Intercept Pharmaceuticals Inc. Moves Forward With OCA 'Regenerate' Trial

On May 19, Intercept Pharmaceuticals Inc. (NASDAQ: ICPT) announced plans for an international Phase 3 trial of OCA in patients with NASH.

Intercept is developing obeticholic acid, or OCA, for patients with nonalcoholic steatohepatitis, or NASH. Patients with NASH often have abnormal liver function due to a fatty liver or inflammation. OCA has already received breakthrough designation by the FDA. The international Phase 3 trial will incorporate approximately 2,500 patients throughout 250 centers in North America, Europe, and other locations. The trial is expected to start in the third quarter of this year.

Top analysts weighed in following Intercept’s announcement to initiate Phase 3 testing for OCA in patients with NASH:

According to Smarter Analyst, Liana Moussatos of Wedbush reiterated an Outperform rating on Intercept Pharmaceuticals though she did not provide a price target. Moussatos commented that the NASH Phase 3 trial is “achievable for OCA” but produces a “barrier for competition.” She elaborated, “the co-primary endpoints of NASH resolution and fibrosis improvement are likely to make it difficult for companies’ with product candidates that have yet to show an improvement in liver fibrosis get approval. Additionally, we believe that the large trial size serves as barrier for approval for other companies seeking approval of product candidates in NASH.”

Liana Moussatos has rated Intercept Pharmaceuticals 17 times since April 2013 with an +83.4% average return per ICPT rating.

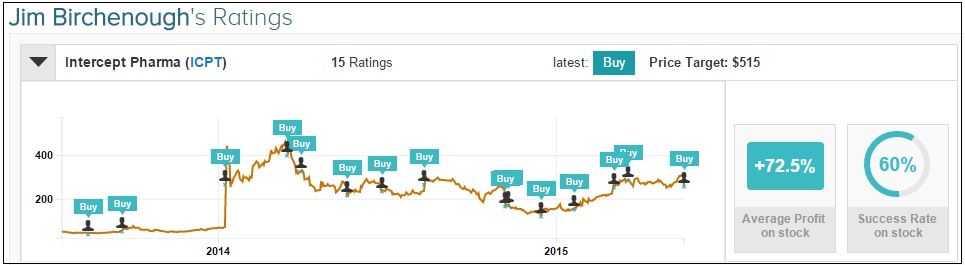

Separately on May 19, Jim Birchenough of BMO Capital reiterated an Outperform rating on Intercept with a $515 price target. Birchenough believes that the Phase 3 trial is “over-powered to demonstrate OCA benefit at reversing fibrosis and resolving NASH.” The analyst continued, “While some profit taking may not be surprising following recent ICPT share price performance, we believe that potential for earlier approval of OCA for PBC over the next 12 months represents a significant upside opportunity on what could approach a $1B opportunity itself and would be buyers on weakness.”

Jim Birchenough has rated Intercept Pharmaceuticals 15 times since August 2013, earning a +72.5% average return per ICPT rating.

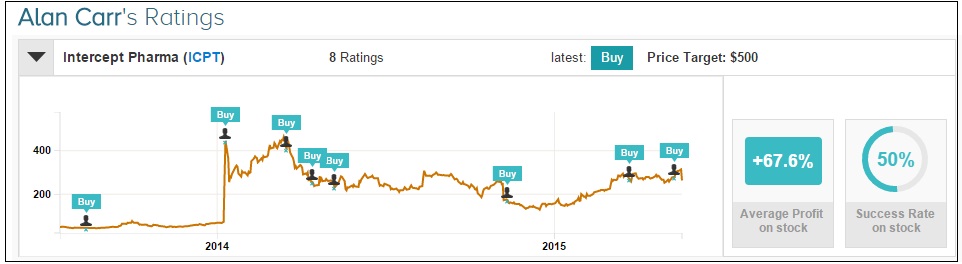

Separately on May 19, Alan Carr of Needham maintained a Buy rating on Intercept Pharmaceuticals with a $500 price target. Carr expects a “favorable outcome from the Phase3 REGENERATE trial based on strength of data from the Phase 2 FLINT trial” and believes that approval for the drug is possible in late 2018 or 2019. Carr also clarifies that “the Phase 2 FLINT trial did not meet the secondary endpoint of NASH resolution because an insufficient number of pts were included in the analysis. This endpoint would likely have been met if the trial had not been stopped early and the analysis pt was larger.”

Alan Carr has rated Intercept Pharmaceuticals 8 times since August 2013, earning +67.6% average return per ICPT rating.

On average, the top analyst consensus for ICPT on TipRanks is Strong Buy.

Disclosure: To see more visit more