Gold… And A Ramble

There seems to be a cottage industry out there, led by a very smart man with a very smart computer, who calls anyone who says anything bullish about gold a ‘promoter’.

Yes, I myself have put out more than my share of gold bug criticism. But changing with the times is what the markets are about. So when I see charts like these, I’ll present them.

Gold is after all, a long-term asset that is NOT to be obsessed over as at least 2 former associates of Jim Sinclair, now gone full frontal anti-gold bug, quasi deflationist, seem to be doing; just as Sinclair had done from the bull side. Very simply and with no proclamations about whether or not the bear market is over…

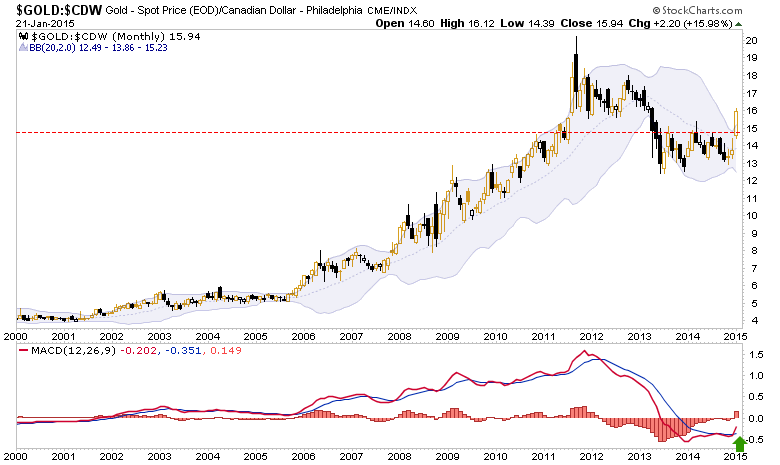

Gold monthly has gotten back above an important resistance point, in-month…

…is above resistance in 2 important ‘commodity currencies’…

…is looking good in Yen…

…and the Euro…

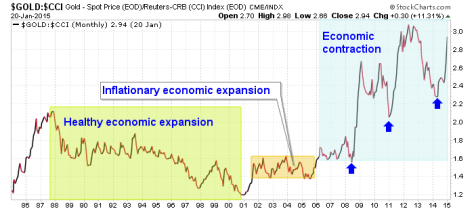

…and of course has been out-pacing general commodities for some time now. This chart is the one that puts so many people on the wrong side of things; first the inflationsists, who saw gold-as-silver-as-copper-as oil-as hogs and second, people who are now reading deflation (in certain areas) as bearish for gold and especially the gold mining industry.

Folks, the chart directly above shows a bull market resumption at the 3rd blue arrow (a higher low) in an important macro indicator. There is so much information out there from so many highly intelligent sources. It’s all flying around trying to make sense. But very simply, gold is rising vs. commodities and the global economic contraction continues.

This written at the website (well okay, it was Biiwii back then) that became constructive on the economy in January of 2013, well before even today’s ‘economic growth as far as the eye can see’ bulls even thought of coming out of their bunkers.

Yes, I know the post above rambled from topic to topic. Sometimes that’s just the way it goes. But this is not a sound-bite oriented, easy to digest destination. The work is hard and it cannot be open to easy interpretation by masses of people. That is why most people get the markets wrong at important junctures.

The above are very big pictures and we have technical targets and trends to be managed on the shorter-term. But on the big picture (talking months and years), gold seems to be on plan.

Disclosure: None.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) ...

more