Gundlach: U.S. High Yield Spread Heading Into Recession

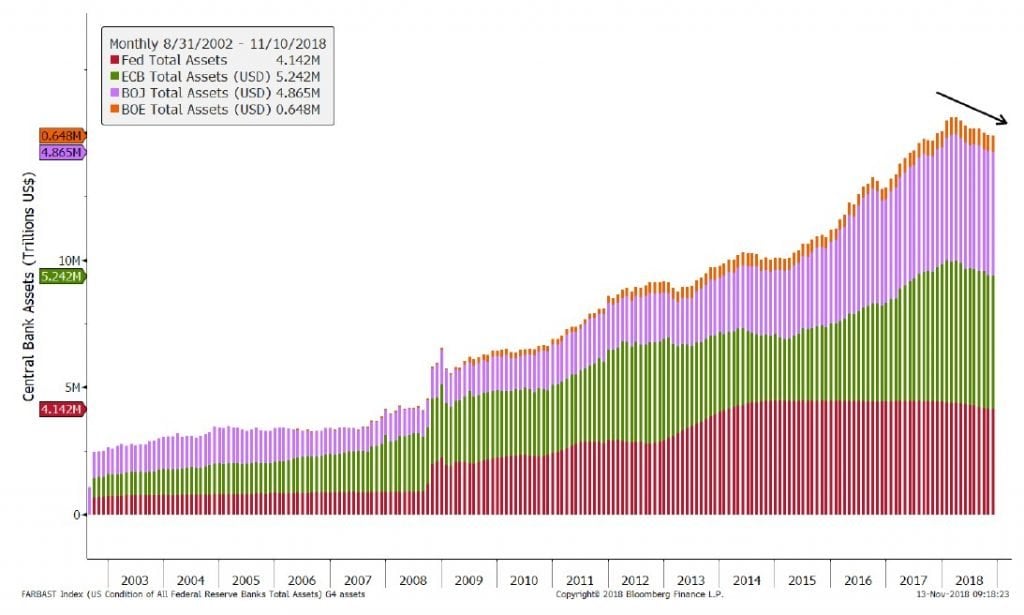

G4 Central Banks’ Balance Sheets

Fed = Federal Reserve, BOJ = Bank of Japan, ECB = European Central Bank, BOE=Bank of England

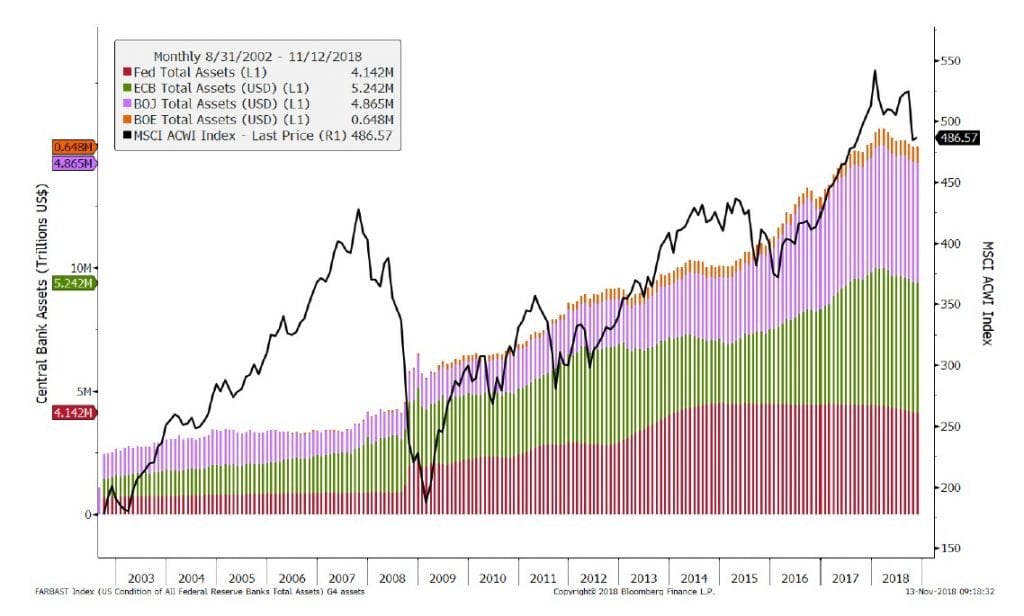

G4 Central Banks’ Balance Sheets & Global Equities

Fed = Federal Reserve, BOJ = Bank of Japan, ECB = European Central Bank, BOE=Bank of England

S&P 500 vs. MSCI ACWI (ex-US) Normalized 1/26/18

(Click on image to enlarge)

Source: Goldman Sachs as of September 4, 2018

U.S. = S&P 500 Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. MSCI ACWI Index is a free-float weighted equity index for developed and emerging market countries (ex-US). EPS = Earnings per share. You cannot invest directly in an index.

