Important Information Why The Precious Metals Price Smash Is Meaningless

Investors need to realize the precious metals paper price smash this week is meaningless when we consider the underlying fundamentals of the U.S. and Global Financial System continue to disintegrate. Financial Industry expert, Vic Patane and I discussed why the current precious metals selloff is a nothing more than a mere distraction from the ongoing systemic financial disaster taking place at Deutsche Bank.

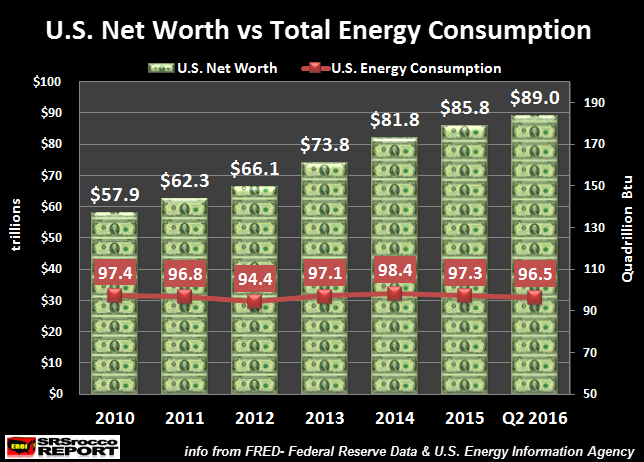

In addition, we covered many other topics, including the strange 2016 U.S. fiscal debt increase of $1.4 trillion, while the budget deficit was less than half of that. We also discussed why the U.S. net worth of $89 trillion (Q2 2016) versus $58 in 2010 is not based on reality as our total energy consumption is actually lower.

(Video length 00:42:14)

During our conversation, I reference the chart below:

Investors need to realize that financial assets must be based on energy. Only a growing energy supply can lead to an increase in net worth. In the chart above, we can clearly see that total U.S. energy consumption as been relatively flat since 2010, however total U.S. net worth has jumped $31 trillion.

On the other hand, total U.S. energy consumption nearly tripled from 34 quadrillion Btu’s in 1950 to 98 quadrillion Btu’s in 2000. Thus, the increase in energy consumed translated into a higher net worth of the U.S. assets.

Vic and I also touched on why it is very important to educate oneself when buying and storing precious metals. Many companies are charging high fees for selling and storing precious metals.

Lastly, I provided some information about my interesting conversation with Bedford Hill of the Hills Group on their Thermodynamic Oil Collapse model. Even though it has taken more time to get Louis Arnoux and the Hills Group on for an interview, I believe it will be well worth the wait.

If you haven’t checked out our new PRECIOUS METALS INVESTING section or our ...

more