Large Cap Best & Worst Report - June 28, 2016

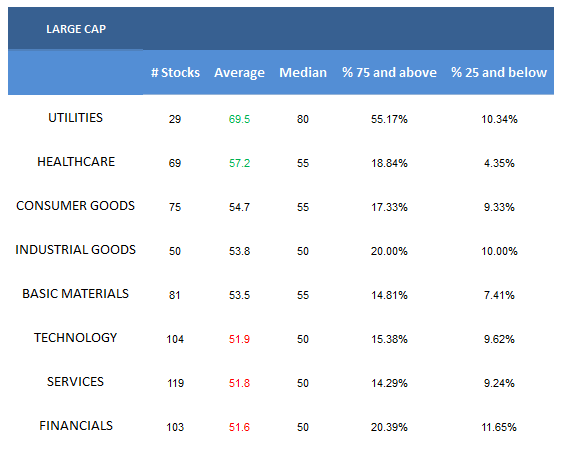

- The best large cap sectors are utilities and healthcare.

- The highest scoring large cap industry is domestic telecom.

Stay on the sidelines until day three post-Brexit vote and then use rebounding markets to de-risk.

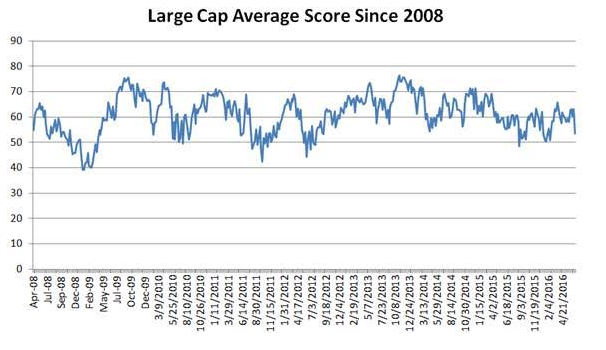

The average large cap score is 53.82 and the four week average score is 60.08. IMPORTANT: Scores reflect the roll to third quarter seasonality. This impact in leadership is magnified post-Brexit. See charts later in today's report showing historical trends in score over time.

The average large cap stock in our universe is trading -20.93% below its 52 week high, -1.48% below its 200 dma, has 4.66 days to cover held short, and is expected to post EPS growth of 13.8% in the coming year.

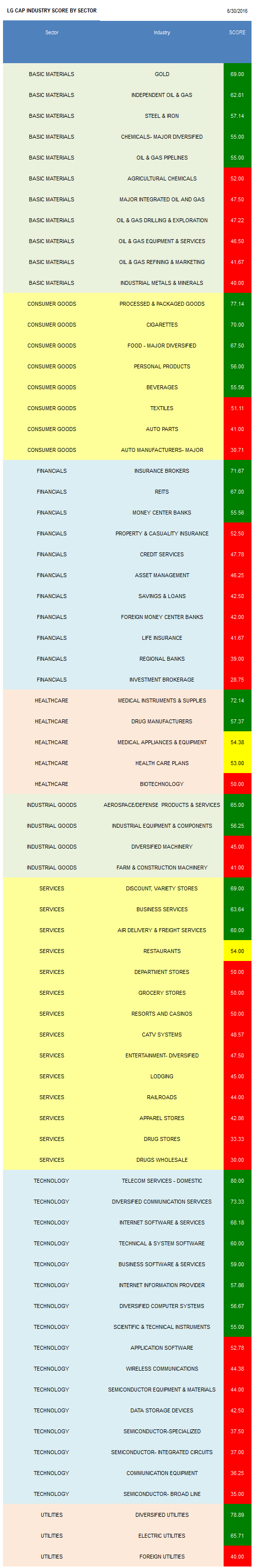

Utilities and healthcare score above average. Consumer goods, industrials, and basics score in line with the average score. Technology, services, and financials score poorly.

