Lower Volatility On Lower Correlation

As equities have rallied this year, volatility has fallen as seen through the VIX. Currently sitting just under 12, the VIX is nowhere near the extreme single-digit lows from earlier in the year, but it is still far lower than a level of over 16 back in June.

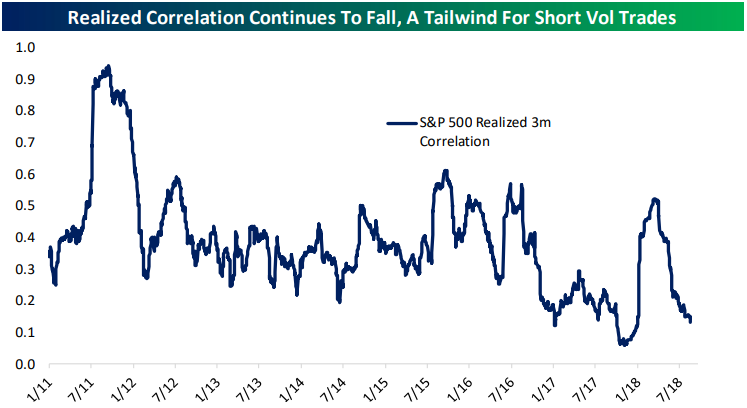

A factor behind the lower level of volatility in the market is that stocks have become less correlated with one another. In other words, in general, the performance of one stock is not necessarily indicative of that of another. In the chart below, we show the realized correlation over time. While the current level is nowhere near new lows, it has been a steep drop off to get to where we are. Further declines in correlation will help to lower volatility more as individual stocks move in opposite directions, canceling each other out.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more