Large Cap Best & Worst Report - February 3, 2015

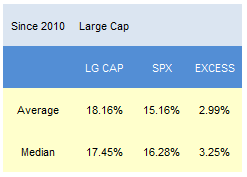

Since 2010, our top scoring weekly has outpaced the SPX by a median 325 bps in the following year.

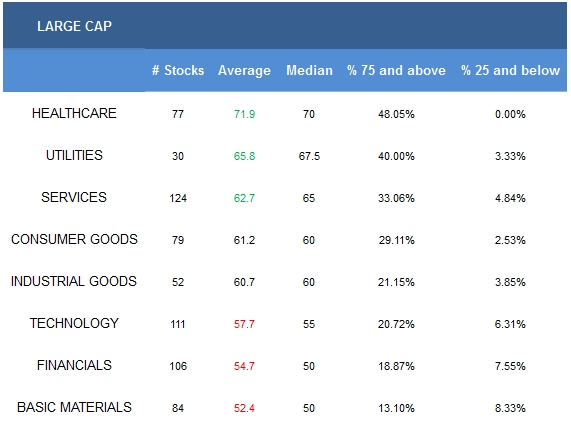

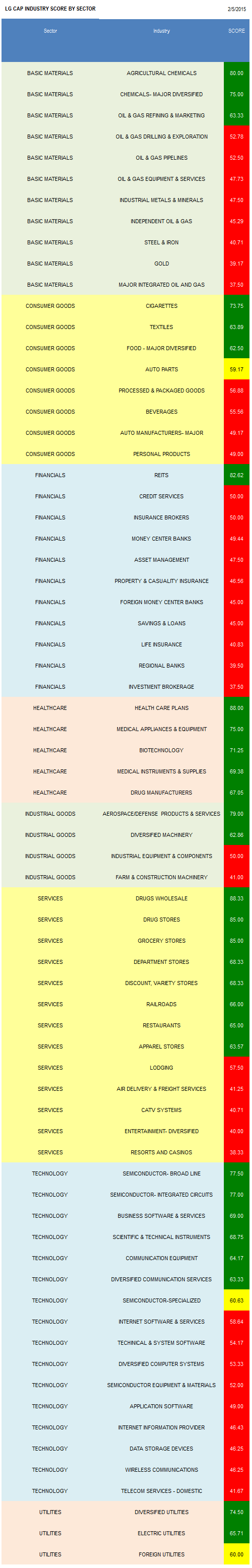

- Healthcare is the best scoring large cap sector.

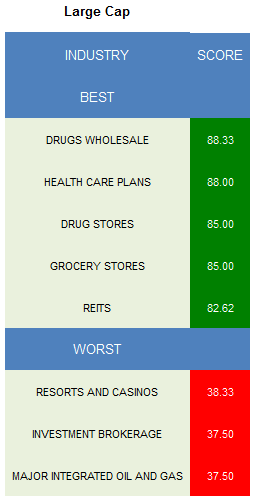

- The top scoring large cap industry is wholesale drugs.

