How The Wall Street Ponzi Works - The Stock Pumping Swindle Behind Four Retail Zombies

In the nearby column Jim Quinn debunks Wall Street’s latest claim that the American consumer is bounding back. He points out that on an inflation-adjusted basis retail sales are still barely higher than the were a year ago, and, for that matter, are only 4% higher in real terms than they were way back in November 2007.

That’s right. Nearly eight years and $3.5 trillion of Fed money printing later, yet the vaunted American consumer is struggling to stay above the flat line, not shopping up a storm.

And there is no mystery as to why. After a 40-year borrowing spree culminating in the final mortgage credit blow-off on the eve of the great financial crisis, the US household sector had reached peak debt. It was tapped out with $13 trillion of mortgages, credit cards, auto, student and other loans - a colossal financial burden that amounted to nearly 220% of wage and salary income or nearly triple the leverage ratio that had prevailed before 1971.

Household Leverage Ratio

So, as is evident from the graph above, we are now in a completely different economic ball game than the consumer debt binge cycle that culminated in 2008. Households are deleveraging out of necessity, and that means that consumer spending is tethered to the tepid growth of national output and wage income.

Yet sell side economists and the financial press are so desperate for factoids that confirm the Keynesian “recovery” narrative - that is, the false claim that the US economy has been successfully lifted out of a growth rut by mega-injections of fiscal and monetary “stimulus” - that they get just plain giddy about Washington’s seasonally maladjusted, endlessly revised monthly data squiggles.

Thus, in response to the 0.6% gain in July retail sales, The Wall Street Journal’s headline proclaimed, “In a Show of Confidence, Americans Boost Spending”.

Even that was fair and balanced compared to the typical economist’s fare. Opined Richard Moody of Regions Financial Corp:

“The July retail sales report should help allay any remaining concerns as to the state, and psyche, of U.S. consumers…… “U.S. consumers are just fine.”

Oh, c’mon. The July retail sales number was barely 1% higher than it was in November 2014, and has been up, down and around the barn in the nine months since then. Indeed, the “signal” in July’s monthly “noise” was that the American consumer remains stranded on the sidelines, and that consumption driven “escape velocity” isn’t going to materialize no matter how long the Fed dispenses zero or near-zero cost money to the Wall Street casino.

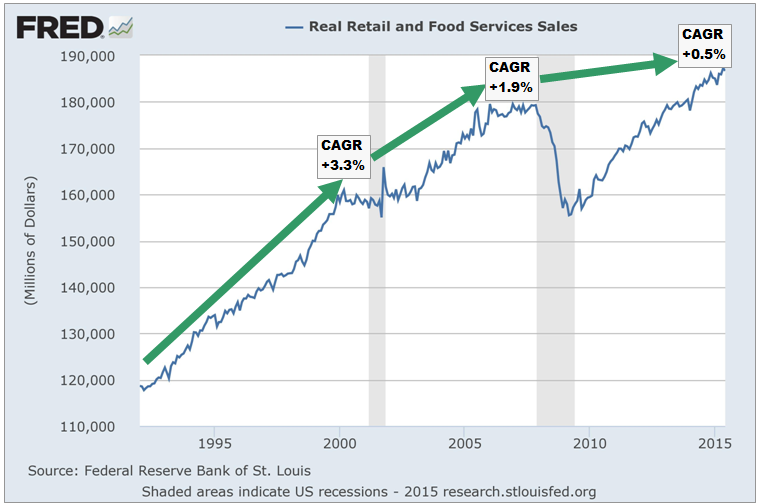

Instead of gumming about the last 30 days of heavily medicated preliminary “advanced” retail sales data, the sell side bulls would do well to look at the last 25 years of inflation-adjusted retail spending. In a word, the trend has drastically decelerated, and, in fact, has nearly lapsed to stall speed since households hit peak debt seven years ago.

Compared to a 3.3% annualized rate of gain in the 1990s recovery cycle (when household leverage ratios were racing upwards) and 1.9% during the 2001-2007 Greenspan housing bubble, real retail sales have only grown at only a 0.5% rate since the November 2007 pre-crisis peak. After 93 months that is not a recession induced, transient dislocation; it’s a deeply embedded trend.

