Hey, Wall Street - This Bud’s For You!

The hoards of Washington politicians promising to boost the nation’s economic growth rate and the posse of monetary central planners and their Keynesian economists (excuse the tautology) gumming about the fact that “escape velocity” appears to have gone MIA have one thing in common. To wit, they have never looked at the chart below, or don’t get it if they have.

Plain and simple, the sum of Washington policy is to induce the business economy to eat it seed corn and bury itself in debt. Capitol Hill does its part with a tax code which provides a giant incentive for debt finance, and the Fed completes the job through massive intrusion in the money and capital markets. The result of systemic financial repression is deeply artificial, subsidized interest rates and free money for carry trade gamblers - distortions which have turned the C-suites of corporate America into stock trading rooms.

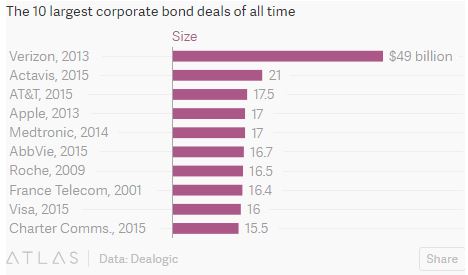

As a case in point, the $46 billion of bonds sold by the owners of Budweiser last night where priced at a ten-year yield of 3.67%, which means that after-tax and after inflation, the company’s borrowing cost was hardly 1%. Yet, as explained more fully below, the only point of this massive offering was to fund with nearly free long-term capital the huge payday for speculators in SABMiller stock that will result from AB InBev’s $120 billion takeover transaction.

But consider the economic context. As astounding as it may seem, US net business investment in fixed assets last year was 10% below its turn of the century level. And that’s in nominal dollars - in real terms its down by nearly one-fifth.

Moreover, net investment is the right measure, and its not at all comparable to the what Wall Street stock peddlers, who claim to be economists, are always bloviating about. Their favorite metric is the quarterly gains in the nonresidential investment component of the GDP accounts, which they trot out as evidence that all is awesome. Actually, that’s just gross!

Stated more clinically, upwards of 85% of the $2.3 trillion annual rate for private nonresidential fixed investment represents the replacement of capital consumed or depreciated in current production. If you don’t do that, you slide back to horse and buggy times real fast.

So what counts for growth is the net investment in machinery, equipment and technology, but that has not only been sliding southward for 15 years. Now it’s just a shadow of its former self. Thus, US net investment by business in 2014 amounted to just 2.3% of GDP or barely half the 4-5% range that prevailed during the high growth era of the 1950s and 1960s.

Needless to say, over any sustained period of time, tepid investment means tepid productivity growth; and that, in turn, means a stagnant economy. Unless, of course, you have booming labor force growth, which is the very opposite of the US, where 102 million or 41% of the adult population is not gainfully employed.

At the same time, the going nowhere green line in the chart below is not for want of available capital. In fact, business debt securities outstanding have doubled since 2000, and have been growing at a 6.4% annual rate since 2008. Indeed, the blue line in the chart betrays not even a semblance of the Great Financial Crisis (GFC) or the supposed deleveraging response to it.

So corporate debt has been off to the races, and even then the chart above does not do justice to the full story. If you count all business debt including bank loans and obligations of non-corporate enterprises, total credit outstanding has surged from $10 trillion on the eve of the GFC to $12.5 trillion today.

And that gets to our current theme. Where did that $2.5 trillion go?

You can’t count gross business investment because most of that was funded with internal depreciation. Yet net investment is still below 2007 levels, meaning that no outside capital has been used at all on an aggregate basis.

So here’s the short answer. This Bud’s for you, Wall Street!

Like the monumental bond deal priced by AB InBev (BUD) last night, all these borrowed trillions have gone into financial engineering - both to stock buybacks and to perfectly pointless M&A deals like the Anheuser-Busch InBev purchase of SABMiller (SBMRY).

Believe me, from an economic efficiency and wealth creation point of view merging the #1 beer behemoth of the world with the #2 giant is truly pointless. Consumers everywhere are voting with their dollars for craft beer by the pint from micro-breweries, not suds by the tanker load from yesterday’s dinosaurs.

