Junk Bond Weakness Limited To Healthcare & Telecommunications

Relative Valuations

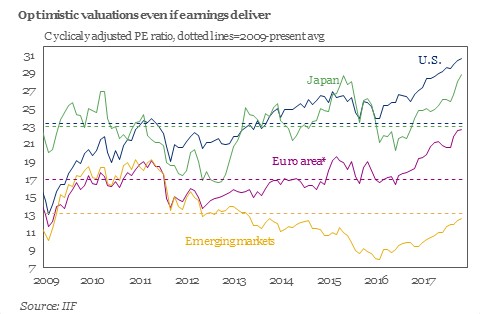

We’ve seen a coordinated stock market rally in about every index globally. The chart below compares the recent Shiller PEs of the American, Japanese, European, and Emerging stock markets. The dotted lines are the average since the start of this bull market in 2009. As you can see, America, Japan, and Europe are all above their recent averages. Considering the fact that the past few years of weakness has moved the 8 year average down considerably, the fact that emerging markets are below their average valuation, and that their economies are looking great, it would seem like a no-brainer to get involved in them. This latest boost in the expansion has sustained itself without much commodity price improvement. Eventually, that will change if growth keeps going as the growth will be demanding more of finite resources. In general, low prices discourage new initiatives which produce more of the commodity. However, that’s obviously not the case in America with oil and gas drilling. Instead, firms are working to lower their costs, so they can produce more oil and gas profitably. The point I’m getting at is these emerging markets who produce commodities will get an additional boost in the next couple of years from higher commodity prices, making their investing prospects stronger.

Is America The Next Saudi Arabia?

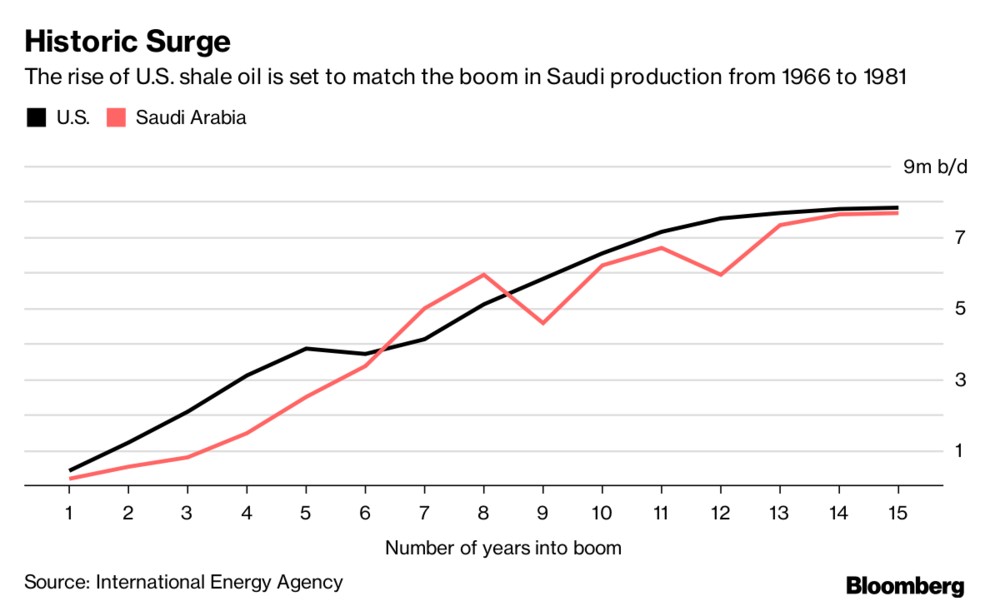

I mentioned the expansive production of American oil and gas fracking. The chart below gives context to how large the U.S. shale production boom in the past few years has been. As you can see, the U.S. production boom has more than matched the production boom Saudi Arabia experienced from 1966 to 1981. The politicians wanted America to get off foreign oil dependence, but the private companies did the grunt work. The production of American oil is much more impressive than Saudi production because the oil is locked in rocks. When oil prices fell starting in late 2014, many prognosticators predicted the fracking boom would be over. However, the break-even prices were lowered. The low-interest rates helps the fringe energy firms at the margin, but it would be foolish to say the whole innovation boom was caused by low rates.

