Is Steeper Yield Curve Bad For Gold?

The U.S. yield curve has steepened since the presidential election. What does it mean for the gold market?

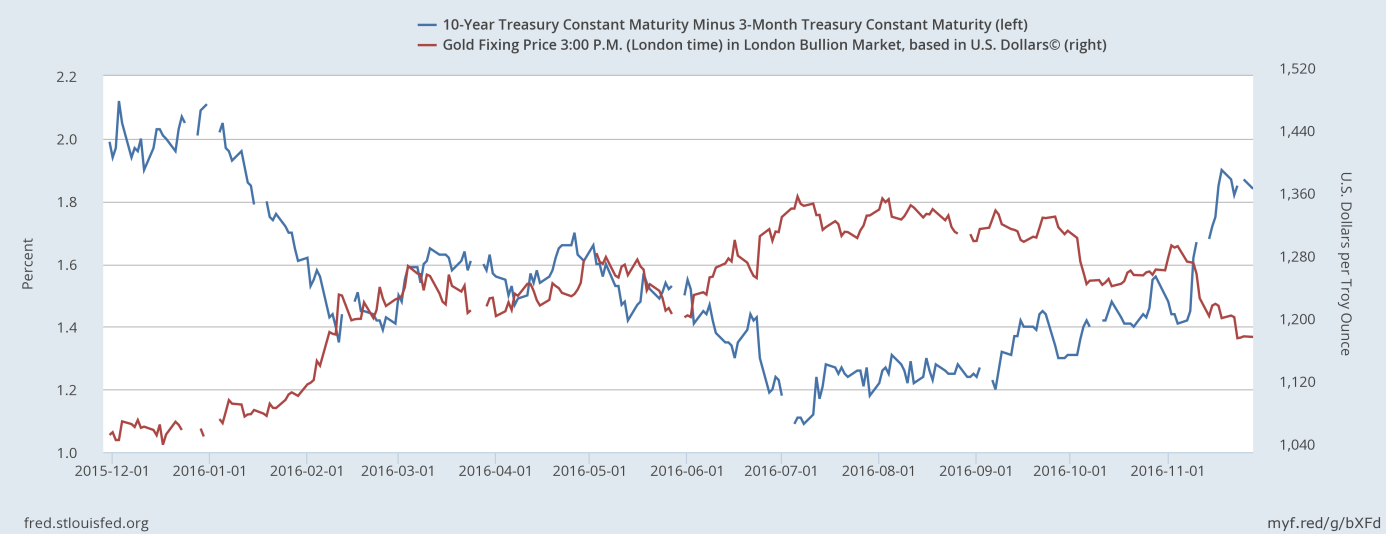

As one can see in the chart below, the difference between short-term and long-term U.S. Treasury yields jumped after the U.S. presidential election. The spread between the 10-year Treasury bond yield and the 3-month Treasury bill yield rose from 1.41 before the election to above 1.80 at the end of November. The chart also shows the negative correlation between the price of gold and the term premium. Indeed, the price of gold declined in that period.

(Click on image to enlarge)

Why was the steepening of the yield curve a headwind for gold? Well, a steeper yield curve usually signals an improving outlook on economic growth and the prospect of rising inflation. Inflation expectations increased but long-term rates climbed even faster, which was definitely negative for the gold market. In other words, the election outcome raised the prospects of fiscal stimulus, which lowered the odds of a protracted deflationary slump. Hence, the steepened yield curve is another bearish fundamental factor for the gold market – along with the appreciation of the U.S. dollar and rising real interest rates. The shiny metal may thus remain under downward pressure in December. GDP growth projected for the fourth quarter of 2016 by the Atlanta Fed GDPNow model is now 3.6 percent, while the market odds of the Fed hike at the next meeting remain above 90 percent. Yesterday, Fed Governor Jerome Powell said that in his view: “(...) the case for an increase in the federal funds rate has clearly strengthened since our previous meeting earlier this month”.

The key takeaway is that the U.S. yield curve has steepened since the presidential election. It is a negative development for the gold market as a steeper yield curve often indicates economic strength (or more optimistic expectations about future growth), which should be bad for safe-haven assets such as gold. Moreover, expectations of improving economic growth imply higher odds of a Fed hike in December, which puts the shiny metal under downward pressure.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly more