Major Asset Classes | Oct 2014 | Performance Review

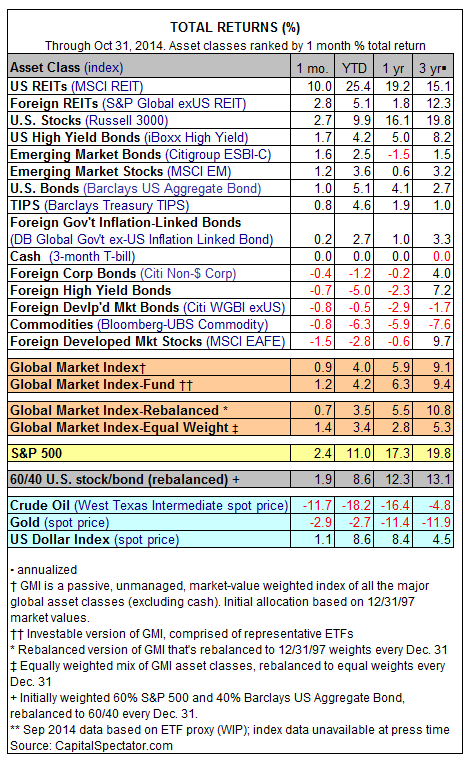

October was an unusually volatile month for most of the world’s markets relative to recent history, but when the dust cleared there were several winners. US REITs, in particular, ended the month with a hefty gain. In fact, the MSCI REIT Index’s 10% surge in October is the biggest monthly advance in four years. Otherwise, October’s gains were less spectacular, albeit decent. US stocks (Russell 3000), for instance, closed out the month with a respectable 2.7% increase.

October had its share of losers as well, led by a 1.5% decline in foreign stocks in developed markets (MSCI EAFE). Commodities overall continued to slide, with the Bloomberg-UBS Commodity Index shedding 0.8% last month, which leaves the benchmark lower by more than 6% for the year so far. One reason for the weakness in commodities is the ongoing strength of the US dollar—a stronger greenback tends to be associated with weaker prices for commodities, which are generally priced in the world’s reserve currency. The US Dollar Index climbed 1.1% in October, rising to a four-year high by the end of the month. Another byproduct of the bull market in bucks is a performance headwind for non-US assets: a gain is nipped after converting the return from foreign currencies into US dollars, while a loss turns into a deeper shade of red after this forex conversion.

As for the Global Market Index (an unmanaged benchmark that holds all the major asset classes in market-value weights), this passive portfolio inched higher last month, rising 0.9%. The modest gain comes after September’s hefty 2.8% decline—the biggest monthly retreat for GMI in more than two years.

On a year-to-date basis, GMI is higher by 4.0%. Unless the remaining two months of the year deliver strong gains, GMI is headed deliver a relatively sluggish performance for the calendar year.

Disclosure: None.