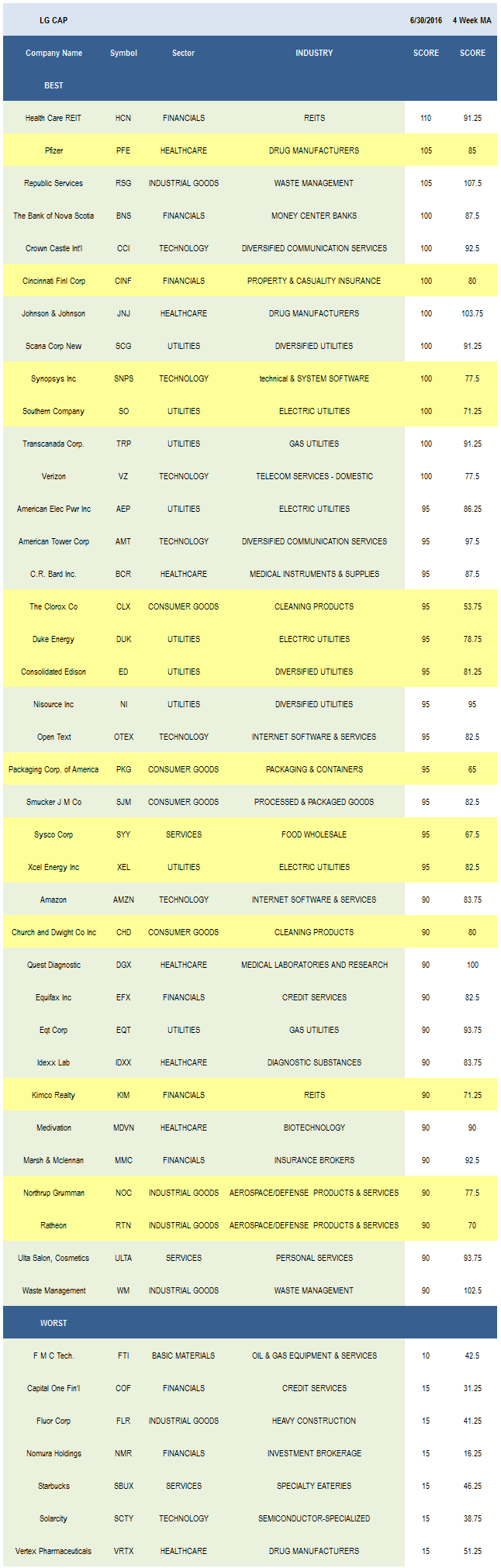

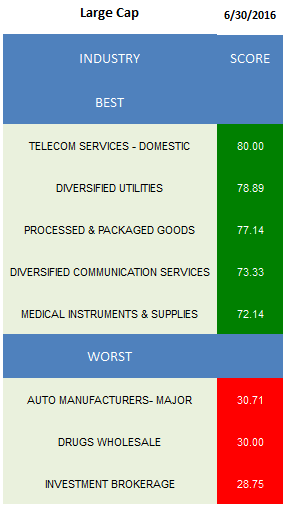

The following table highlights the best and worst scoring large caps in our universe following the roll to Q3 10-year seasonality.

The next chart shows historical large cap scores. Large cap scores tend to find their footing below 50 and closer to 40.

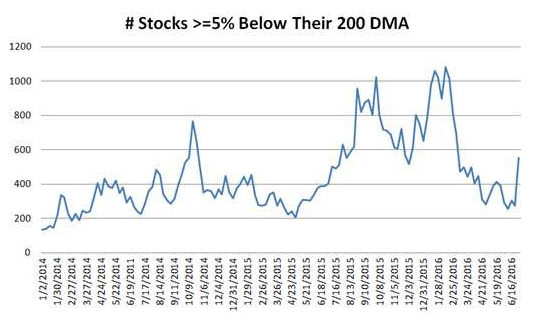

We break this next chart out at inflection points. It shows the number of stocks in our universe that are trading more than 5% below their 200 dma. Historically, this measure is very actionable when it gets to extreme levels. We will keep you posted. (Note summer seasonality's impact on this dataset).

The best scoring industry in large cap is domestic telecom (VZ, T). Diversified utilities (SCG, NI, ED, AEE, WEC, PCG, CNP), processed & packaged goods (SJM, MKC, MJN), diversified communication services (CCI, AMT), and medical instruments (BCR, SYK, COO) score best.

The best basics baskets are gold (GOLD, NEM, KGC), independent oil & gas (APC, NBL, DVN, CNQ), and steel & iron (GGB). The top consumer baskets are processed & packaged goods, cigarettes (MO, PM), and major food (MDLZ). Insurance brokers (MMC, AJG) and REITs (HCN, KIM, PSA, DLR, VTR, PLD, O) score highest in financials. Medical instruments and drugmakers (PFE, JNJ, BMY, ABBV) score strongest in healthcare. Aerospace/defense (RTN, NOC, TDG, LMT, HON) and industrial equipment (PNR) can be bought in industrials. The top services industries are discount/variety stores (WMT, DLTR, DG) and business services (CSGP, IRM, CTAS). Domestic telecom, diversified communication systems, and Internet software (OTEX, AMZN, FFIV, VRSN, EQIX) are high scoring in technology. Diversified utilities and electric utilities (SO, XEL, DUK, AEP) can also be bought.

Disclosure: None.