Global Asset Allocation Update - 7/14/2016

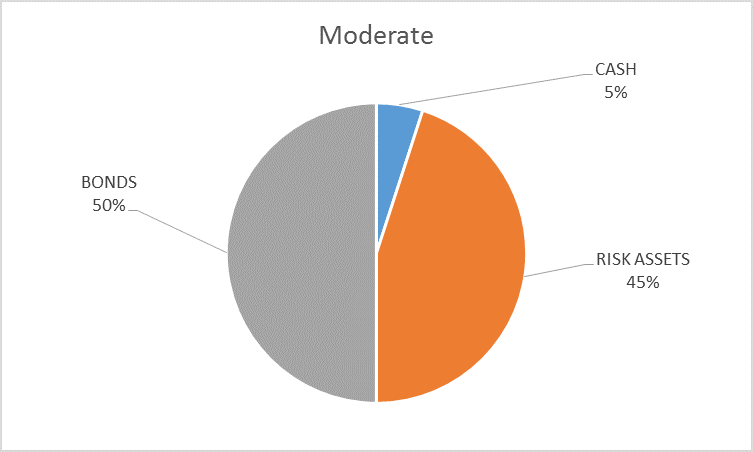

I am raising the budget for risk assets this month. For the moderate risk portfolio, I am raising the risk allocation to 45%, reducing the bond allocation to 50% and adding a 5% cash position. The narrowing of credit spreads necessitated a move in the allocation as investors are clearly willing to take on additional risk right now. This is a bit of a compromise. I normally move in 10% increments but for a variety of reasons I lay out below, I decided a full move was unwarranted. With all of my other major indicators still bearish I could not justify a 10% increase in the risk allocation.

The change to the risk budget was necessitated by the narrowing of credit spreads which has become too large to ignore. I have resisted the change until now because the longer term trend was still toward wider spreads but the big moves in the wake of the Brexit rebound made that position untenable – the trend has changed. It could very well be a short lived reversal as it appears to be entirely a function of sentiment rather than any substantive change in economic conditions. However, there is also the possibility that the narrowing of spreads will have a beneficial impact on the economy that we cannot yet observe. That is something we will only know with the benefit of hindsight. In the meantime, our process dictates a change in our risk allocation.

Indicator Review

- Credit Spreads: Spreads churned around the 6% level until the Brexit vote on 6/23 when they started to widen rapidly, moving from 5.83% right before the vote to 6.57% in the two days after. But then, as with stocks, junk bonds suddenly caught a bid, Treasuries sold off a bit and spreads narrowed rapidly to the present level of 5.46%. That is the narrowest since last August although still quite a ways from the 3.35% recorded in June 2014. There has been little change in the underlying fundamentals of the junk market but we have seen a recent resurgence in new issuance. This is mostly a reflection of sentiment, of risk appetite and yield chasing.

- Valuations: With the S&P 500 breaking out to new highs and earnings still declining, US valuations are at the high of the cycle. Emerging markets are still the cheapest as a group with emerging Europe cheapest of all. Developed Europe is also relatively cheap, trading at about a median valuation.

- Momentum: In the US long term momentum continues to favor bonds and gold over stocks. Long term momentum for the S&P 500 is also still negative although obviously the shorter term measures have turned positive. Momentum for emerging market stocks has turned positive on a short and intermediate term basis and is on the verge of giving a long term buy signal. European stocks continue to struggle to gain momentum.

- Yield curve: The yield curve has continued to flatten with the 10/2 curve now at 84 basis points, a level last seen in November of 2007. I would point out though that the curve was actually steepening back then in anticipation of Fed easing. That is typical of what happens right before the onset of recession. That we aren’t seeing that today though provides only a little comfort since short term rates are already very low.

Credit Spreads

This has been an across the board narrowing of spreads from AAA to CCC, from emerging markets to the US to Europe (although the latter was the smallest of moves). It is an incongruous move with the market seemingly still at the beginning of a default cycle but appetite for yield is apparently insatiable. As you can see the trend toward wider spreads has been broken. Only time will tell whether this rally can continue.

