High Corn Input Costs & Low Wheat Prices Switch Acres To Beans & Cotton

Market Analysis

The USDA surveys U.S. producers during the first half of June to see if their initial planting intentions were carried out each year. A near record set of cold temperatures across much of Midwest and Northern Plains during April delayed spring wheat seedings and kept many corn planters in their sheds. Southern and Central areas of the ECB fared better with planters rolling in late April and first half May while the Northern Lake states received excessive rains for much of May. The Delta and the SE also received above normal rainfall during April delaying some corn seedings and possibly upping some cotton plantings for this region this spring. Dryness continued in the S. Plains thru April before rains arrived during May. Heavy rains continued across a swath of N. Iowa and S. Minnesota through much of June while above normal temperatures during May and June have spurred growth across most of the eastern 2/3 of the US.

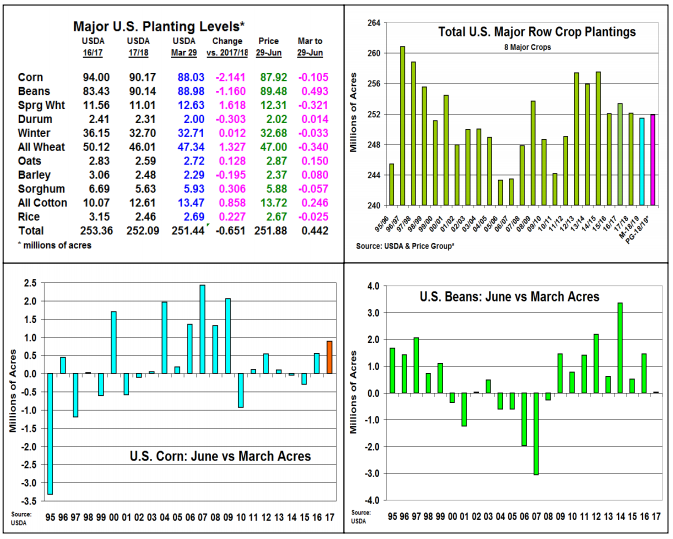

This year’s cold April in the WCB and N Plains likely swapped some spring wheat and corn acres into soybeans while IL, IN and MO’s early jump in seedings likely prompted some additional corn plantings. A small bump in oats and durum might have also have occurred. Overall, we anticipate 493,000 larger soybean plantings while spring wheat is down 321,000 from its previous 1.6 million jump in intentions. Corn’s high input costs has us cautious about a 105,000 smaller area for this feed grain yet this spring. Cotton’s strong spring prices could attract another 246,000 acres to this fiber crop after improved rains. Nationally, we anticipate only a 442,000 increase in the 8 major US crops to 251.88 million acres on the upcoming June 29 US Acreage report.

Corn’s June plantings have increased modestly 5 of the last 8 years from its March’s intentions. Soybeans June US area has rose 7 of the last 8 years, but 2017 was virtually unchanged after a 6.1 million March jump vs 2016.

What’s Ahead

The USDA’s 2018 acreage report will likely be the most influential of the upcoming June 29 updates. Current crop ratings are strong, but heat during July’s corn pollination or dryness during August’s bean podding and filling remain important to 2018’s crop sizes. However, any news about the resumptions of the US/China trade negotiations will likely be supportive for grains and soybean prices. Hold sales for now.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more