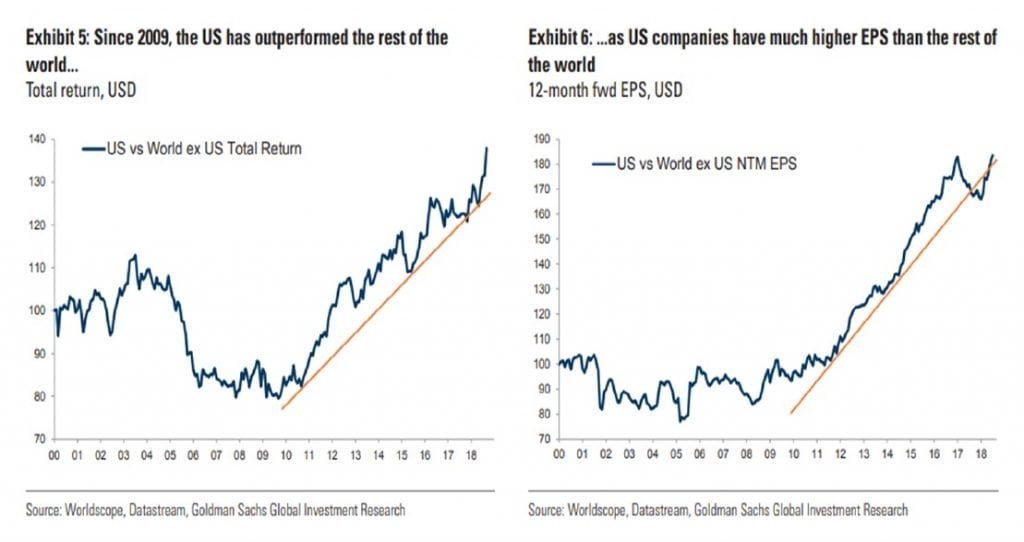

U.S. Outperformed the Rest of the World

(Click on image to enlarge)

Source: Goldman Sachs as of September 4, 2018

U.S. = S&P 500 Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. MSCI ACWI Index is a free-float weighted equity index for developed and emerging market countries (ex-US). EPS = Earnings per share. You cannot invest directly in an index.

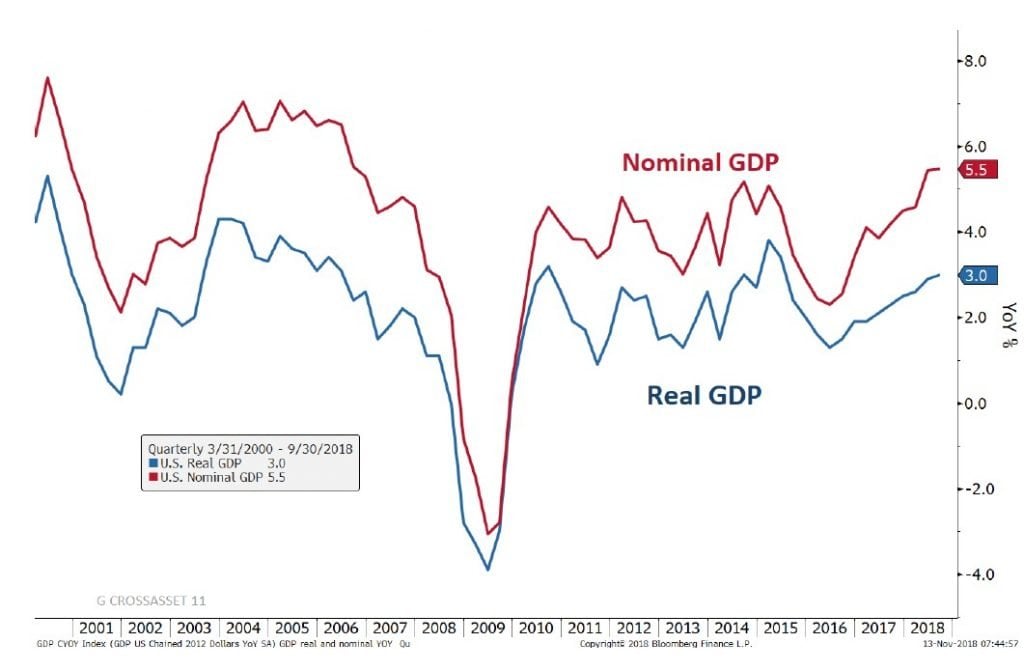

Gross Domestic Product – Real and Nominal

(Click on image to enlarge)

Source: Bloomberg

YoY - year-over-year; GDP = Gross Domestic Product includes the total amount of goods and services produced within a given country. Nominal GDP is adjusted for inflation. You cannot invest directly in an index.

