Major Asset Classes (November 2018) Performance Review

November brought relief for several asset classes after October’s rout. Red ink was far from banished, but there was a welcome upside bias in last month’s trading.

US real estate investment trusts (REITs) led November’s partial recovery. The MSCI REIT Index surged 4.7%, posting its strongest monthly gain in nearly two years. A close second for last month’s winners: emerging market stocks. MSCI Emerging Markets Index gained 4.1% — the first monthly advance for the benchmark since July.

The list of losers was contained last month, but October’s sell-off spilled over to November in several corners of global markets. The deepest setback was in foreign inflation-linked government bonds. The FTSE Russell World Inflation-Linked Securities Index ex-US slumped 1.9% last month, marking the fourth straight monthly slide.

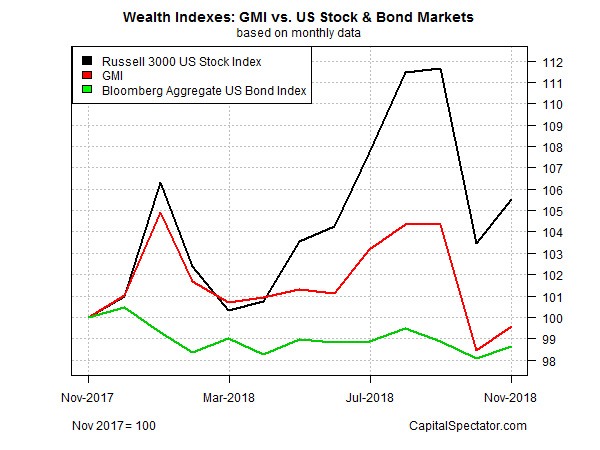

The broad trend for assets was convincingly positive overall. The Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, clawed back a portion of October’s hefty decline with a 1.1% total return in November. For the trailing one-year window, however, GMI is still in the red with a fractional 0.4% dip through last month’s close.

For US stocks, by contrast, last month’s 2.0% increase for the FTSE Russell 3000 Index helped the benchmark keep its head above water for the past year via a respectable 5.5% total return. Meanwhile, a broad measure of investment-grade US fixed income securities (Bloomberg US Aggregate Bond Index) remains in the red for the trailing one-year result by slumping 1.3% at November’s close vs. the year-earlier level.

Disclosure: None.