It Is Growth, Not Inflation, That Keeps The Fed At Bay

A recent speech by the vice–chairman of the Federal Reserve, Stanley Fischer, revealed what really concerns the FOMC. In the words of Fischer it is “growth, growth, and growth”. He raises many underlying conditions in the world that hold back economic growth and then ties those conditions to help explain why the Fed cannot just raise interest rates, even though it is the most powerful central bank in the world.

In an earlier speech by Governor Lael Brainard she discusses what is the “neutral “rate of interest in today’s world. By that she means what is the rate '' that is consistent with output growing close to its potential and with full employment and stable inflation". She makes two major points that: *

1. the current rate of interest is consistent with the neutral rate, and

2. the neutral rate today is much lower than in previous decades.

This is an important insight into the Fed’s thinking regarding the trajectory that rates are expected to take over the longer term. Fischer takes this as a starting point and extends the analysis to argue that long term interest rates are going to remain very low for an extended period.

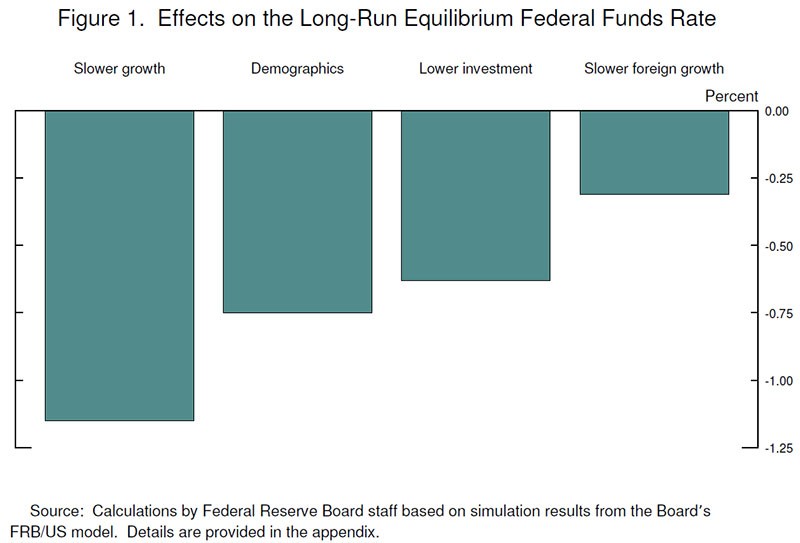

Fischer identifies the four main reasons that keep interest rates low (Figure 1).

- Slower economic and productivity growth in the United States;

- An aging population resulting in a slowdown in labour force growth;

- Weak business investment , especially given the low interest rates; and

- A slowdown in the emerging markets.

Above all else, low long-term rates are a warning sign that long term growth prospects remain poor. The Fed’s economic models indicate that the overwhelming factor contributing to low interest rates is slower growth; depressed growth, in turn, puts downward pressure on interest rates; an undesirable sequence that haunts all central bankers.

The connection between growth and investment is upper most in the minds of the Fed. Productivity in the business sector has decline significantly, from an average of 1.25 per cent yearly in the past decade to only 0.5 per cent in the past five years. While there are many reasons behind the deceleration in productivity growth, the fact remains productivity growth is the biggest single factor accounting for higher living standards.

I believe the most important observation made by Fischer is that the Fed is concerned that there is virtually no room to lower rates to counter an adverse shock leading to a recession. Simply, there is no buffer left in the financial system. Immediately after the 2008 crisis, investors were introduced to zero bound interest rates and that concept prevailed for a few years until it was necessary, in Japan and in the EU, to move to negative rates. Now, we have the concept of effective lower bound rates i.e. negative nominal and real rates of interest. As Fischer states,

“operating close to the effective lower bound limits the room for central banks to combat recession using conventional interest rate tool---that is, cutting the policy rate”

Hence, in his view, central banks were forced to adopt non-conventional policy tools such as asset purchases and forward guidance. In other words, they were compelled to enter the realm of untried, non-conventional policy. Tying this to the theme of growth, Fischer argues that the only way to re-ignite growth was to go unconventional route.

Where does this leave the Fed regarding the future of long term rates?

If the forces affecting productivity growth and labour growth remain on their current path, potential growth will slow down and rates will remain low for many years. Indeed, many have adopted that scenario and have set out their long term financial investments accordingly. But Fischer does not concede so readily that nothing can be done to boost the long run equilibrium rate of interest. He cites the significant benefits of an expansionary fiscal policy, noting that an increase in government spending and/or tax reduction would boost the equilibrium rate by 50 basis points, according to the Fed model. He cites the value of public expenditures on infrastructure and a better approach to regulation as a means of promoting greater private investment. The jury seems to be still out regarding whether there is any political will to turn to fiscal policy now that monetary policy appears to have run its course.