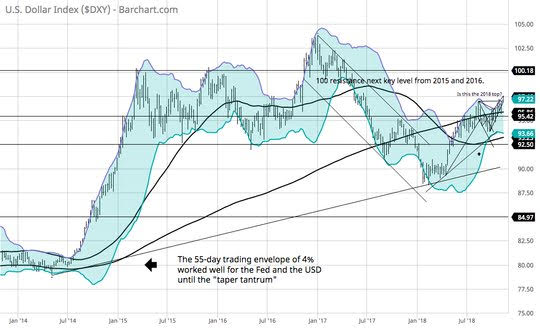

The rally up in the USD dominates price action today. The EUR slips to 16-month low as the 1.13 barrier breaks with 1.1187 the next target all on fears about Italy and Brexit. GBP loses 1% as deals continue to elude for UK/EU and politics continue nag. Oil stabilizes as Saudi unilaterally cuts its output and sees need for 1mbd more cuts in 2019 but OPEC pushes back with 106% compliance in October. The USD rally and the Oil rally aren’t enough for Europe. The fears over growth, ECB policy, EU/Italian budget clashes, EU/UK Brexit deal failures and ongoing political discord from Germany to France all make the start of the week less obvious. Many would like to believe that US divergence with growth and rates continues and that the USD is not playing a safe-haven role today as much as an obvious investment flow barometer. Whether this proves out will be hard to tell given this is a US bond holiday and that many see the markets as waiting for the more important CPI and FOMC Powell speech to decide. US rate sensitive sectors will be important to watch this week along with the usual rotational plays into year-end as many want to hear that all-clear siren for risk but hearing that for the noise of the news headlines maybe hard. The trend up in the USD seems clear with 96 base and 98 short-term target and perhaps that is all we need, as the correlations to other markets fray like the faith that it’s going to be a sunny day.

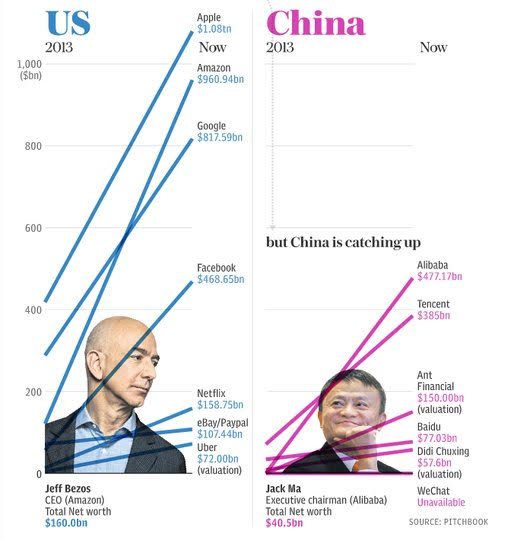

Question for the Day: Does Alibaba's Singles Day Sales matter? Worries about the state of China growth should ease modestly on the $30.8bn record sales. There are two stories wrapped in the event – first is how Beijing treats Jack Ma, second is how the company actually performs into 2019. The fact that Ma appeared at the event (albeit via video clip matters). While the event broke records, the sales growth rate clearly slowed in 2018 from the 40% climb in 2017. Also notable, Alibaba cut its full-year forecast earlier this month by as much as 6% as growth slowed in categories such as consumer electronics. And at yesterday’s event, the housing-related big-ticket items slowed down sales. The other story related is the role of the on-line retailer as the government tries to regain some controls. Overall, online retail sales growth in China slowed to 24% in the third quarter, down from 36% in the previous quarter, according to the National Bureau of Statistics. For investors, China tech and US tech are a key focus as they correlate and lift the entire regional bourses. The recent pullback in shares in both places isn’t just about US/China trade relationships and the sales event yesterday makes this clear.