Indeed, this business expansion is already long in the tooth at 74 months compared to a post war-average of 61 months. So given the 2% +/- real growth trends of the last few years, there is no chance whatsoever that retail spending will rebound to historic rates of over-the-cycle gain before the next recession takes its toll.

Real Retail Sales

This radical downshift in the trend rate of real retail sales surely demonstrates that the radical dose of QE and ZIRP hurtled at the American consumer by the Fed has not worked. But it also points to the actual blatant deformations that it has inflicted on the financial markets in the process.

To wit, the last thing that you would expect in an environment were the consumer sector is dramatically and visibly stalling is a rampage of borrowing to open new retail stores and to fund the buyback of gobs of retailer stock.

But the fact is, debt financed retail leases are so cheap that new capacity never stops coming. At the same time, some of the nation’s largest retailers, faced by withering competition from what amounts to Fed subsidized supply expansion, have been loading-up their balance sheets with the very same kind of cheap debt in order to buy back stock at rates which far exceed their faltering net income - a development which is reckless in the extreme in light of their imperiled business circumstances.

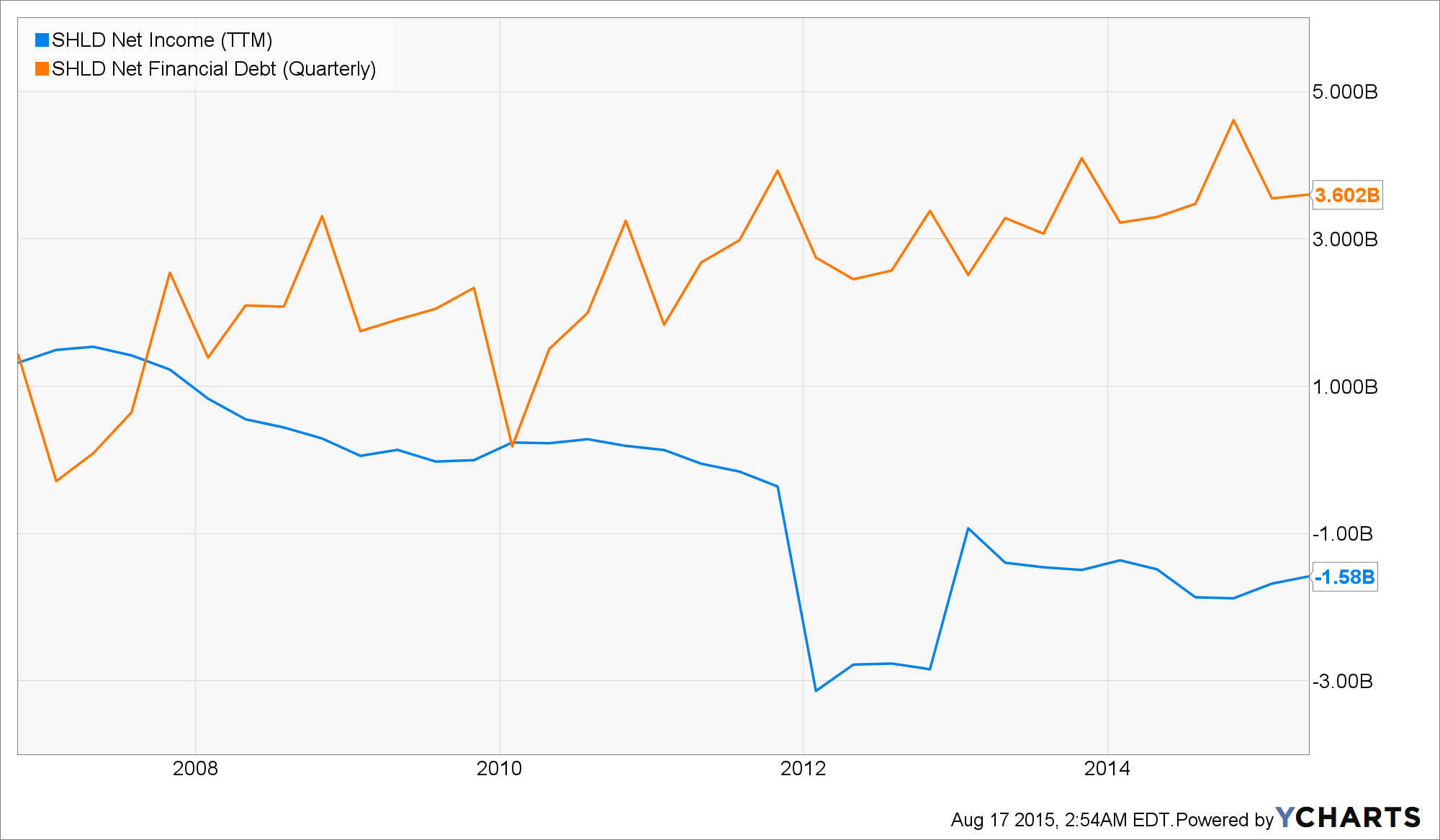

To illustrate the dodgy condition of the debt-strapped American consumer, Jim Quinn dissected the most recent financial results of four of the largest US mall retailers - Macy’s (M), Kohl’s (KSS), Sears (SHLD) and J.C. Penney (JCP). Their combined sales in the most recent quarter of $19.1 billion were down 10% from the prior year; and even when you take Eddie Lambert’s trainwreck at Sears out of the basket, the results are not much better. Sales are flat versus the year ago quarter and combined net income of the other three amounts to a piddling 1.4% of sales.

To be sure, these results are not surprising in the face of a tepid consumer and shift of sales to on-line venues. Department stores sales in July, for example, were down by 2.6% from prior year, and now stand 18% below there pre-recession level. But what is surprising is that the four hardest hit among these once and former retail kings have spent years feeding the Wall Street casino with cash from stock buybacks and dividends.

In fact, during the 10 years between 2005 and 2014, these four retailers spent $34 billion on stock buybacks and dividends, but, alas, their cumulative net income during the period was only $13 billion. So they pumped 2.6X more into the casino than they earned.

Again, it wasn’t just Eddie Lambert and his hedge fund pals sucking the life out of Sears. On a combined basis, J.C. Penney, Macy’s and Kohl’s pumped $28 billion into the stock market in the form of buybacks and dividends during a period when they posted cumulative net income of just $16.5 billion.

