Golden Frosting On An Equity Cake

Despite the high levels of uncertainty in the world and specifically in Washington D.C., equities continue to trade at or near all-time highs. Many investors are exploring different hedge strategies to employ in their portfolios to try to protect these equity gains and diversify themselves going forward.

In the past, bonds have generally shown positive returns when equity markets are in flight-to-quality mode, but investors looking in that direction have to grapple with the possibility of the Fed raising rates. Gold is another asset that historically has provided safe haven appeal and has played a part in endowment style models for years. However, not all institutions have allocations to gold. Many acknowledge and enjoy the protection and store of value status it holds, but have difficulty determining an intrinsic value and using that value as justification to replace earning assets such as dividend paying equities or bonds in the portfolio.

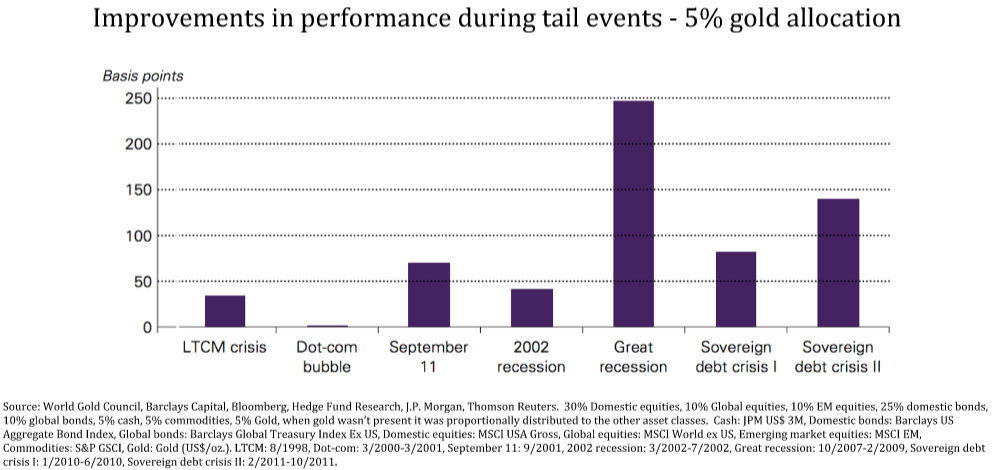

Still, even those who are not confident in their ability to properly evaluate gold's long-term appreciation potential realize how much value it can add to a balanced portfolio as a diversifier and tail risk hedge. The World Gold Council addressed this topic in a study it released in 2013. Its analysis reviewed, among other things, how a portfolio would fare in tail risk events if it contained a 5% gold allocation. The Council determined that gold helped meaningfully protect total value during historical flight to quality events.

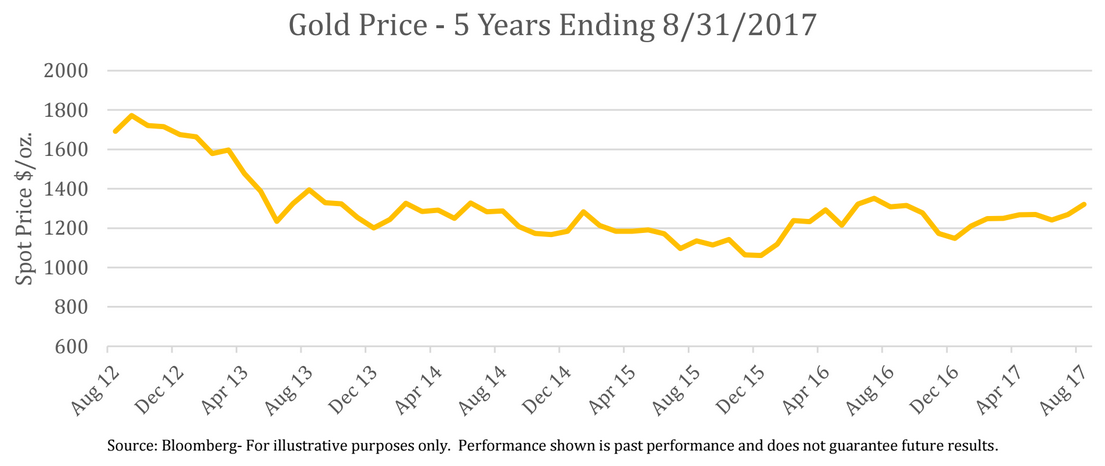

(Click on image to enlarge)

