Large Cap Best And Worst Report - August 12, 2014

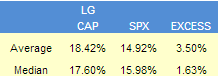

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 350 bps of excess to the SPX in the following year. The best performers from our list one year ago are FTR up 47%, ITT up 38%, and AMP up 32%.

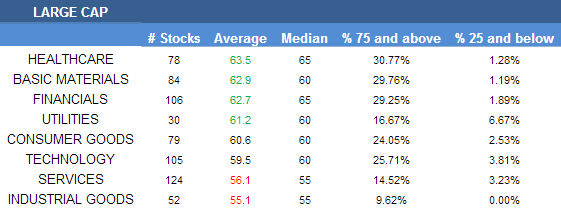

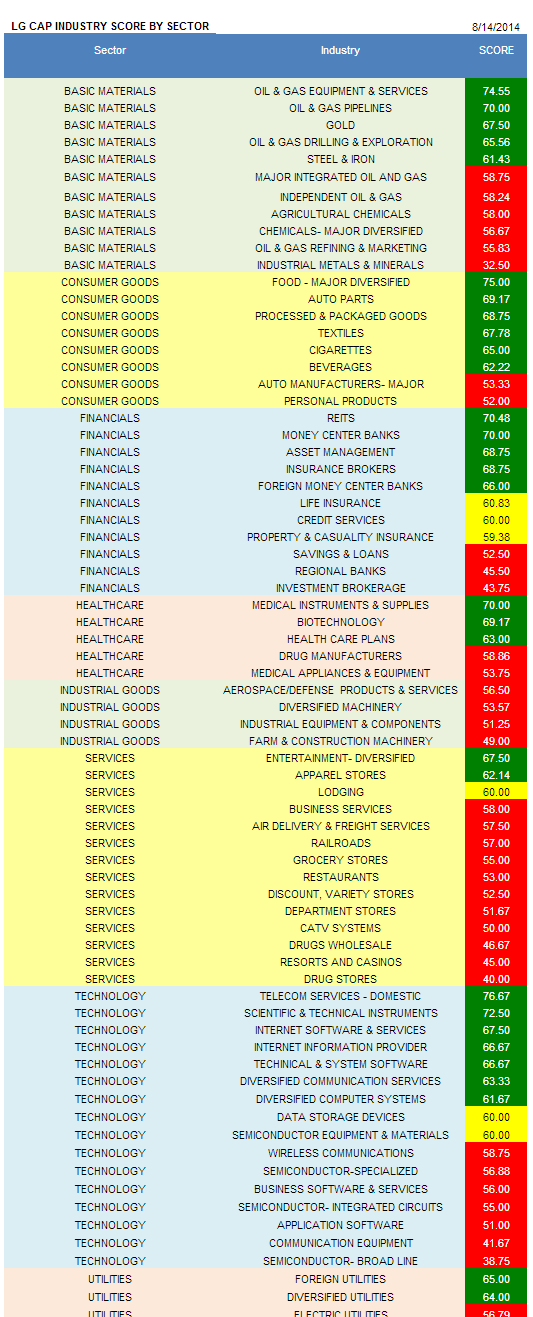

- The best scoring large cap sector is healthcare.

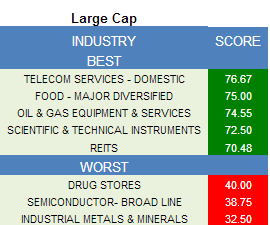

- The top scoring large cap industry is domestic telecom.

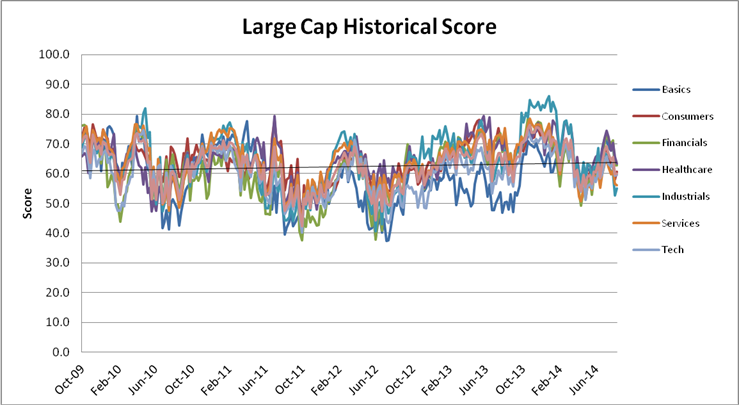

The average large cap score is 60.09 this week, below the four week moving average score of 62.60. The average large cap stock is trading -11.73% below its 52 week high, 0.59% above its 200 dma, has 4.49 days to cover held short, and is expected to see its EPS grow 13.42% next year.

Healthcare is the best scoring large cap sector. Basic materials, financials, and utilities also score above the average large cap universe score. Consumer goods and technology stocks score in line with the average large cap score. Services and industrials score below average.