Indeed, the $120 billion combination of world’s two largest beer companies - AB InBev with a 20% global market share and SABMiller with 10% - will result in just the opposite of where the consumer market is going. That is, an unmanageable globe spanning monstrosity with $60 billion in sales spread among scores of highly differentiated regional and national beer markets.

In fact, the two companies are already giant M&A roll-ups representing a string of mergers that have been going on for two decades, including the $52 billion InBev purchase of Anheuser-Busch six years ago. But you don’t have to be an expert in the beer industry to realize that these rollups were mainly the product of cheap debt and financialization, not free market economics. Recall that the beer industry ran out of true economies of scale 30 years ago when world class breweries reached their maximum efficient size in terms of production and distribution.

Stated differently, in the absence of drastic financial repression by the world’s central banks there would be no case whatsoever for the globe-spanning beer merger now at hand. The latter will only create more dis-economies of scale as all the pieces and parts from two decades of financially driven M&A create another artificial, discombobulated enterprise which is too big to manage and wrong-sized for the nature of the market which it serves.

Too be sure, the whole thing is predicated upon operational synergies. But that’s just a euphemism for front-end jobs cuts which get labeled as “synergies” and taken as one-time “ex-items” charges which don’t count by the lights of Wall Street’s hockey stick purveyors. The fact is, these job cut synergies may or may not be sustained over time; and they are as likely to cause operational disruptions and setbacks as efficiencies and gains.

Indeed, merger synergies are one of the great scams of our bubble finance regime. They fail to account for the fact that at the scale of giant global businesses involved in these mega-deals, diseconomies of scale are just as likely as economies of scale. Long ago the former would have been punished by honest free markets, meaning that most of today’s mega-deals would never happen. But the casino does not punish failed M&A deals; its just rewards corporate executives for taking restructuring charges when failure becomes undeniable.

In fact, since cheap debt always trumps expensive labor, Wall Street’s M&A machinery just keeps creating one giant malinvestment after another. And our monetary central planners keep braying that the labor market is still too weak and that it must therefore keep rates lower for longer.

Just maybe, however, the Fed’s new financial stability monitoring group might note something suspicious about these mega-debt deal percolating up through the deal machinery. Namely, that in this case, and in most others, the merger partners are already vastly over-valued momentum plays that can be explained only by the fact that the financial markets have been turned into gambling casinos.

Specifically, the TEV (total enterprise value of debt plus market equity) of the two beer giants combined is currently around $340 billion, yet in the most recently reported LTM period InBev generated just $13 billion of free cash flow (EBITDA less CapEx) and SABMiller under $5.3 billion. In sum, their combined number for that crucial valuation metric is just $18.3 billion, meaning that they are trading at 18.5X free cash flow.

Folks, these two momo plays are in the suds business, not social media! The overwhelming share of their cash flow is generated in Europe and North America were volume has been flat for two decades, as shown below. Even on a global basis, industry growth over the last 17 years has averaged only 2% per annum; and most of that is attributable to China where competition is plentiful, prices cheap, profits scare and the government is increasingly unfriendly to foreign companies.

So what we have here is a giant overvaluation bubble in the suds business. Yet the result of current central bank policy is just more of the same. In fact, at the planned $125 billion bond and bank loan financing package, the merger company’s leverage will reach nearly 7.0X free cash flow. In a no-growth business in a world where interest rates must eventually normalize - that is sheer lunacy. But it well explains why our monetary politburo is so reluctant to let interest rates normalize and is so deathly afraid of a Wall Street hissy fit.

None of this would happen in a world with honest interest rates and stable two-way capital markets for the simple reason that the financing could not be raised; boards and CEOs would have no momentum driven stock market inducing them to engage in patently irrational mergers; and, in any event, short sellers would swiftly punish serial roll-up machines that destroy rather than create sustainable economic value.

Here’s the thing. This deal is not an outlier - its par for the course. Everyone of the giant bond deals of the last few years - there were $182 billion last year attributable to deals over $10 billion - have been used to fund M&A deals and other financial engineering maneuvers. Virtually none of them have funded the purchase of new assets, and yet that was originally the whole point of the long term bond market.

Indeed, after two decades of bubble finance, Wall Street has turned the corporate bond market into a fee scalping machine.

Disclosure: None.