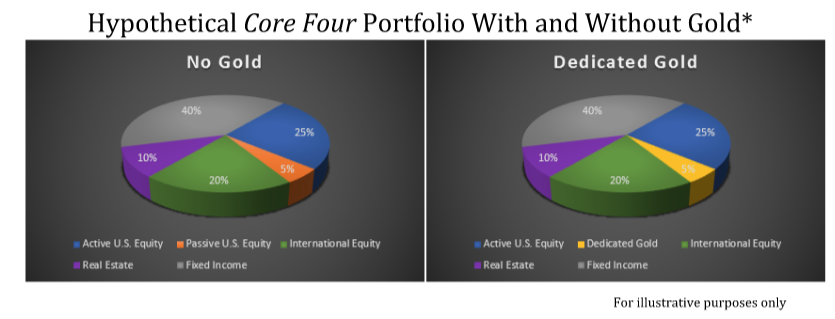

The World Gold Council's argument for gold as a tail hedge is a solid one. The next question, is what does this protection cost? Certain protection strategies have an explicit cost associated with them. For example: equity derivatives have a premium you pay up front. Gold, on the other hand, is generally considered a store of value, and the cost of holding gold is the opportunity cost of investing in something else. We can quantify this cost over the past 5 years by comparing a simple balanced portfolio, commonly referred to as a Core Four* Portfolio, without gold to the same portfolio in which we sell 5% of passive U.S. equity exposure in favor of gold. (A Core Four portfolio was made popular by investment author, Rick Ferri, and is one of the simplest forms of a diversified portfolio. The portfolios consist of Bonds, U.S. Stocks, International Stocks, and Real Estate. Ferri explains the investor's risk tolerance determines the percentage to bonds (we use a common amount for a moderate tolerance level, 40%) and the rest is to be split in roughly a 3:2:1 ratio respectively. Many investors use a mix of active and passive U.S. equity, for simplicity, we will use 25% in active U.S. equity proxied by the S&P 500 Value Index, and 5% in the passive S&P 500 Index which we will use to toggle the 5% dedicated and layered gold positions.)

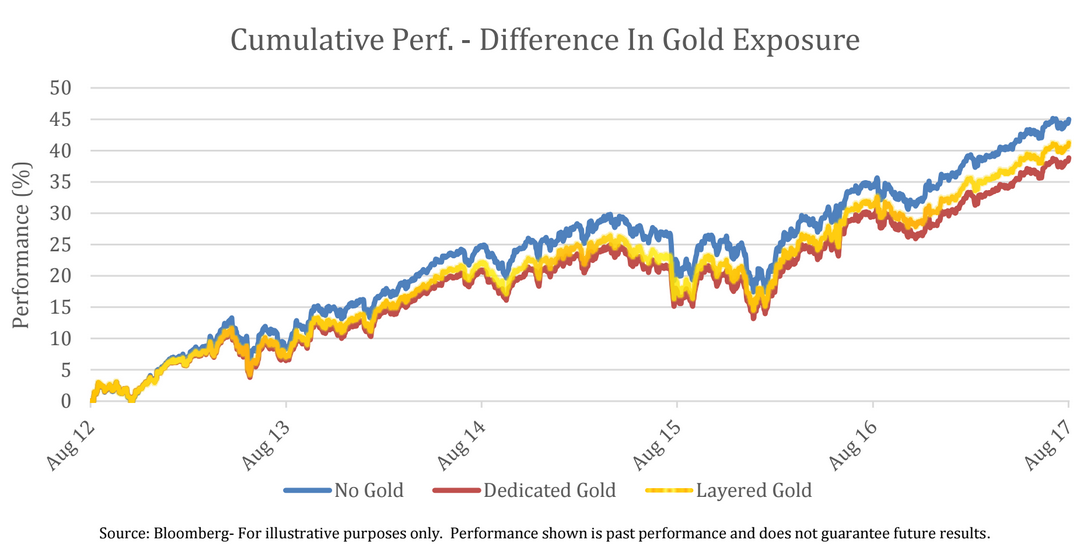

(Click on image to enlarge)