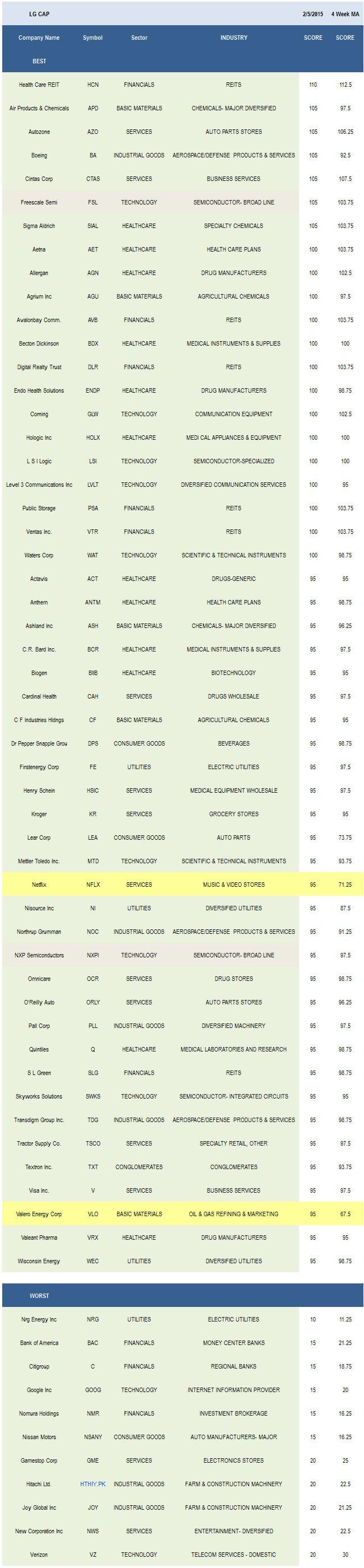

The average large cap score is 60.22, below the four week moving average score of 63.41. The average large cap is trading -14.53% below its 52 week high, -0.16% below its 200 dma, has 4.13 days to cover held short, and is expected to post EPS growth of 9.58% next year.

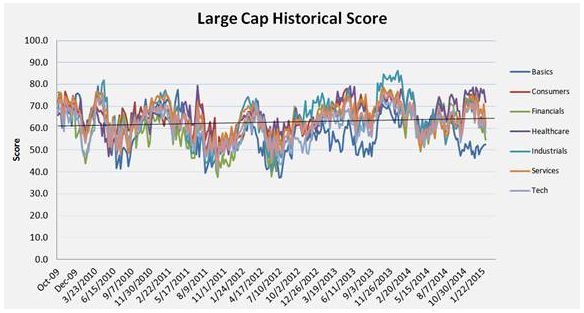

Healthcare is the best scoring sector across our large cap universe. Utilities and services also score above average. Consumer goods and industrial goods score in line with the average universe score. Technology, financials, and basics score below average.

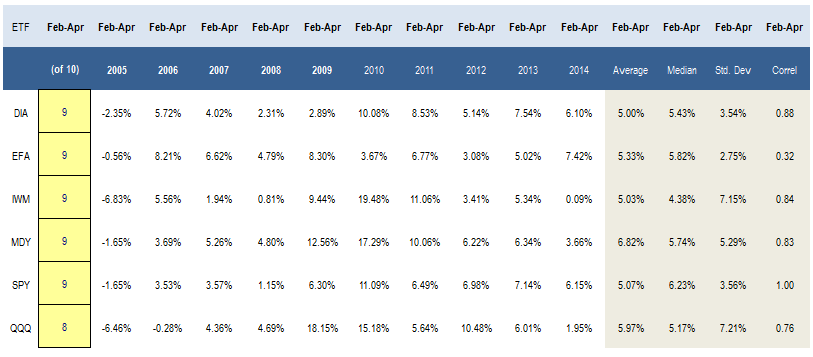

Over the past decade, the S&P 500 has finished April higher than it has begun February 9 times, generating a median 6.23% return.

The best large cap industry is wholesale drugs (CAH, MCK, ABC). Drug stores (OCR, CVS, RAD) are also among the best scoring industries. Rising utilization tied to aging America and healthcare reform continues to support prescription volume growth. Healthcare plans (AET, ANTM, CI, HUM) benefit from rising Medicare, exchange, and Medicaid enrollment. Grocery stores (KR, WFM) and REITs (HCN, VTR, PSA, DLR, AVB, SLG) round out the best scoring industries across large cap this week.

In basics, large cap investors should focus on ag chemicals (AGU, CF, MOS), major chemicals (APD, ASH, SHW), and refiners (VLO, TSO). Cigarettes (RAI, MO, LO), textiles (UA, LULU, MHK), and major food (ADM) are best across consumer goods. In financials, only REITs are above average. Every healthcare group scores above average; led by healthcare plans, medical appliances (ZMH, EW, MDT), and biotechnology (BIIB, MDVN, ILMN, INCY, CELG, REGN). Aerospace/defense (BA, TDG, NOC, COL) and diversified machinery (PLL, IR, XYL) are the top industries across industrial goods. Buy wholesale drugs, drug stores, and grocers in services. Concentrate on broad line semiconductor (FSL, NXPI, TXN), semi ICs (SWKS, TSM), and business software (FISV, WIT, DOX) in technology. Diversified utilities (WEC, NI, SCG, NU) and electric utilities (FE, NEE, XEL, SO, DTE) score better than average in utilities.

Disclosure: None.