Considering the stress in emerging markets, spreads have remained remarkably well behaved. Spreads are still elevated relative to where they were in the last cycle though.

Yield Curve/Bonds

As I said last month, while credit spreads have been urging us to take more risk the yield curve continues to suggest caution. The continued flattening of the curve is one reason I decided to only make a half step in the risk allocation. I simply don’t know what will happen with the yield curve before the next recession. In the past, the curve has inverted prior to and then steepened rapidly right before the onset of recession. The steepening was due to a collapse in short term yields as the market anticipated further Fed rate cuts. I don’t know if that can happen this time since there is little room for short rates to fall. What I do know is that the flattening moves us closer to recession and that makes raising the risk budget more than a little uncomfortable right now.

Inflation expectations, by the way, are back to the February lows another uncomfortable fact:

Real interest rates have continued to fall since the last update, real growth expectations continuing to erode:

And, as everyone knows by now, the nominal 10 year Treasury recently hit an all time low:

In short, the bond market is not saying anything good about growth, nominal or real. The problem facing investors though is that we can’t be sure how much to trust these bond market indicators because of the extent of central bank distortion. Are yields in the US being influenced by negatively yielding foreign bonds? Maybe, but if so, it would appear to just be through psychology; there is no indication that foreign bonds are being sold in favor of US bonds. Foreign bonds have not sold off and there has been no surge in the dollar both of which would seem to be required for that to be true.

The disturbing truth is that excess demand for Treasuries is apparently being driven by mutual fund investors chasing performance. Inflows to bond funds have been enormous and show little sign of abating. One can’t help but wonder if these investors have any idea what they are buying. A bond fund manager recently told me that he knows long term Treasuries make no sense at these levels but he’s buying them anyway because he has new money to put to work and Treasuries have momentum. And so it appears we have now turned what is supposed to be a safe haven market into just another speculative play thing of the momentum crowd. And so, yes, I am reducing the duration and credit risk of our bonds this month as you’ll see later.

Another factor in my decision to reduce the duration of the bond portfolio this month is the action of the US dollar index. Despite the concerns about Europe, particularly in regard to the Brexit vote, the dollar has not been able to move significantly higher. That is likely a function of real interest rates which as noted above are solidly negative here in the US. And while the negative nominal yields get all the press in Europe, the fact is that real rates for much of Europe are positive. That real rate differential is what drives currency values and I see no reason to expect a reversal just yet. Assuming that is true I would expect the dollar to fall further at some point, something that should push inflation higher and presumably bond yields too.

Those negative real rates should also continue to be positive for gold and part of the increase in the risk budget will be used to raise our allocation to the barbarous relic.

Valuations

As I said above, US valuations are at the highest of this cycle making it impossible, at least for me, to raise our allocation to the S&P 500. Small caps offer no better bargain. Developed market stocks in general are expensive with the exception of Europe but momentum is lacking there on a relative or absolute basis. Emerging market stocks, on the other hand, are cheap and starting to exhibit momentum although a long term buy signal has yet to be triggered.

Momentum

The S&P 500 did break out to a new high this week but our long term momentum indicator remains in sell mode.

We do have what appears to be a momentum shift between EM and S&P 500. Intermediate momentum has already shifted in favor of EM while the long term will have to hold until the end of the month to be valid. I am going to front run the long term signal a bit by adding EEM to the portfolio to raise our risk allocation. I’ve said in the past that I am reluctant to add EM unless the dollar breaks down but I am underwhelmed by the recent action of the dollar (or impressed by the resilience of the Euro) and comforted by the real rate differential.

Momentum continues to favor gold over the S&P 500 as well:

And for now, bonds continue to be favored over stocks:

Japan continues to outperform EAFE:

And real estate continues to outperform general stock indexes:

International real estate versus EAFE:

One area I’m watching closely is the relative performance of small caps. EAFE small caps had been outperforming since the beginning of 2015 but have recently seen a setback against US small cap. EAFE small cap is currently overweighted versus US small cap in the portfolio and I’m not making a change yet because there is a large valuation difference favoring the foreign stocks.

