Halozyme Therapeutics: A Good Bet To Get Back To Previous Highs

Our second selection this month is Halozyme Therapeutics (Nasdaq: HALO). Halozyme is a small biopharma play with a $1 billion market capitalization. Biotech and biopharma have been fascinating spaces this year and have yielded some of my best returns so far in 2014 as anyone that purchased Avanir Pharmaceuticals (Nasdaq: AVNR) in the inaugural issue of Small Cap Gems knows.

Both sectors were crushed in a six week sell-off triggered in early March that swept over the entire biotech/biopharma complex. Interestingly almost all the large cap stocks like Gilead Sciences (Nasdaq: GILD) soon fully recovered from their plunge to hit new all-time highs by summer. Small biotechs and biopharma firms in contrast are still down substantially overall from their highs earlier in the year. This divergence offers opportunity, especially as performance in this space has perked up over the past month or two.

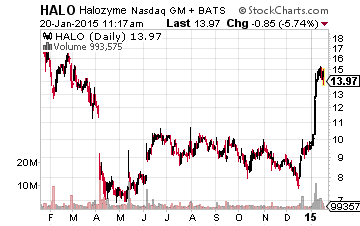

Halozyme is a San Diego-based biopharma company that develops human enzymes to enable or enhance subcutaneous drug delivery of biological drugs. As can be seen from the chart above, Halozyme sold for nearly $18 a share before the big biotech plunge in March. The stock has spent the last six months or so in a relatively narrow price range of $8 to $10 a share. Now is a good time to start to build a position in this promising biopharma near the bottom of that recent range.

The value proposition for Halozyme consists of a successful platform that has delivered successful candidates in partnerships with major pharma players and an early stage candidate to treat pancreatic cancer. Let’s take a look at both parts of Halozyme’s potential catalysts.

Enhanze® Platform:

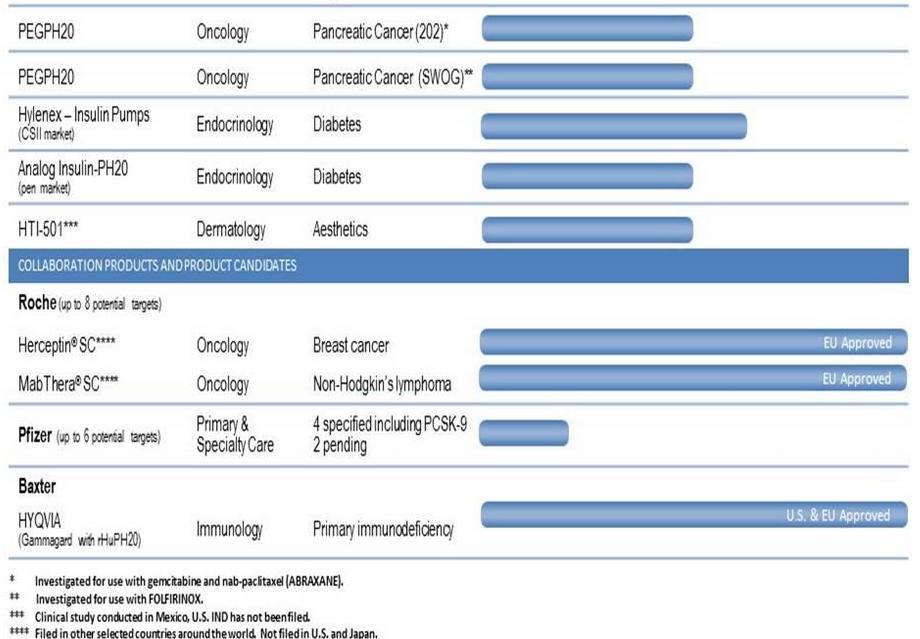

Halozyme has a hyaluronidase enzyme platform whose trademark name is Enhanze®. This platform has delivered four drugs to market as of this time. One product (Hylenex) is wholly owned and marketed by Halozyme. The other three products are marketed by their partners. These include Herceptin SC and MabThera SC which is marketed by partner Roche (OTCQX: RHHBY) and HyQVia which is distributed by Baxter (NYSE: BAX). All of these partnered compounds are currently being distributed in Europe only while Hylenex is being distributed in the United States.

This platform should deliver many more drugs with partners over the next few years. Roche’s agreement with Halozyme calls for up to eight products and the company has an agreement with Pfizer (NYSE: PFE) to develop up to 6 drug candidates for potential commercialization over the next few years. Halozyme receives milestone payments, license fees, and mid-single digit royalties on these types of partnered drugs.

Herceptin and Rituxan (known as MabThera in Europe) are widely used in cancer therapies with annual sales each in the $7 to $8 billion range. Both therapies are administered by intravenous infusion over several hours. The patent in Europe for MabThera expired in late 2013 and the Herceptin patent expired in 2014 in Europe. By partnering with Halozyme’s Enhanze® platform Roche is using life cycle management to extend these blockbusters. Halozyme has been able to formulate both drugs for subcutaneous delivery rather than IV.