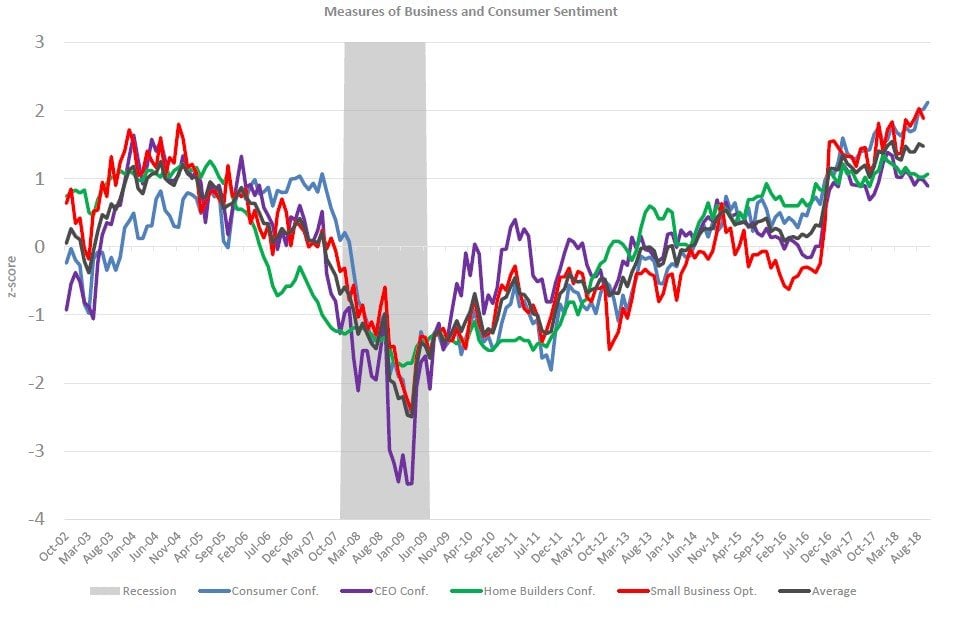

Measures of Business and Consumer Sentiment

Normalized based on z-scores since Oct 2002

(Click on image to enlarge)

Source: Bloomberg; DoubleLine

z-score = the number of standard deviations from the mean a data point is. You cannot invest directly in an index.

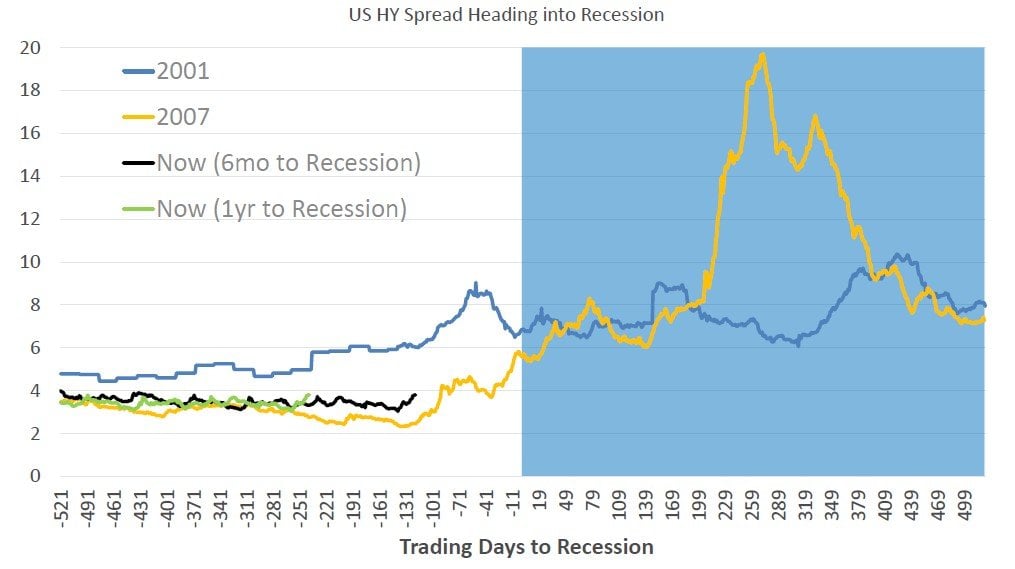

U.S. High Yield Spread Heading into Recession

(Click on image to enlarge)

Source: Bloomberg, DoubleLine as of October 30, 2018

US HY = Moody’s Bond Indices Corporate BAA Index are an average of the daily values for the corresponding month and weekly values are averages for the daily yields of the corresponding week. Spread = the difference between the yields of two bonds with differing credit ratings. You cannot invest directly in an index.