In a market where the price of debt is not falsified and where the C-suite is not rewarded for mortgaging company balance sheets to feed the fast money speculators and thereby goose short-term share prices and their stock option winnings, nothing remotely this reckless could happen. In the face of the powerful secular shift of main street consumers to the internet and new retail concepts, companies on an honest free market in finance would plough their cash flow into debt reduction and investments to improve the competitive viability of their stores, not massive financial engineering.

In fact, these four companies raised their combined debt from the equivalent of $6 billion in 2005 (adjusted for sale of their credit card receivables operations to third parties) to nearly $19 billion in the most recent reporting period. Given the overall-trend in department stores sales shown in the graph below, this is nothing short of a death wish.

Needless to say, J.C. Penney’s and Sears are already on deaths door and the other two are stuck with $10 billion of debt and seriously eroding cash flow.In fact, during the first half of this year, Kohl’s and Macy’s reported operating free cash flow of negative $250 million, representing nearly a billion dollar adverse swing from the $725 million of positive free cash flow reported during the first half of 2014.

So here’s the long and short of it. Owing to the Fed’s bubble finance, traditional retailers like the four zombies spotlighted above face endless competition from internet competitors like Amazon and every manner of new bricks and mortar retail concept that entrepreneurs and financiers can dream-up. But much of that new age competition is not on the level economically because it is based on ultra-cheap capital available in both the equity and debt markets.

So the dance of the zombies goes on. Sears shows how it is done, but it’s only an advanced case.

In that episode, Eddie Lambert was the willing agent of its demise, but the casino momo games among the hedge funds which clambered on board in the early days when massive amounts of cash were being sucked out of the company, and its ability to access cheap debt markets during the long years when the disaster was unfolding, were enabled by the mad money printers in the Eccles Building.

In short, last week’s tepid retail reports were not only a remainder that QE and ZIRP have by-passed main street entirely. The faltering department store sector is also a reminder that the monumental amounts of Fed confected cash pooling-up in the canyons of Wall Street are breeding debt-laden zombies throughout the length and breadth of the land.

SHLD Net Income (TTM) data by YCharts

Disclosure: None.