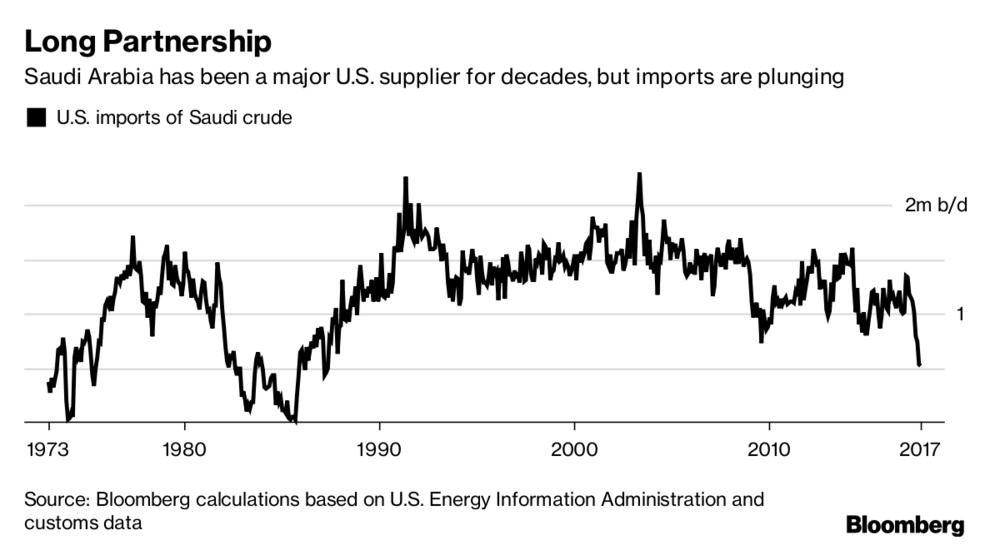

If you’re curious about how this production of American oil has affected the American imports of Saudi oil, the chart below shows the U.S. imports are at a multi-decade low. This has led America to have a trade surplus with Saudi Arabia as oil prices are still low and America sells Saudi Arabia arms. The American production of oil is only part of the reason why Saudi imports have declined. As you can see, the decline only started in the past few months even as fracking has been producing oil for years. The reason is Saudi Arabia realized that America was the only country to publish weekly inventory data, so it decided to pull back sales to America. It’s a ‘cat and mouse game’ as Saudi Arabia tries to make the supply glut look smaller by limiting sales to America. That’s a smart idea, but eventually, investors will realize the American inventory data is less reliable. This could also catalyze other countries to report inventories. As a result of this change, Saudi Arabia has fallen from the 2nd biggest exporter of oil to America to the 4th largest.

