Headline-Driven Markets Will Continue

"Seasonally, on average, the index highs have come between mid April and early May during the 2nd year of the Presidential Cycle. It seems unlikely we will see new index highs in the next month, but a significant rally is possible." Mike Burk, March 24, 2018

The market has punished us this week for being too complacent, and it is washing out our excess bullishness. It sounds almost religious.

Even those of us who follow sentiment and know that it is a contrary indicator... we still get swept in the euphoria and the FOMO.

I read on Twitter this week that often our worst trades come after our best trades because we let our guard down. So true, and this year so far has been a perfect example.

This bull market has been led higher by Technology, so I think it is an important indicator to consider regarding the health of the market overall.

This chart looks healthy, and that means it continues to favor higher stock prices.

The banks are very sensitive to short-term rates, so any weakness in this chart calls into question the assumption of higher short-term rates. And a healthy economy assumes gradually higher short-term rates, etc.

This chart is a bit of a concern, and it needs to hold at the shelf support.

The chart below helps reassure that short-term rates will continue higher. Strong oil prices are sure to be followed by rising rates. I like the looks of this, and it makes me think that we might get a very nice snap back rally in the banks when the mood of the market swings back in favor of stocks.

I am still feeling the sting of being so wrong to think that new highs for the NDX would pull the overall market higher last month. I should have consulted this chart beforehand.

This Dow test of its 200-day looks inevitable from the view of this chart. The Dow moved too high, too fast, and it had to crack at some point.

Now we are looking for the diffusion indicator to move back up above its zero-line.

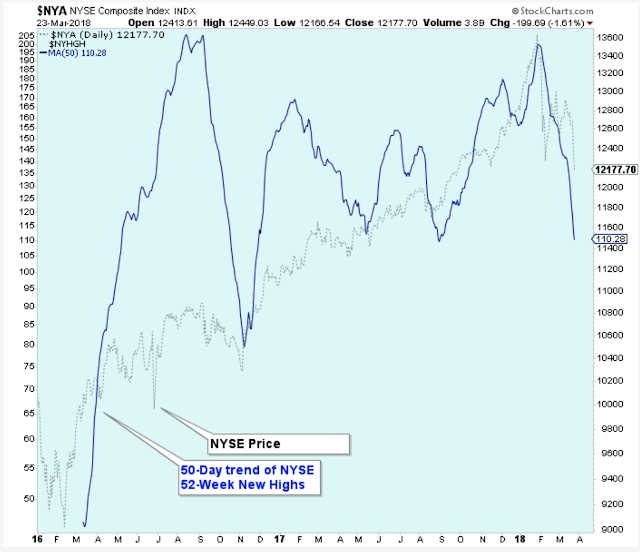

You can't have much of a sustained market rally unless there is a healthy number of new 52-week highs. I am watching for this indicator to turn higher.

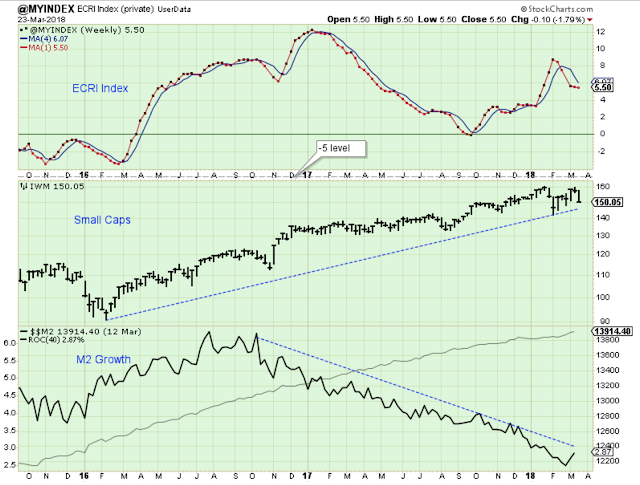

The ECRI has dipped, but is still well within the range of decent projected economic growth. And the small caps continue to point higher which favors higher stock prices for the general market. Weak M2 growth remains a concern. (Side note: I suspect the weakness in the gold miners is related to this weak M2 growth.)

Outlook Summary:

I am expecting a choppy, headline-driven, sideways market between now and the November elections. I still plan to buy the dips for short-term gain, but over time I plan to continue to reduce my overall exposure to stocks.

The expected US economic growth rate is back down to the 2% level.

Higher rates are now a headwind for US stocks. The recent tax cut, the 300 billion spending increase, and the already out-of-control federal deficit are a set up for a very dangerous spike in interest rates.

Once again, the problems in Europe related to debt and the banking system are serious issues.

Something else to consider is the Mueller investigation. I worry that the headlines generated by the investigation may rattle the markets more than people are currently anticipating.

Based on market seasonality, Mike Burk is projecting a medium-term stock market peak in May, which sounds about right to me.

The long-term outlook is increasingly cautious.

The medium-term trend is down.

The short-term trend is down.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a ...

more