Investment Outlook - October 2016

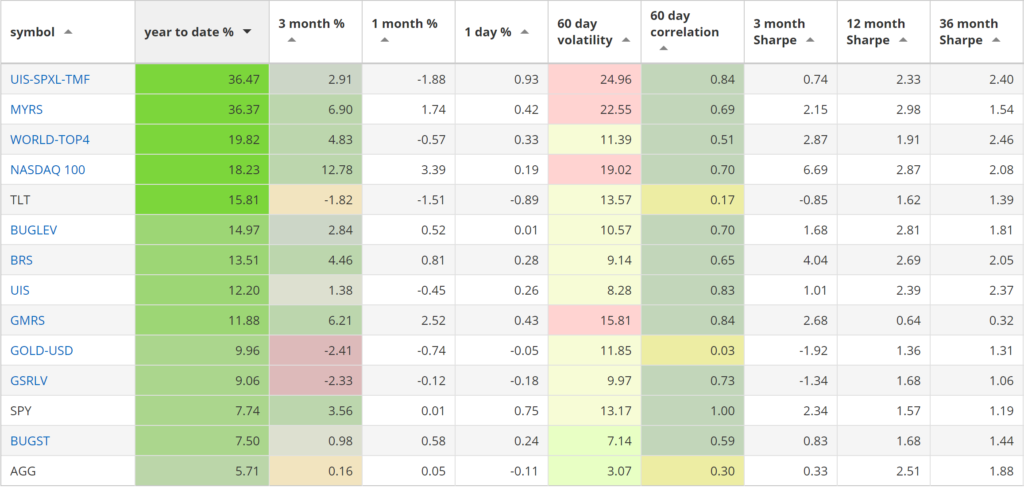

Our top year-to-date strategies:

- The Leveraged Universal strategy with 36.47% return.

- The Maximum Yield strategy with 36.37% return.

- The World Top 4 with 19.82% return.

SPY, the S&P500 ETF, returned 7.74%, year-to-date.

Market comment:

Following a quiet summer, volatility has increased this past month. It was first introduced in the bond market as participants became concerned about an upcoming rate hike as well as the effectiveness of central bank policy. This was reflected in a sudden 4% drop in the 20-year Treasury ETF (TLT ) during the first few days of September. The SP500 (SPY) also had it’s first 3% sharp correction since July. Both these ETFs have since recovered but uncertainty has remained due to upcoming U.S. elections, world politics as well as the deterioration of Europe’s most prestigious bank.

Most of our strategies remained flat for the month although some experienced a correction during the first week. The Nasdaq100 was the best performer with a 3.39% return followed by GMRS at 2.52%. Our worst performer was the aggressive 3x UIS losing 1.88% for the month.

We wish you a healthy and profitable October.

Logical Invest, October 1, 2016

Strategy performance overview (Visit our site for daily updated performance tables.)

Logical Invest performance October 2016

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Thanks for sharing