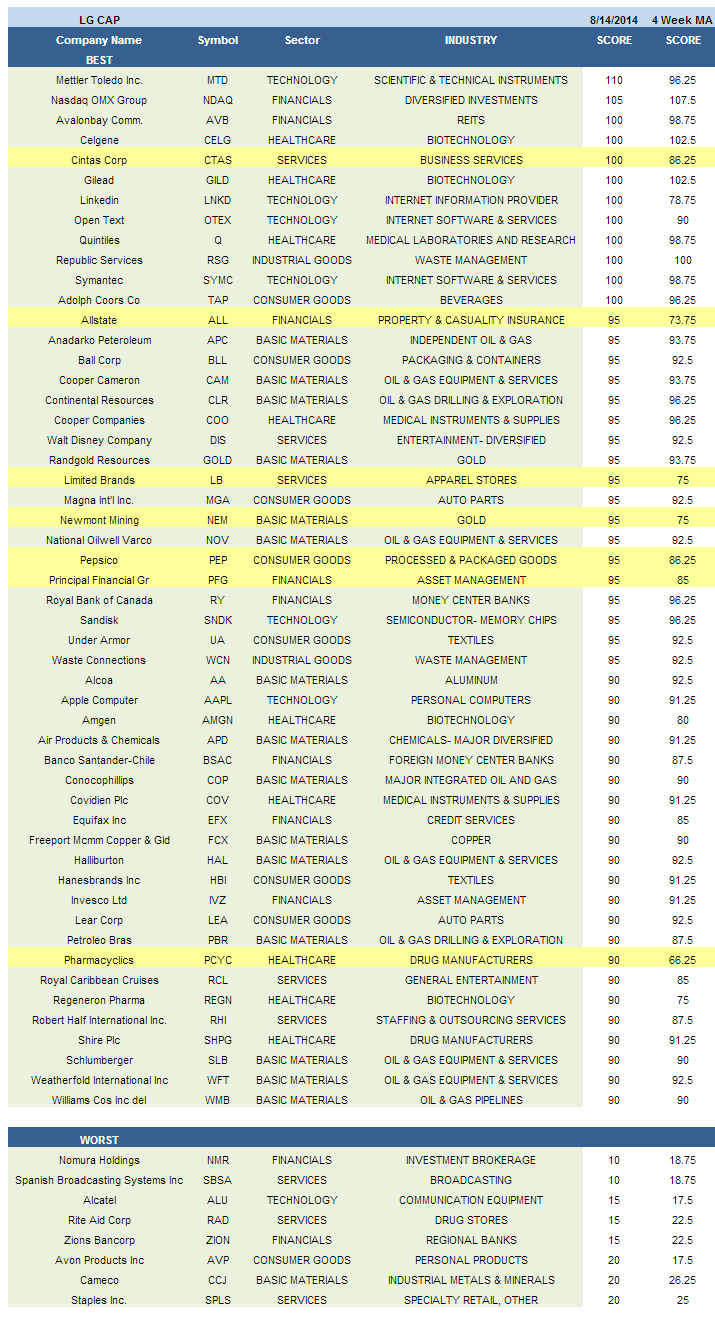

Domestic telecom (CTL, T, VZ) is the top scoring large cap industry. High bandwidth content demand and device pricing innovation offers revenue opportunity and dividend support. Major food sales (MDLZ, ADM) are improving thanks to new overseas markets, while post-recession product pricing, cross-branding, and sizing support margin. Rig count activity is strongest during summer and this year is playing out as stronger than last year given that the U.S. rig count is above 1900 for the first time in two years. 130 more rigs are active this year versus last year, offering support to oil & gas equipment & services (NOV, CAM, WFT, SLB, HAL) Scientific & technical instruments (MTD, GRMN) and REITs (AVB, PSA, HCN, DLR, ESS, CPT) round out the top scoring large cap industry ranking this week.

In basic materials, concentrate portfolios in oil & gas equipment & services, pipelines (WMB), and gold (NEM, GOLD). Major food, auto parts (MGA, LEA, TRW), and processed & packaged goods (PEP, MJN, MKC) score best in consumer goods. The top financials industries include REITs, money center banks (RY, BNS, BK, WFC, STI), and asset managers (PFG, IVZ). In healthcare, buy medical instruments (COO, COV, BDX), biotechnology (GILD, CELG, REGN), and healthcare plans (WLP, HUM, CI). Stay on the sidelines in large cap industrial goods until scores improve. Only diversified entertainment (DIS, TWX) and apparel stores (LB, FL, JWN) score above average in services this week. Retailers are typically weak at this time of year, but should return to their winning ways in Q4. In technology, focus on domestic telecom, scientific & technical instruments, and Internet software (SYMC, OTEX, CTXS). Foreign utilities (HNP) and diversified utilities (ED, SCG) remain high scoring.

Disclosure: None.