Finally, the general commodity indexes have rolled over short term versus the S&P 500. While I do expect commodities to eventually outperform on a sustained basis, it is still very early in this trend so setbacks should be expected.

Portfolio Changes

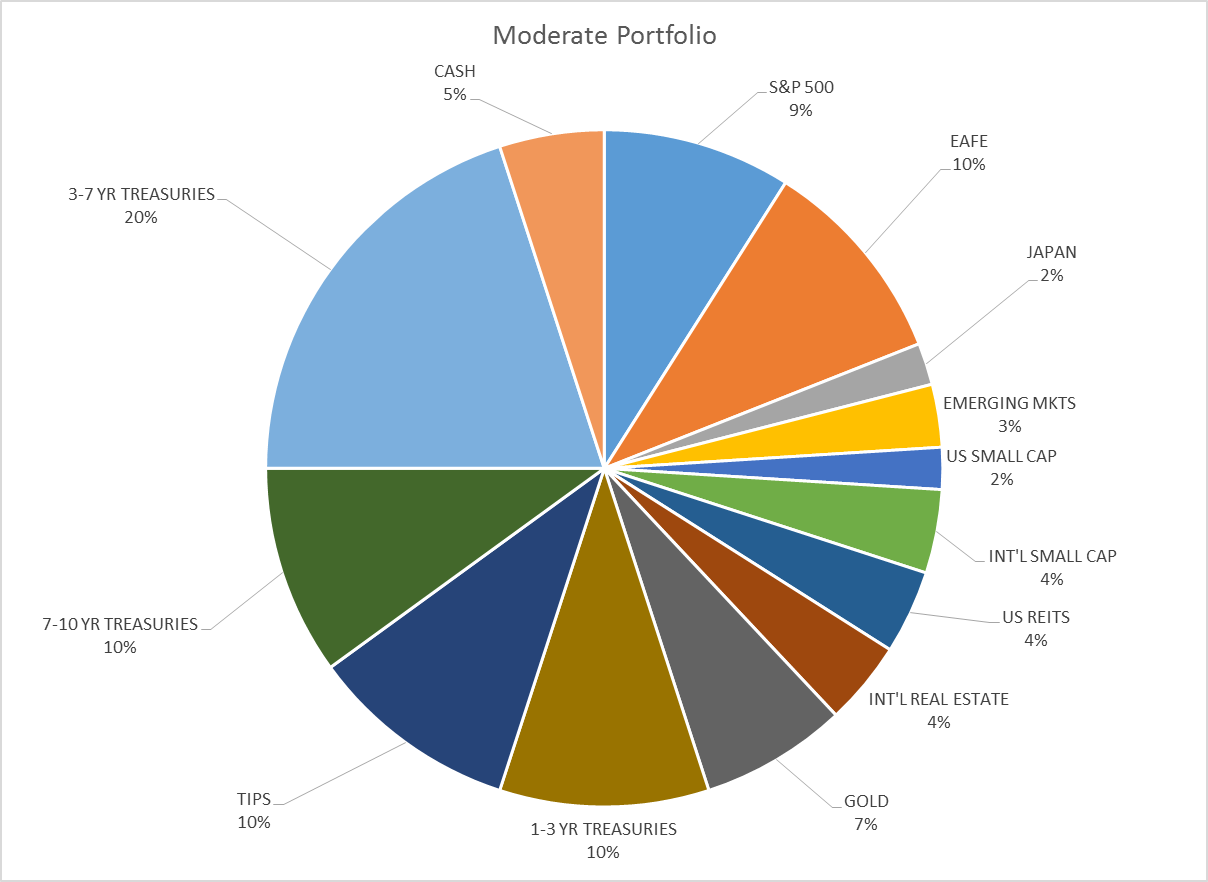

The changes to the portfolio this month are fairly extensive. Bond duration is reduced by selling half of the 7-10 year Treasury position. Credit risk is reduced by selling the LQD position and replacing with 1-3 year Treasuries. The risk allocation is raised by adding to the gold position and initiating a position in EM stocks. Finally, a cash reserve is established. Here’s the overall allocation:

Disclosure: This material has been distributed for ...

more