Gold Can Do A Double Correction

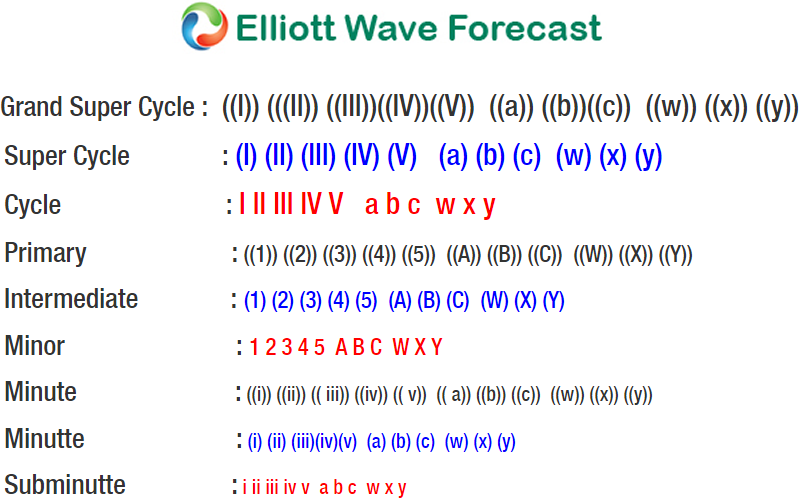

Gold short-term Elliott Wave view suggests that the yellow metal is still correcting the cycle from 12.13.2017 low ($1236.30) as a double three Elliott Wave structure. Down from 1.25.2018 high ($1366.06), the decline is unfolding as a double three where Minor wave W ended at $1306.96 and Minor wave X bounce ended at $1361.81.

Minor wave Y is in progress and the subdivision is also unfolding as a double there where Minute wave ((w)) ended at $1324.75 and Minute wave ((x)) ended at $1336.21. Near-term, while bounces stay below $1336.21, but more importantly below $1361.81, the yellow metal has scope to extend lower towards $1288.27 – $1302.28 to end Minor wave Y. Afterwards, expect Gold to resume the rally higher or at least bounce in larger 3 waves to correct cycle from 1.25.2018 high. We don’t like selling the proposed pullback

For this view to be gain more validity, Gold needs to break below Minor wave W at $1306.96. Until then, there is no guarantee Gold will extend lower and the right side remains higher as the yellow metal still has 5 swing bullish sequence from 12.15.2016 low. We do not like selling the proposed pullback and expect buyers to appear at $1228.27 – $1302.28 (if reached) for a 3 waves bounce at least.

Gold 1 Hour Elliott Wave Chart

(Click on image to enlarge)

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for you. ...

more