Latest Oil Inventory Report: Could The Glut Finally Be Here?

As many of you are no doubt already aware, I have been tracking the trends in the nation’s oil inventories over the past several weeks. Unfortunately, other matters prevented me from posting an update last week so this article will discuss the past two reports from the U.S. Energy Information Administration.

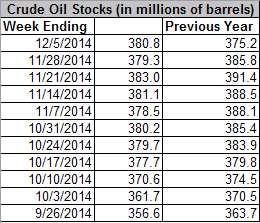

One of the most prevalent trends in oil inventories present over the past several weeks is that the nation’s inventories contained, without fail, less crude oil than they did last year. This week was the first time that this rule was broken. At the end of the week ending December 5, the nation’s commercial crude inventories contained a total of 380.8 million barrels of oil compared to 375.2 at the same time last year. Inventories also increased in size week-over-week, a switch from last week’s decline. As it is normal to see a week-over-week decrease in inventory size during the first week in December, this could be the early stages of the glut that the media has been talking about for the past few months should it continue.

The amount of gasoline that is contained in the nation’s inventories of that substance has been increasing over the past two weeks. Gasoline inventories in the United States contained a total of 216.8 million barrels of gasoline at the end of the week ending December 5. This is a substantial increase over the 208.6 million barrels that these same inventories contained at the end of the previous week. However, the prevailing year-over-year trend that I have shown and discussed in all of the previous articles in this series continues to be true here. The nation’s inventories contained a total of 219.1 million barrels at the end of the same week last year.

Despite this week-over-week increase in the size of the nation’s gasoline inventories, the actual production of gasoline fell slight from its previous levels. During the four-week period ended on December 5, the nation’s oil refineries produced an average of 9.106 million barrels per day. This is a lower level then where refinery production was during some of the previous four week periods, however it was considerably higher than gasoline production during the corresponding four-week period last year. The fact that inventories increased week-over-week despite the production decrease could be an indication that the nation as a whole has decreased its demand for gasoline during the week.

It is interesting to note that this decrease in gasoline production comes despite the massive increase in refinery utilization that this report shows. During the four-week period ending December 5, the nation’s refineries processed an average of 16.213 million barrels of crude oil per day in aggregate. The prevailing trend this year has been for refineries to consistently have higher utilization rates than they did during the corresponding periods last year and that trend continued in the most recent period. During the corresponding period last year, the nation’s refineries processed an average of 15.809 million barrels of oil per day in aggregate.

In previous articles, I have on several occasions stated that the oft-reported glut that the media has been discussing does not actually appear to be present. This report may be beginning to show the emergence of this glut. The unexpected increase in size in the nation’s oil inventories has, for the first time since I began this series, pushed inventories up to a higher level than where they stood last year. It will be interesting to see if this trend continues.

Disclosure: I am long several oil stocks and MLPs as are several clients. I have no positions in oil futures.