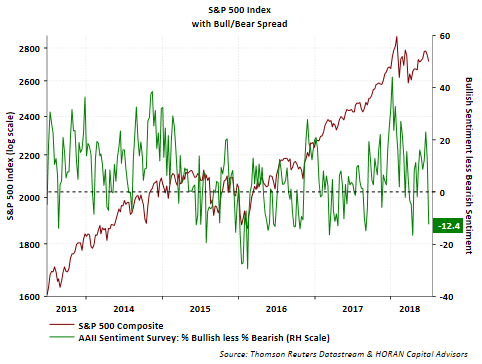

Large Swing To Bearishness And Market Rallies

On Thursday the American Association of Individual Investors reported results from the weekly Sentiment Survey and sentiment swung decisively bearish. As noted in the past, the sentiment surveys are contrarian indicators and high levels of bearishness and/or low levels of bullishness can signal equity market turning points. Yesterday's report saw the bull/bear spread swing 24.9 percentage points, the fourth largest swing to bearishness in the last five years.

(Click on image to enlarge)

The actual bull/bear spread was reported at -12.4 percentage points versus the prior week's reading of 23.1.

(Click on image to enlarge)

The swing to a higher level of bearishness places the 40.8% bearishness level at the seventh highest percentage in the last five years. True to form, subsequent to the report Thursday morning, the S&P 500 Index has moved higher for two consecutive days, assuming a higher close today (Friday) and seeming to find some support at the indexes 50-day moving average.

(Click on image to enlarge)

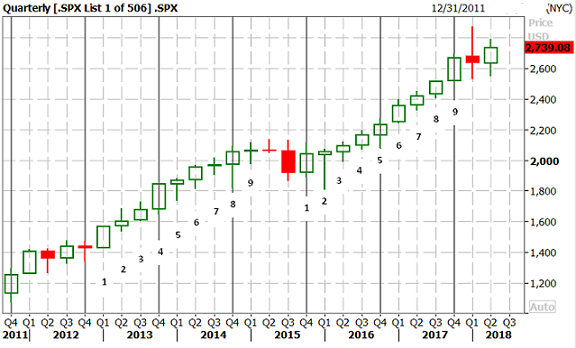

It does seem the second quarter has been bombarded with negative headlines, lead by potential consequences around tariffs. However, as the below chart shows, the second quarter is on pace to close up 3.5% on a price only basis. In my view this would represent a pretty decent quarter and could serve as a positive spring board for the second half of the year. In spite of the negative news flow, the underlying company and economic reports continue to come in on the positive side of the ledger.

(Click on image to enlarge)

Disclosure: None.