Market Leaders Getting Crushed

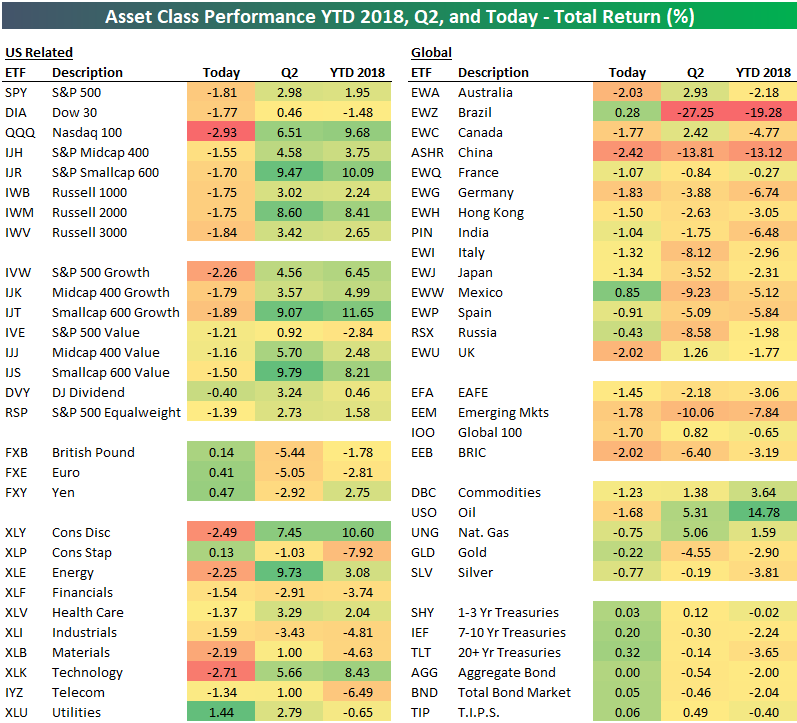

With the US stock market getting crushed to start the trading week, below is a quick snapshot highlighting the performance of various ETFs across asset classes. For each ETF, we show its performance today, quarter-to-date, and year-to-date.

Today’s market action is pretty simple to explain. We’re seeing extreme selling in the areas of the market that had been performing the best over the last couple of months.

As shown in our matrix below, the Nasdaq 100 (QQQ), small caps (IVW, IWM), Consumer Discretionary (XLY), Energy (XLE), and Technology (XLK) are the areas of the US market that are getting hit the hardest today. These are the areas that have rallied the most both YTD and in Q2. Defensive areas of the market like Utilities (XLU) and Consumer Staples (XLP) are actually catching a bid today as investors have decided to rotate out of recent winners and into more non-cyclical areas of the market.

Outside of the US, both Brazil (EWZ) and Mexico (EWW) are actually up on the day, while China (ASHR), the UK (EWU), and Australia (EWA) are down more than 2%.

(Click on image to enlarge)