Gold And Silver Still A Bargain

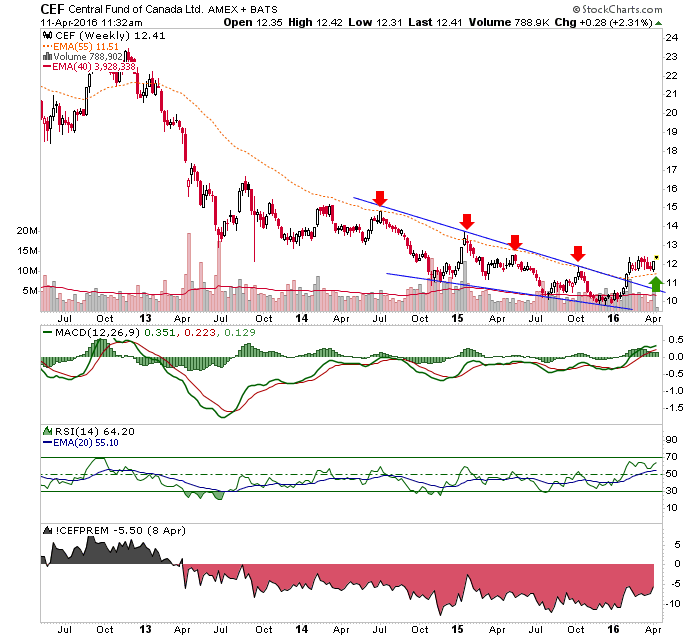

At least the gold and silver held in the Central Fund of Canada’s vault is a bargain as it was still selling for a 5.5% discount to NAV at the last reading on Friday.

As for the chart, it broke above its bear market moving average along with gold and the gold miners (silver is also doing that today) early in the year but the bugz just did not seem to have the stomach for it. Hence the discount.

We can argue all we want about the sector being over bought, driven by hype and desperation, or what have you. There is no argument however, that this weekend CEF was selling for a 5.5% discount to the prices of its assets held.

On a related note, I expect an inflationary phase to descend upon the landscape and thus aside from any long-term gold holding, I want to increase silver exposure. BTW, if the Silver-Gold ratio breaks out not only will commodities be a play, but a stock market bear stance could get dicey as well. The wonders of chickensinflation… come home to roost.

The gold sector’s fundamentals have been noted to be good for some time now. If we go inflationary (watch those indicators, folks!) then so too would silver’s.

Disclosure: Subscribe to more