There are a few other points about the Singles’ Day sales that matter – 1) Role of international retailers- Over 40% of Alibaba's Singles' Day shoppers bought from international brands, and almost 240 brands—including Apple, Dyson, Kindle, Estée Lauder, L’Oréal, Nestle, Gap, Nike and Adidas—each topped RMB 100 million ($14.4 million) in one-day GMV, Alibaba said. 2) Competition- JD.com—whose impressive list of investors and partners includes Walmart, Google, and Tencent, the parent of China’s top mobile messaging app, WeChat—said its Singles' Day transaction volume totaled RMB 160 billion, or $23 billion.

What Happened?

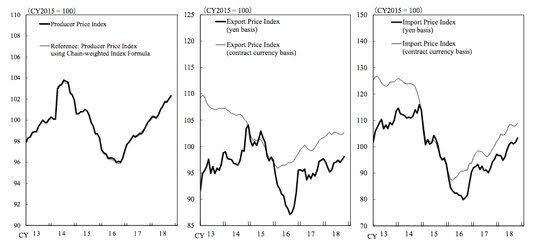

- Japan October Corporate Goods PPI up 0.3% m/m, 2.9% y/y after m/m 0.3% m/m, 3% y/y – more than 0.1% m/m, 2.7% y/y expected. Export prices rose 0.3% m/m, 1.4% y/y while import prices rose 1% m/m, 9.9% y/y. The main contributing sectors to monthly rises were 0.35% rise in oil and coal, 0.04% in electrical machinery, 0.2% in production machinery and steel. Electricity, gas, water dropped 0.18% m/m while agriculture fell 0.4%.

- Japan October machine tool orders -1.1% y/y after revised 2.9% y/y – preliminary report. This was worse than expected and awaits the end of month confirmation.

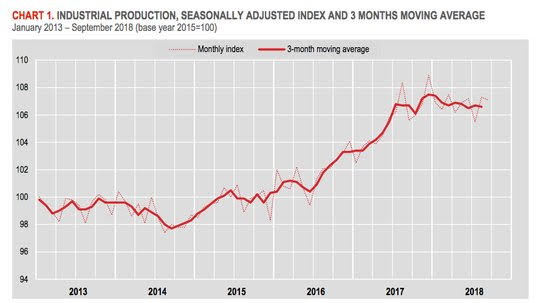

- Italy September industrial output fell 0.2% m/m, up 1.3% y/y after +1.7% m/m, -0.8% y/y – better than -0.7% m/m, -1.4% y/y expected.By industrial groupings, electricity and gas up 7% y/y, machinery and equipment up 4.5%, while mining off 11.2% and oil/coal refining off 4.7% y/y.

Market Recap:

Equities: The S&P500 futures are up 0.1% after losing 0.92% last Friday. The Stoxx Europe 600 is off 0.2%. The MSCI Asia Pacific rose 0.1% while the MSCI all-country World is off 0.2%.

- Japan Nikkei up 0.09% to 22,269.88

- Korea Kospi off 0.27% to 2,080.44

- Hong Kong Hang Seng up 0.12% to 25,633.18

- China Shanghai Composite up 1.22% to 2,630.52

- Australia ASX up 0.27% to 6,027.20

- India NSE50 off 0.97% to 10,482.20

- UK FTSE so far off 0.15% to 7,096

- German DAX so far off 0.75% to 11,444

- French CAC40 so far off 0.2% to 5,098

- Italian FTSE so far off 0.5% to 19,160

Fixed Income: US bond markets are closed today for Veteran’s Day. EU bonds opens bid with focus on Brexit and Italy still – risk-off mood driving – UK 10-year Gilt yields off 5bps to 1.438%, German Bunds off 2.5bps to 0.378%, French OATs off 2bs to 0.763% while Italy suffers up 4.5bps to 3.44%, Spain off 1bps to 1.582%, Portugal off 0.5bps to 1.93% and Greece up 1bps to 4.345%.

- Italy sold E5.5bn of 12-month Nov 2019 BOT at 0.63% with 1.67 cover.

- US Bonds closed for holiday.

- Japan JGBs bid with focus on 30Y sale next– BOJ keeps buying unchanged with Y450bn in 5-10Y. 2Y -0.1bps to -0.146%, 5Y up 0.1bps to -0.093%, 10Y off 0.3bps to 0.107%, 30Y off 0.3bps to 0.873%.

- Australian bonds rally with China growth key worry– 3Y off 1bps to 2.10%, 10Y off 2bps to 2.74%.

- China PBOC skips open market operations again, leaves liquidity neutral but bonds see curve steepening. 2Y off 4bps to 2.85%, 5Y up 1bps to 3.27% and 10Y up 1.5bps to 3.475%.

Foreign Exchange: The US dollar index up 0.55% to 97.44 with 96.96-97.57 range. In emerging markets, USD is mostly bid – EMEA: ZAR off 0.15% to 14.38, TRY off 0.15% to 5.4650, RUB up 0.35% to 67.71 with oil driving; ASIA: TWD off 0.4% to 30.888, INR off 0.55% to 72.89, KRW off 0.5% to 1133.70.

- EUR: 1.1265 off 0.65%.Range 1.1240-1.1332 with focus next on 1.1187 with 1.13 resistance.

- JPY: 113.90 up 0.1%.Range 113.65-114.21 with EUR/JPY 128.30 off 0.55% - equities drag, rates support USD with 114.20 still key.

- GBP: 1.2870 off 0.8%. Range 1.2828-1.2964 with 1.2750 next target and Brexit key still, EUR/GBP .8750 up 0.15% - with EUR hit harder.

- AUD: .7205 off 0.25%.Range .7188-.7246 with China doubts rising. NZD .6735 off 0.1% - focus is on .68 resistance.

- CAD: 1.3200 off 0.1%.Range 1.3183-1.3213 with oil bounce helping, crosses key – 1.3150-1.33 risks.

- CHF: 1.0095 up 0.65%.Range 1.0050-1.0106 with EUR/CHF 1.1370 off 0.25% - all about Italy, Brexit and EUR weakness 1.02 next key.

- CNY: 6.9476 fixed 0.21% weaker from 6.9329 Friday, trades off 0.1% to 6.9650 with range 6.9454-6.9731 with focus on 7.00 still

Commodities: Oil up, Gold down, Copper up 0.35% to $2.7670.

- Oil: $60.49 up 0.5%.Range $60.37-$61.28 with focus on Saudi calls for output cuts supporting against global demand and US energy independence. Brent up 1.2% to $71.01 with $70 base building against $72.50 resistance.

- Gold: $1206.60 off 0.25%.Range $1206-$1210 with USD driving and 200-day key at $1206 then $1200 again. Silver off 0.05% to $14.15 with $14 key, Platinum off 0.05% to $852.75 and Palladium off 0.8% to $1107.65.

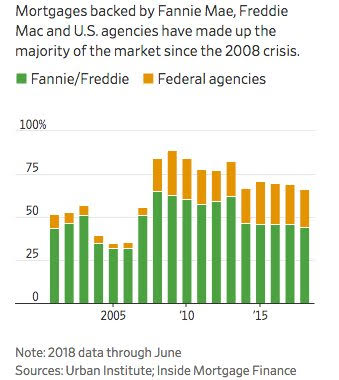

Conclusions: Is US housing the next shoe to drop? The role of FNM and FRE in housing continues even after the 2008 crisis. The White House is planning an overhaul according to the WSJ. Without Congress, Trump can push up fees on lenders and adjust the size of loans the companies can buy, among other things. The president is expected to nominate a successor to the FHFA’s Obama-appointed director in the coming weeks. Fannie and Freddie don’t make loans. They purchase mortgages from lenders and repackage them as securities that are insured if the loans default, maintaining the plumbing of the $10 trillion U.S. mortgage market. Getting Fannie and Freddie out of government conservatorship is the largest piece of unfinished business from the crisis era. While lawmakers have said overhauling the companies is a priority, they disagree on how to do it. The split in Congress come January means there is likely even less of a chance that legislation affecting Fannie and Freddie will become law.

Economic Calendar:

- 0230 pm San Fran Fed Daly speaks in Idaho on economic outlook

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.