Is Equal Weighting Beneficial For Asset Allocation? Part II

<< Read Part I: Is Equal Weighting Beneficial For Asset Allocation?

Yesterday’s post on equal weighting for asset allocation motivated a reader to point out that equal weighting’s tendency to outperform in equity portfolios is due to frequent rebalancing events. A passively managed market-cap-weighted portfolio, by contrast, is allowed to drift, with weights evolving based on Mr. Market’s whims. But unrebalanced benchmarks were missing. Let’s correct that oversight and rerun the numbers.

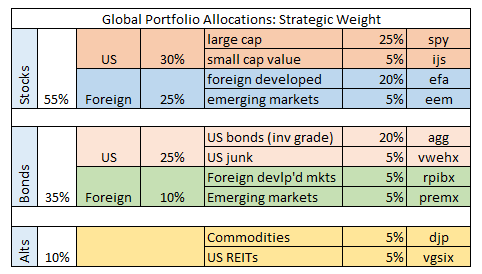

To refresh our memory, here’s the asset-allocation profile for the strategic-weighted strategy…

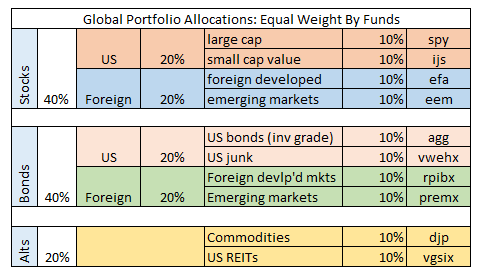

And the equal-weighted strategy…

In yesterday’s post, both strategies were rebalanced back to the target weights at the end of each year. Let’s add unrebalanced versions of each strategy to the mix. As you can see in the chart below, all the benchmarks deliver similar results over the test period (Dec. 31, 2006 through Oct. 11, 2016).

True, the strategic-weighted portfolios post slightly higher returns vs. the equal-weighted counterparts, in rebalanced and non-rebalanced versions. But the differences are trivial and it’s not obvious that one or the other is decisively superior. Indeed, risk levels for all four portfolios are comparable. Sharpe ratios, for instance, are in a tight range of just 0.30 to 0.32.

The rebalanced versions of each strategy earn slightly higher returns vs. the unrebalanced counterparts, but the edge isn’t big enough to convince your editor that there’s significant difference on this front either.

Granted, the test period is relatively short and so the results are hardly the last word on the subject. But taking the numbers at face value suggests that the choice of assets—the asset allocation—is the crucial factor. The choice of weights and rebalancing schedule, by contrast, are far less influential, perhaps trivially so.

Keep in mind that different time periods will likely deliver different results and so we should be wary of accepting this toy example as gospel. On the other hand, the analysis above implies that there’s a danger in assuming that different rebalancing schedules and/or target weights offer a high level of control over an investment strategy’s risk/return profile.

In short, the single-biggest influence resides with the selection of assets, or so the test above suggests. We’ve heard this before, of course, starting with the seminal Brinson study, along with the countless follow-up studies. The main takeaway: asset allocation casts a long shadow over investing results. Deciding just how much influence is tricky, particularly from one portfolio to another. But the biggest bang for the buck still resides in the selection of assets. And for some time periods and portfolios, that variable alone may be the overwhelming factor, for good or ill. Choose wisely, grasshopper.

Disclosure: None.