Investors Yearn For A Tax Cut

Market Summary

The stock market wants its tax cut. One of the primary reasons the major indices attained all-time highs is the expectation of a significant tax cut. Republicans’ proposed healthcare legislation provides a huge tax for upper income taxpayers. Enacting the healthcare law is being hung-up by disgruntled constituents pushing back on the prospect of tens of millions losing their healthcare. After the healthcare revisions stalled, the Trump administration outlined possible tax legislation that proposed lower tax rates to give a big tax cut to high income earners. Massive tax cuts are generally considered to primarily benefit wealthier citizens who presumably would put the extra money to use by investing in the stock market. Especially if capital gain rates are cut that would most certainly drive stocks higher as additional funds flood the market. The problem is that turmoil surrounding the Donald Trump administration is putting major legislation on the backburner. Any Donald Trump rally ended months ago and up until recently the market rejected any significant selloff attempts. Political gaffes from the Donald Trump team are splintering unified Republicans which is required to pass major new laws. From an investor perspective, if there are questions about whether a tax cut will happen this year there is less incentive to keep money in the market.

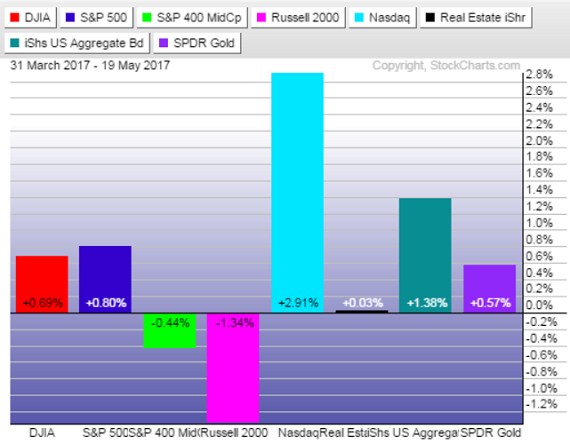

In a landscape devoid of blockbuster earnings and policy catalysts, the stock market is likely to remain hostage to political uncertainty, setting the stage for continued daily triple-digit price moves and while the outcome of the current bear versus bull battle has yet to be known, most analysts believe the bulls have a slight edge. Synchronized global growth, continued stimulus around the world, and improving U.S. economic data all support the bullish case. On the other hand, concerns about asset valuations and the aging bull market, central banks’ plans to normalize interest rates, and elevated leverage tip the scale in favor of bears, according to some market pundits. The updated graph below displays investors’ nervousness buying more bonds and gold. Nasdaq remains the unabashed leader driven primarily a select group high value stocks.

Disclaimer: Futures, Options, Mutual Fund, ETF and Equity trading have large potential rewards, but also large potential risk. You must be aware of the risks and be ...

more