Larger S. American Crops Impact Corn & Soybeans In Different Years

Market Analysis

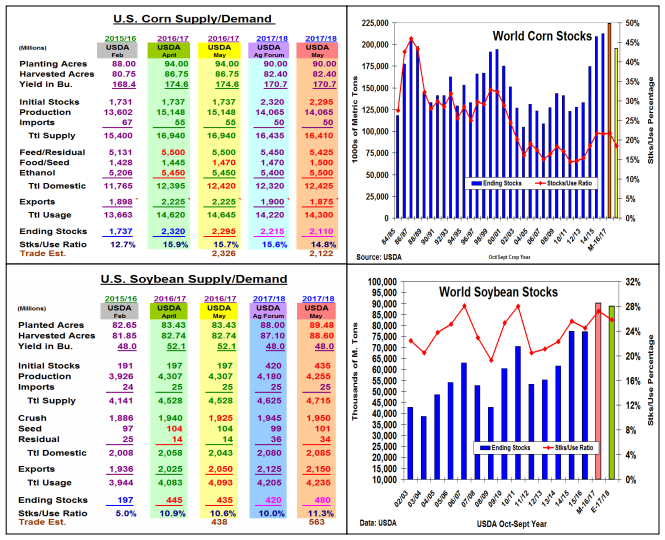

The USDA’s May supply/demand updates had some surprises in both their old and new-crop corn and soybean ending stocks when the World Board issued their 1st U.S. and World 2017/18 supply/demand projections. Two things that didn’t change however was the USDA’s Ag Forum yield levels and 2017’s planting intentions, which are normally used in 2017/18 balance sheets.

Larger S. American corn estimates (Brazil +2.5mmt & Argentina +1.5 mmt) curtailed the USDA from raising corn’s old crop exports again this month despite shipments and sales being 90-100 million ahead of 5 yr seasonal pace to reach the current 2.225 billion bu. forecast. The USDA did up food demand by 25 million while keeping ethanol & feed demand unchanged this month. May’s corn number surprise was the USDA’s world 2017/18 ending stocks being off 28.6 mmt to 195.3 mmt. Smaller US and Chinese seedings (as we pointed out) and expanding feed and industrial demand (+2.2%) may tighten the world’s corn stocks to 2013/14 levels. The USDA didn’t follow this pattern in its 2017/18 US balance sheet. Despite a minimal yearly price change, feed demand was sliced 75 million and exports were cut 350 million bu. from this year’s levels. Brazil’s dramatic crop recovery from 67 to 96 mmt has the USDA worried about 1st half 2017/18 US export demand it seems.

As suggested, 2016/17’s US bean crush was sliced by 15 million because of the recent slowdown. Old-crop exports however were upped by 25 million because sales are higher than the USDA’s 2.025 billion forecast. After recent hefty jumps, S. America’s crop level was raised just 1.8 mmt as harvest is now winding down. However, these supplies added to the world’s 2016/17 stocks by 2.7 mmt to 90.1 mmt. Yields normally retreat towards trend after big crops. This may provide cushion vs. expanding US and the World plantings. However, hefty Asian interest is expected to boost both US & World demand by 3.5%-4.0%.in 2017/18.

What’s Ahead

After an initial bean rally on a smaller new crop stock forecast, the market turned its focus to the world’s carryovers. This prompted corn to firm while soybeans turned defensive with 2018’s stocks remaining 2nd highest ever. With the impact of these numbers fading, the trade will turn to the remaining US plantings. Temps are rising, but rain remains in the forecast. We’ll look at USDA’s wheat data in a separate report.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more