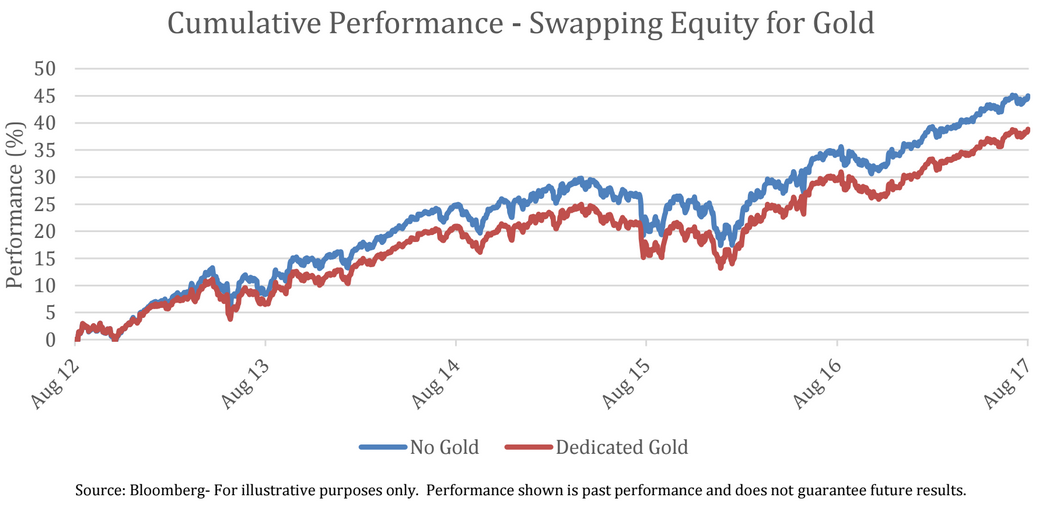

Looking at the generally consistent bull market for the five year period ending August 31st 2017, we see the value of our hypothetical goldless core four* portfolio was up a cumulative 45.0%. Removing the 5% passive U.S. equity allocation in favor of gold caused the end value to lag to 38.8%. Gold may have helped the overall performance if there was a substantial drawdown during the period, but there wasn't, and this unneeded hedge cost 6% in missed performance.

(Click on image to enlarge)

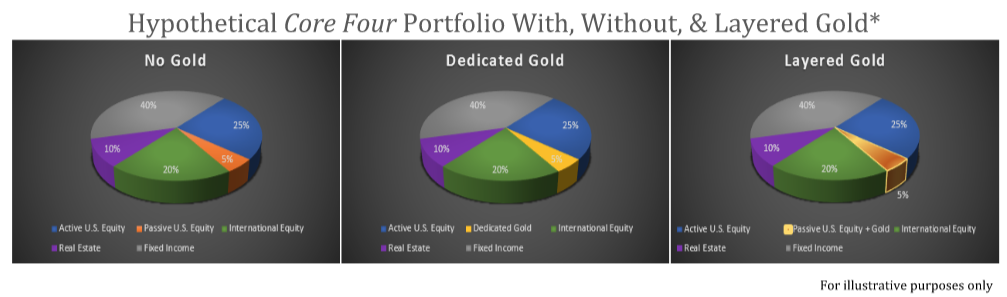

Gold is often a great tool for portfolios, but perhaps sometimes the give-up is just too big to make room for it. Relatively recently, some astute investors have pioneered a way to have their cake and eat it too. Most famously, hedge fund manager, John Paulson, offered investors the choice of having their returns be based in U.S. dollars or having performance hedged over to gold. By using futures to layer gold exposure on top of his portfolio, he provided the diversification benefits of gold without having to sacrifice existing assets to make room for it. We can explore this general tactic by updating the last example and instead of selling passive equity to fund gold, we keep the equity and layer gold on top of it as shown by the S&P 500 Dynamic Gold Hedged Index.

(Click on image to enlarge)

Equity is usually the long-term return driver of portfolios, and in strong bull markets most other assets, including gold, tend to lag. During this 5 year period, we can see the gold exposure still hurt the portfolio with layered exposure, but returns kept up much better than the portfolio with dedicated gold because it kept 30% U.S. equity exposure. The layered gold portfolio netted a return of 41.2% - showing a much lower cost for protection than the dedicated position.

(Click on image to enlarge)

This layered gold concept, which historically has only been an institutional style strategy, is now available in an ETF. The construction of the REX Gold Hedged S&P 500 ETF (NYSEARCA:GHS) is simple: it takes a passive U.S. equity portfolio and uses futures to add a layer of gold on top of it. Swapping out passive U.S. equity exposure in favor of gold-layered equity still provides the same level of equity beta and adds an additional gold allocation equal to the notional dollar amount.

(Click on image to enlarge)

The time period used for the portfolio comparisons was relatively brief and happened to be during a down period for gold. There have been extended periods of time where gold hasn't only acted as protection, but as a return driver as well. During the periods where gold was in a bull market, the layered equity-gold exposure would combine the equity returns with the positive gold performance. Since 1969 gold has appreciated by more than 2000%.

(Click on image to enlarge)

Investors are always looking for ways to diversify their portfolios without sacrificing long-term growth potential. If the outlook on bonds isn't rosy and stand-alone gold positions are sapping too much allocation, a layered gold strategy could be an ample alternative.

*Core Four Portfolios Discussed

Our Hypothetical Portfolio Components: Passive U.S. Equity - S&P 500 Index, Active U.S. Equity - S&P 500 Value Index, International Equity - MSCI ACWI Ex U.S. Index, Real Estate - FTSE All Equity REIT Index, Fixed Income - Barclays U.S. Aggregate Index, Gold - Gold Spot Price. Layered gold - a 5% gold position was added on top of the 'No Gold' portfolio, resulting in 105% gross exposure.

Disclosure:

Disclaimer: Performance is based on the net asset value returns from November 30, 2016 to June 12, 2017.The market price return for GHS is 18.99% for the same period.The net ...

more