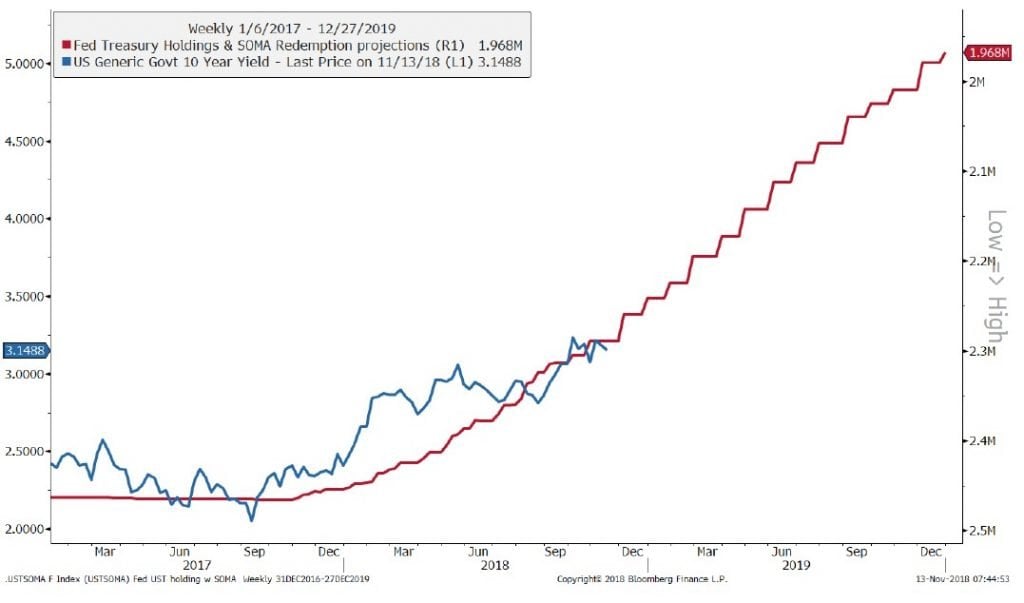

Fed Treasury Holdings vs. 10Y UST

(Click on image to enlarge)

Source: DB Research, Bloomberg

SOMA = Systems Open Market Account is one of the monetary policy tools available to the Federal Reserve.

Deutsche Bank and Credit Suisse Near Lows

(Click on image to enlarge)

Source: DoubleLine, Bloomberg

DoubleLIne Core Fixed Income Fund and DoubleLIne Flexible Income Fund own 0% of Deutsche Bank and 0% of Credit Suisse as of October 31, 2018.

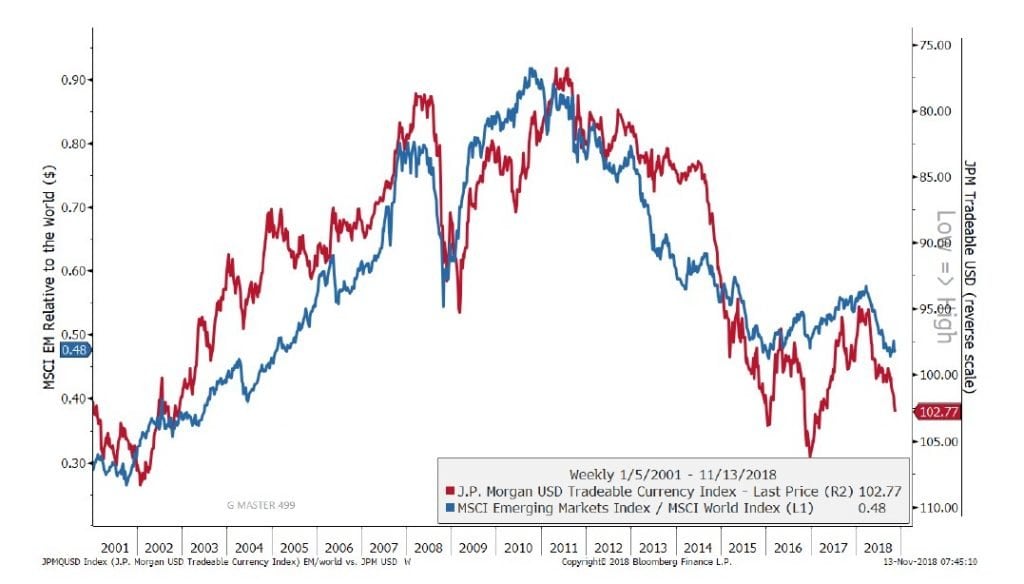

Emerging Markets vs. Developed Markets and U.S. Dollar

(Click on image to enlarge)

Source: Datastream, Bloomberg

MSCI EM Index - A float-adjusted market capitalization index that consists of indices in 23 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates. JP Morgan USD Tradeable Currency Index - Is an index that is not investable. It tracks the volatility in the U.S. dollar. DM - Developed Market. USD - U.S. Dollar. You cannot invest directly in an index.

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get ...

more