Market Briefing For Friday, April 6

'Here We Go Again' - might as well be the famous old tune applicable to this market; because as the lyrics suggested: "I'll throw all your old stuff away" (China); "I'll clear you out of my head" (retreat to domestic stuff); "I'll tell everyone that we're through" (though we're really not; hence no trade war when all is sorted out); and that's "Cause I'm so much better without you" (and of course we're not and they're not; just that after what was done yesterday, by Trump and especially Kudlow; why am I not that surprised at tonight's news).

That tune continued with a: "Cause I'll break down every time you come around" line, which better describes how previous Administrations have responded to hardball plays whenever they briefly attempted protecting American industry. Trump has sworn he's not going to be a pushover.

And therein likes the rub. Yesterday I bemoaned the Kudlow commentary (despite agreeing with it) regarding this President being a 'free trader at heart', to use Larry's words. My concern, especially given the S&P's very dramatic down-and-then-up turnaround (which allowed follow-through in Thursday's market as expected), was that it would 'embolden' a tougher line with China, because of the belief there rally wouldn't be a trade war.

Well the way TO get a trade war is for the officials to keep saying there's not going to be one; the market rallies; Boeing leads; Washington again isn't taken seriously; and today's China Daily (official newspaper).. guess what.. they headlined exactly what I said last night: however putting it the context of the United States 'blinking' in the standoff on trade. They even singled out Kudlow (I just knew that would result in trouble as I have few problems with his perspective other than being a rampant Keynesian we all know; but you just can't refer to barely begun negotiations with what in this case was interpreted as a capitulation by the Chinese). It's part of a limitation of what an 'official' can say; not an observer on CNBC. Trump himself went too far by saying in advance 'we'll have a beautiful NAFTA deal; close to it; and oh if we don't get it then we'll cancel NAFTA.' But for now this is mostly about China; and (not to be overlooked) the EU role.

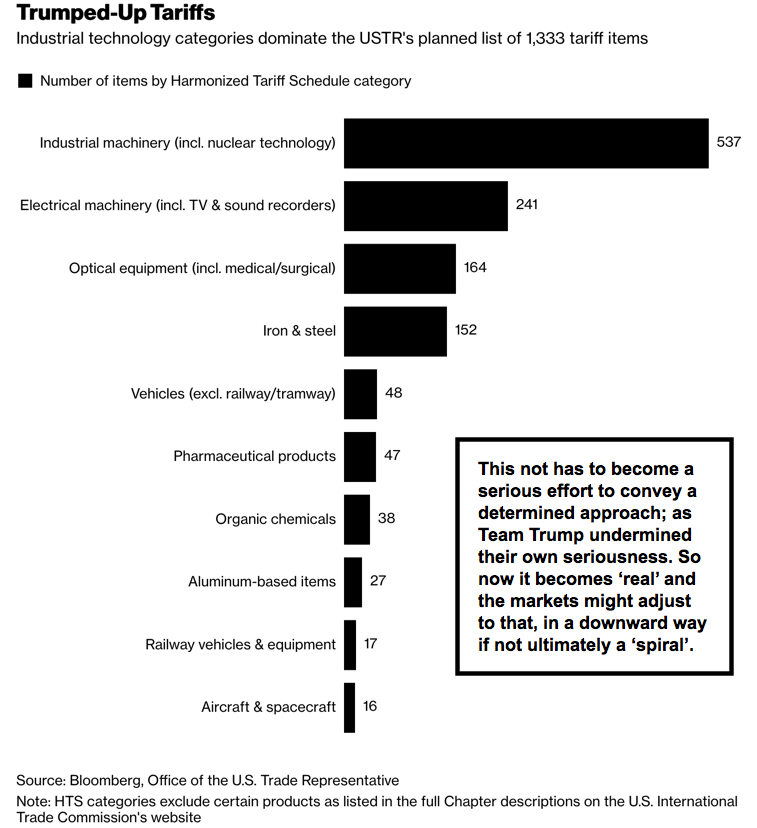

Bombshells. . . may become only hand-grenades with the seeming too early concessions and references as I've noted (mostly last night). Now we see how it goes full circle. President Trump this evening (Thursday) is upping the ante by saying he's considering another 100 Billion in tariffs.

Oh fine...they didn't believe him yesterday; the market recovered; so he gets emboldened by believing he can indeed get tougher. That's exactly what I warned of last night. This matters obviously because odds are the Chinese are laughing tonight (Friday morning) and will dismiss this as an escalation in rhetoric, but while they might come-up with another list they will tit-for-tat respond with; they won't believe Washington is serious.

So that's how things can actually become serious. They need to talk and pronto. And if the President thinks he's strengthened his position with his raising-the-stakes statement tonight; it's possible the opposite is closer to being realistic; even though I've pontificated on our poor trade policies of course for..gosh...40 years (or more?). I'm glad he's taking the challenge on 'trade'; just believe it's not being handled smoothly enough right now.

Bottom-line: this is still the pattern I've talked of; take the market up just enough to confound many (they did); when in reality it was yet-another of the massive short-squeezes, with some capitulating money coming-in as they gave-up on sensible assessments of the market.

That's because this is NOT a controversial or confusing market; it's very closely following the technical parameters we've laid-out (best we can do in what is of course a wide-swinging market) as well as the post-topping phases desperately trying to keep the market together.

In-sum: we'll probably get a stronger Jobs number in the morning (which does matter for the credit markets that everyone is sort of ignoring); but that will be overshadowed by yet-another market purge and that too will likely be attempted to be recovered from; but don't be sure sure of it just running back up like yesterday, as I'll continue below.