Italian Vote Leads To A Hung Parliament

Italian Election: Big Win For Anti-Establishment

The Italian election was on Sunday. It came and went with little response from the markets. However, since I’m a fundamental investor, I look at events the market isn’t focusing on now, but might focus on in the future. If you’re only looking at what is moving the markets today, you’re a momentum trader. It’s easy to see why the market ignored the election and then yawned at the results. Because no coalition got 40% of the vote, this will be a hung parliament. I’ll review what that means later.

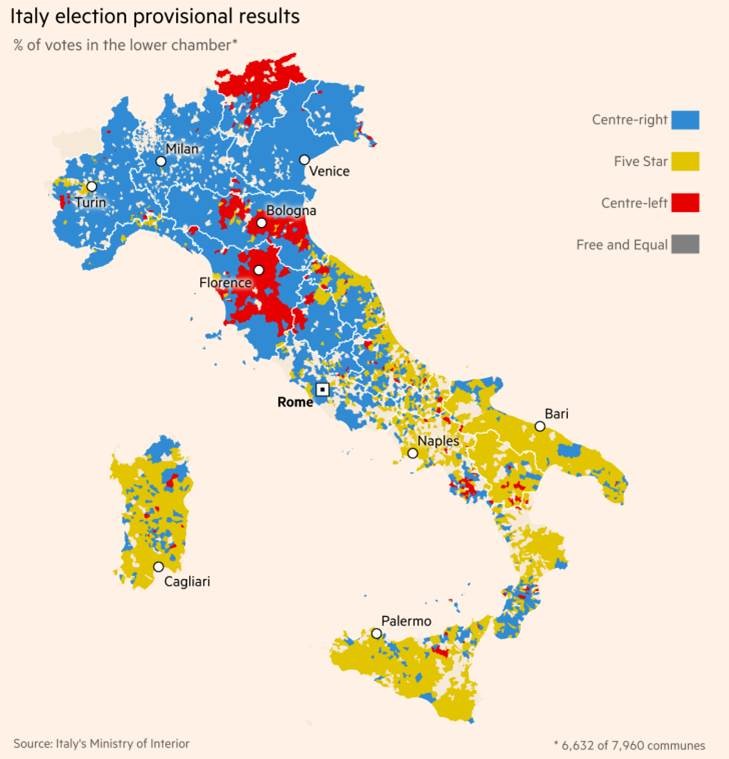

First let’s look at the results. In the lower house, the 5 Star Movement got 32.67%. The center right coalition, which includes League and Forza Italia, received 37% of the vote. The center left coalition, which includes the Democrats, received 22.85% of the vote. The Senate had similar results as the 5 Star got 32.22%, the center right got 37.49%, and the center left got 22.99%. The chart below shows the geographical distribution of the vote. As you can see, the 5 Star Movement dominated the south and Sicily because the party appeals to the economic uncertainty the people face. To oversimplify the vote, if you are happy with the current direction of the country, you vote Democrat. If you are unhappy, you vote 5 Star. It’s not surprising 5 Star did the best because about 85% of Italians think the country is headed in the wrong direction.

(Click on image to enlarge)

Hung Parliament, But 5 Star Gains Momentum

One takeaway is this election is bad for the country because a hung parliament means there’s no clear path for the government. Another takeaway is this is a big win for the anti establishment parties. None of the polls this year had the 5 Star Movement at 30% or higher which shows the size of the upside surprise. The last poll had the party at 26.3% which means it outperformed by about 6.1%. The last poll had the League at 14.8% and the Democrats at 21.3%. As you can see, the League beat estimates by about 3.7%. Since it’s the other anti-establishment party, it’s consistent with the other results. The establishment Democrats missed estimates by about 2.3%.

As you can see, the total for the 2 anti-establishment parties was more than half the vote, which implies Italy leaving the E.U. might win in a referendum. It’s too far of an assumption to say that would definitely happen because as these anti-establishment parties grow, they have been watering down their message. One issue which is more likely to be solved is closing the southern border, preventing the migrants from coming. Italy’s economy is already weak. Adding in the migrants has made the situation worse.

