Higher Grain And Soybean Crops, But US Stocks Changes Limited

Market Analysis

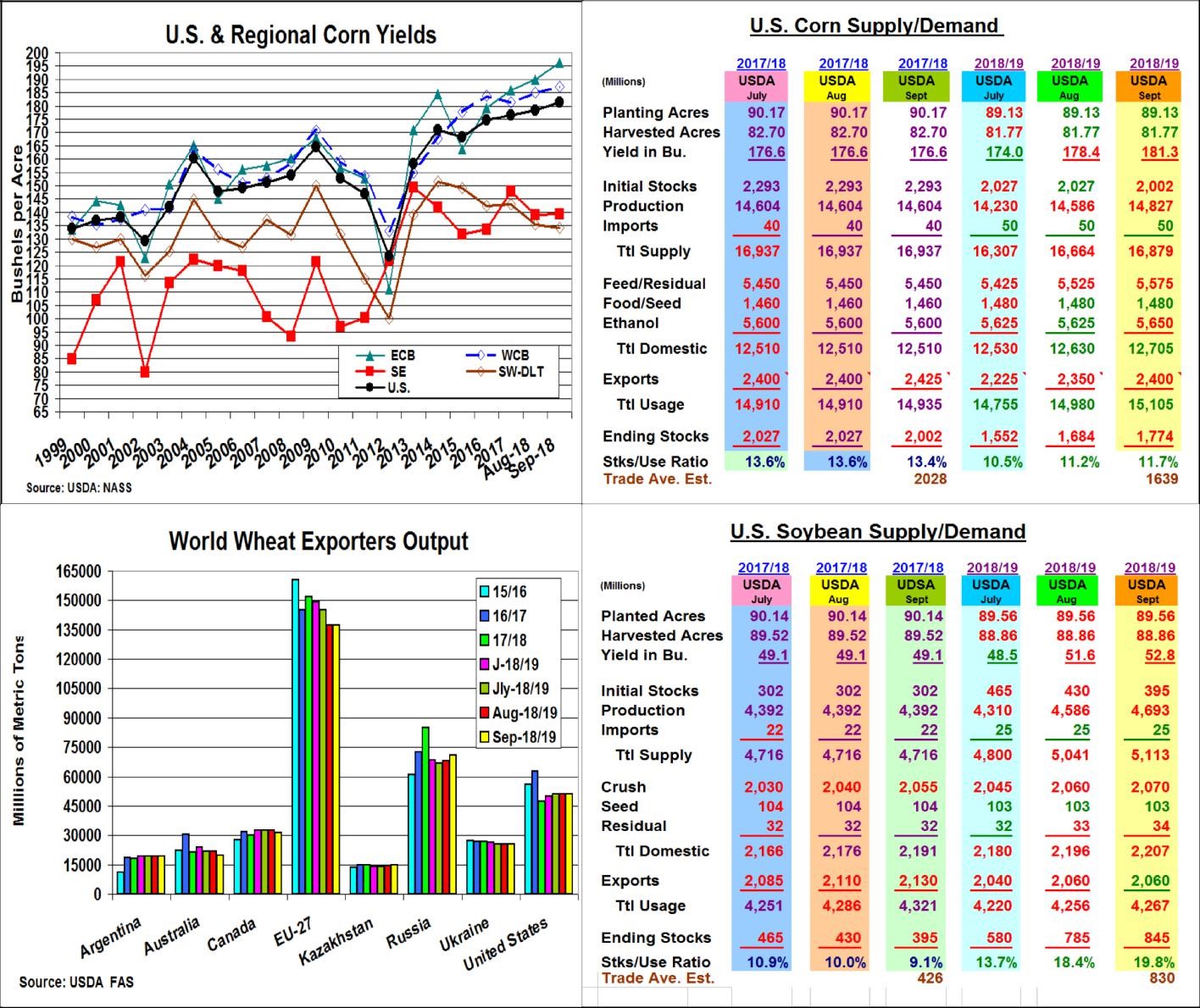

The USDA stunned the markets again this month with a higher-than-expected US corn yield and world wheat crop on their September update. Instead of a modest decline in the US average yield given the recent slippage in crop ratings, corn’s yield rose by 2.9 bu. to 181.3 bu. Similarly, after numerous wheat crop reductions across the globe in the past few weeks, the USDA’s 3.4 mmt jump in its world wheat output when their EU’s estimate was left unchanged and Russia’s output was raised 3 mmt hit this pit too. The US soybean yield also rose, but remained below the feared 53 bu. yield.

September’s US corn output is now projected at 14.827 billion bu., up 241 million bu. from August. The USDA’s dramatic ECB regional yield increase of 6.3 bu to 196.3 bu. prompted this monthly increase when 6 of the 7 states had 6-8 bu. monthly yield jumps. The WCB’s regional yield also rose this month, but only by 2.1 bu. with MN’s yield left unchanged and ND’s yield trimmed by August dryness. Given 2018’s advanced maturity, corn’s yield increases were surprising. However, demand increases across all 3 major 2018/19 usage levels limited corn’s new-crop stock advance to just 90 million bu. at 1.774 billion.

Given recent European downgrading of the EU wheat crop to the 130 mmt area, the USDA staying at 137.5 mmt and their higher Black Sea & India crops took the legs out of the wheat market. Late season weather issues impacting FSU spring wheat, ongoing Australian dryness & further EU crop updates all suggest a tightening of the world exporter supplies. This should bring buyers to the US during the final quarter of 2018.

This month’s US soybean crop forecast of 4.693 billion bu. was just 44 million bu. over the trade’s average. Given the hefty pod counts from the Midwest Crop tour and some late August rains, fears of a plus 53 bu. yield still circulated. .As expected, the USDA’s 35 million old-crop crush & export demand increases also compensated for about 0.4 bu. of this month’s 1.2 bu. US yield increase through a smaller beginning stock. Similar to corn, the ECB states were behind this month’s larger crop.

(Click on image to enlarge)

What’s Ahead

The USDA’s aggressive 2018 corn yield approach has surprised the markets, particularly given the 12-14 day advance in corn’s maturity vs 2017. After early month Midwest rains, the trade will be closely monitoring field reports the balance of the September to determine if any further yield advance is needed. With the US promoting new talks with China, producers should hold new 2018/19 sales.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more