If Roche can use this method to capture just $1 billion in sales for each drug in Europe alone, Halozyme’s mid-single digit royalty could easily amount to over $100 million annually with further upside as distribution moves on to other major markets such as Latin America. There is less urgency to garner approval in the United States for these drugs since the patent expiry here for Rituxan is 2018 and 2019 for Herceptin.

The FDA approved HyQvia a few months back. This is Baxter’s subcutaneous treatment for adult patients with a primary immune deficiency. HyQvia consists of immunoglobulin with Halozyme’s recombinant human hyaluronidase. Peak sales are projected to come in just under $1 billion a year annually. Given the royalty structure, Halozyme could garner between $30 million and $50 million a year as these sales expand. The company’s propriety product Hylenex is bringing in just over $3.5 million in quarterly sales of the last quarter.

Given the growth prospects, pipeline and partnerships around this platform, Enhanze® by itself is worth more than the $1 billion market capitalization of the company currently in my opinion as the platform is now well established and beginning to generate real revenues.

PEGPH2O:

Another potential major catalyst that investors are basically getting for free at these price levels is PEGPH20 which is a drug targeted at pancreatic cancer. This very lethal form of cancer is diagnosed in just over 45,000 people in the United States annually with almost 40,000 deaths caused by pancreatic cancer in any given year. A person’s chances of developing this form of cancer over their lifetime are around 1 in 70.

PEGPH20 is Halozyme’s pegylated hyaluronidase drug candidate administered with gemcitabine. The company currently has a small early stage study with some 24 late stage cancer patients being treating for this disease. Full results will be presented at a healthcare conference in San Francisco in mid-January. The company also plans to start an early stage study for use against small cell lung cancer this month.

The early data showed remarkable efficacy in the small cohort of patients. Early hints of the drug’s efficacy drove Halozyme’s stock price to $18 a share earlier in the year before the big sell-off that cratered the entire biotech/biopharma space in early March. In addition, a clinical hold was placed on the drug due thromboembolism concerns in early April.

Thromboembolism is the formation in a blood vessel of a clot (thrombus) that breaks loose and is carried by the blood stream to plug another vessel. These concerns have been addressed and the hold was removed two months later.

The stock has yet to recover from these two events earlier in the year presenting investors an opportunity to get in at less than half the price of the stock in March. Based on the data already released this drug should have a good probability of moving on to further trials which could trigger a nice rise in the underlying shares. In addition this drug targets hyaluronic acid, a substance which is found at high levels in several types of tumors and serves to enhance tumor growth as well as provide a shield against chemotherapy. If successful, this drug could be applied to other forms of cancer, expanding its potential base of treatable population and greatly enhancing the drug’s possible value.

Pancreatic cancer is just the first target for this potential blockbuster. Halozyme has received Fast Track and Orphan Drug designations from the FDA for PEGPH20 for the treatment of pancreatic cancer which is promising.

Summary:

As can be seen above, Halozyme has plenty of possible catalysts and potential “shots on goal”. The company should garner some $100 million via royalty payments, license fees and milestone payouts in 2015. These revenue streams should do nothing but increase in the years ahead as revenues ramp up from existing products and as new compounds are developed and come online.

I expect the company to post a small loss in 2015 but given its pipeline profits should be forthcoming in the years ahead. The company has some $80 million in net cash on its balance sheet which should get it through to when it produces positive free cash flow.

The presentation of PEGPH20 a month from now could also be a major catalyst and as the drug moves on to later stage trials. Insiders seem positive on the stock as they bought almost $700,000 in new shares in mid-September.

Given its pipeline, increasing revenue streams and partnerships with several major players within the pharma space I would not be surprised at all if the company receives a lucrative buyout offer at some point in the foreseeable future.

I hesitate to put any firm price target on the shares given the company’s potential and it current undervaluation. Our risk mitigation strategy will remain just as it is on numerous other plays in this speculative space. Catalysts have already triggered a rally taking Halozyme up to just under $15.

Readers of The Turnaround Stock Report have enjoyed a nice gain of 71% in the past six weeks when we initiated a Buy notice at $8.65. I’m looking for this stock to easily get back to previous levels of $18 a share in short order, giving you a quick 20% gain. At that time, I will re-evaluate our position and let Turnaround Stock Report readers know whether to hold for more gains or cash out for profits.

Disclosure: Long HALO.

Bret Jensen is a regular contributor with Investor Alley, publisher of ...

more

Oliver Fox, you forgot the 70 percent sell off was b/c of a self imposed trial halt on PEGPH20 for clotting. Since then they added low molecular weight Heparin (a blood thinner) and trial is back on track. Recent run up was b/c of release of new data from that trial which was great. Also, now PEG has orphan status in US and EU. CEO Helen Torley says HALO is meeting with FDA late Q1/2015 to seek registration trial. Could be granted breakthrough status. On top of that, Enhanze platform generating expanding licensing income while PEG trials continue. HALO is in much better shape than when it was an $18 stock and I foresee share price reflecting that by June.

It was the kiss of death when HALO was mentioned on Mad Money

i would highly suggest no one buy a stock that is up 100 percent in two weeks.... and that sold off 70 percent the last time it was at 18