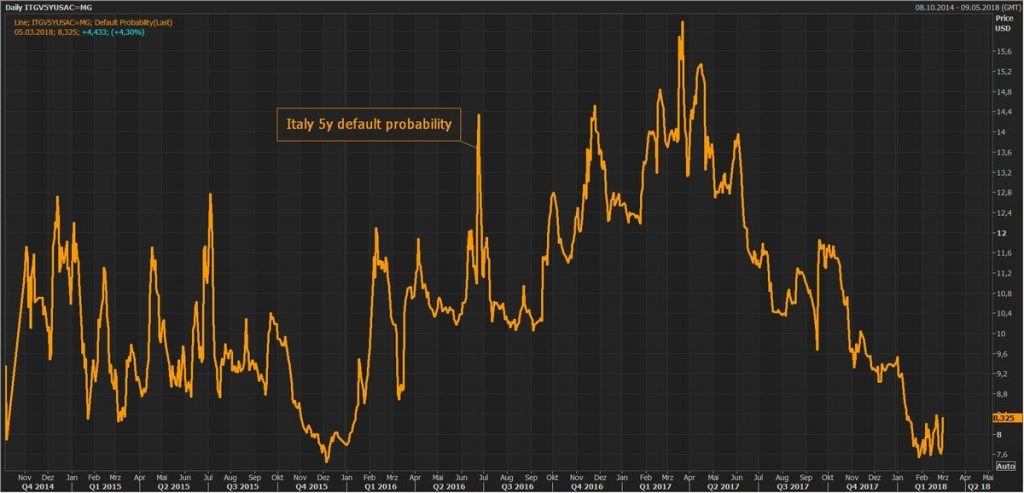

Ultimately, nothing major will result from this election, but judging by the momentum the 5 Star Movement has, there’s a good chance in the next few years it will get large enough to govern. The question will be what happens when the 5 Star Movement governs unsuccessfully because it can’t meet its promises such as universal basic income and a flat tax. Either it can decide to leave the E.U. or go against its original message. As you can see, there are many steps before the country considers leaving the E.U. which is why the chart below shows the Italian 5 year default probability barely moved up yesterday.

(Click on image to enlarge)

Stocks Rally On Monday

Stocks had a great Monday as the S&P 500 was up 1.1%. The stock market has been range bound ever since it made its initial rally from the bottom early in February. Some headlines said stocks rallied on Paul Ryan’s rebuke of the Trump tariff, but that occurred last week, so I don’t buy the argument. It seems like market is caught in a rut. Making new highs is problematic because the euphoria was extreme in January. Making new lows doesn’t make sense because the economic data is too good. Therefore, it seems reasonable to expect the market to stay between the January high and the February low for the next few weeks. If Trump completely forgets the tariff or if the Congress checks him, stocks will rally. A vicious trade war would cause a bear market.

Utilities and real estate had a great day as they were up 1.95% and 1.36% respectively. That’s a huge day because the two rate sensitive sectors have been declining because of the sell off in treasuries and the increasing expectations for 4 rate hikes. The tech sector was up 0.94%. Some are wondering if the recent action in the past few months will reverse. As you can see, utilities and real estate have declined while tech has rallied. I think it’s more likely that utilities and real estate rally than tech declines. Obviously, it depends on where rates go. Previously, I recommended utilities because I thought rates would fall. The 10 year yield was up 1.65 basis points on Monday to 2.88%. It has also been range bound since it peaked at 2.95% in late February.

(Click on image to enlarge)

To give more detail on the long utilities, short technology trade, momentum has outperformed low volatility by 4% in the past 3 months. You can also go short industrials and long healthcare. This is a sector rotation which makes sense after the trend had gotten extended. It’s a way to make money in a choppy market. It could be a bet that this range bound market continues like I said.

My feeling is that stocks would have been choppy without the tariff announcement, but it has definitely caused more uncertainty. The dollar index was flat on the day as it closed at $90.00. I’m surprised to see it wasn’t down since stocks were up. Today was another example of the new phase change the market has gone through as the action has been more violent than last year. Some are wondering is this means the bull market is over. I think it’s just a return to normalcy. The chart below shows how this is the 2nd longest bull market since WWII.

(Click on image to enlarge)

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more