Junk Bonds Fall Modestly

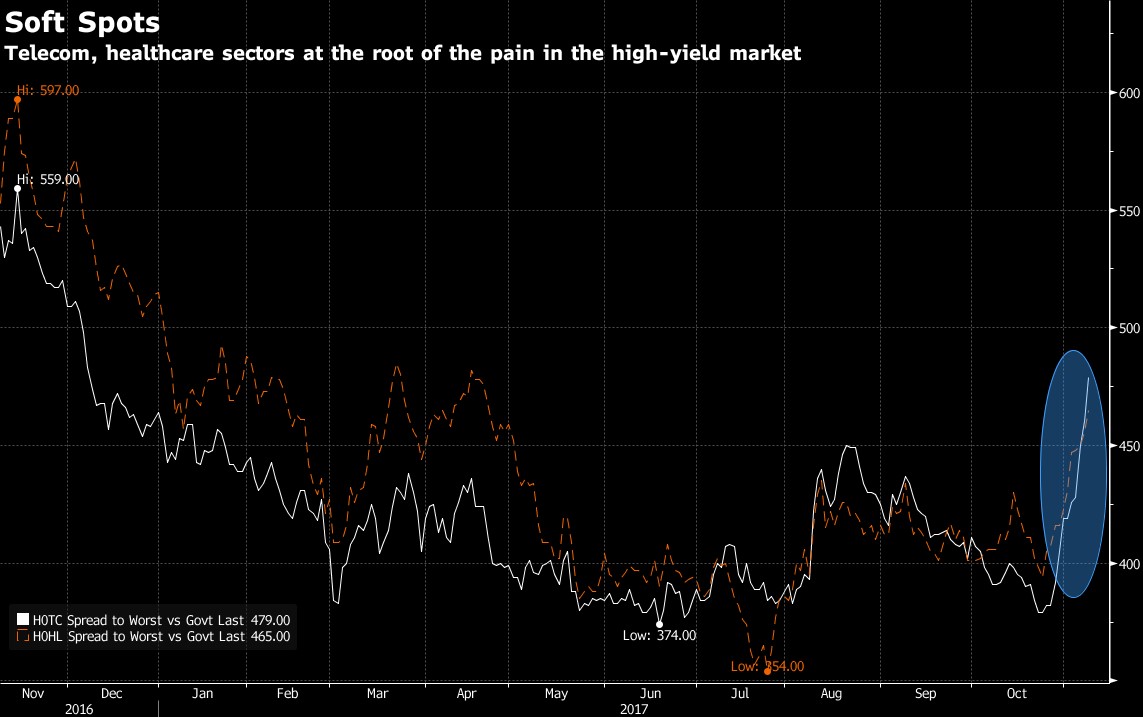

The mention of fringe energy companies brings us to the junk debt market where many reside. There are bearish investors who are claiming the recent junk bond weakness is a signal the economy is about to crater. Before making such a bold prediction, it’s a good idea to figure out the cause of the weakness. The telecommunications sector is pushing the American junk bond market lower. Sprint, Charter Communications’ parent CCO Holdings, and Frontier Communications are all in the top 10 holdings of the JNK which is a popular junk bond ETF. In August, Windstream’s bonds fell from about 98 to about 88 when it halted its dividend and announced a buyback. The failed merger between Sprint and T-Mobile also hurt the telecom junk bond market.

The white line shows the spike in the telecom junk bond yields in August and November. Recently, the healthcare sector has added to the weakness, as you can see from the orange dotted line. Another problematic deal was Tesla’s bond offering. This is probably company specific as the company can’t produce as many Model 3s as expected. The theme for the market is the weak players are getting penalized. That doesn’t sound like a crash is coming. If you own Tesla stock, you should be very worried that the debt market is starting to reflect reality, but other investors shouldn’t be worried.

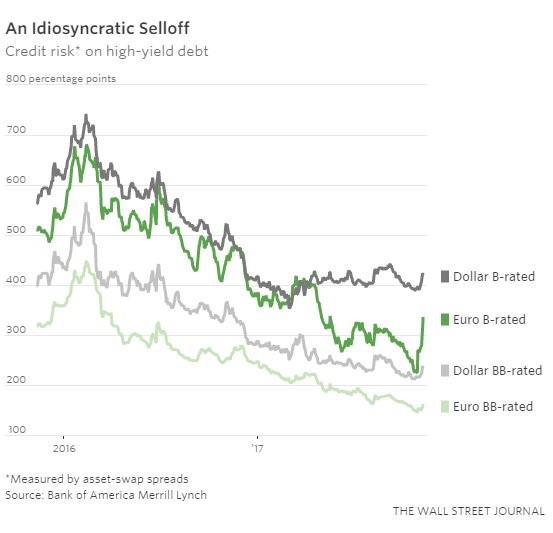

Speaking of groups who should be worried, the ECB should be worried about the effects of its tapering program. The chart below breaks down the credit risk of B and BB rated bonds in America and Europe. Since the tapering plan in 2018 was announced, the Euro B rates bonds have seen their credit risk increase. Just like how if the American junk bond selloff gets worse, the recession fears will increase, if the Euro junk bonds sell off further, the ECB will be pressured to extend its bond-buying into 2019.

Yield Curve Flattens

Besides the junk bond selloff, the bears are hyper focused on the yield curve which is flattening modestly. The difference between the 10 year bond and the 2 year bond has fallen to 68.45 basis points. Usually, there’s a year or two difference between when the yield curve inverts to when there’s a recession. Therefore, this latest action increases the odds for a 2020 recession. If that’s when the next recession is coming, the junk bond market wouldn’t react yet. This means both negative market reactions aren’t correlated. I expect the junk bond market to join the stock market in a rally in the next few months. There will be some bumps along the way in any bull market. Calling for a recession because of this junk bond selloff would be like calling for a recession after a 5% correction in the S&P 500.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more

Almost all junk bonds rated BB, which account for 50% of junk bonds were not affected by the sell off. Also the sell-off seemed sector specific and more of a risk adjustment then anything. Definitely a buying opportunity.