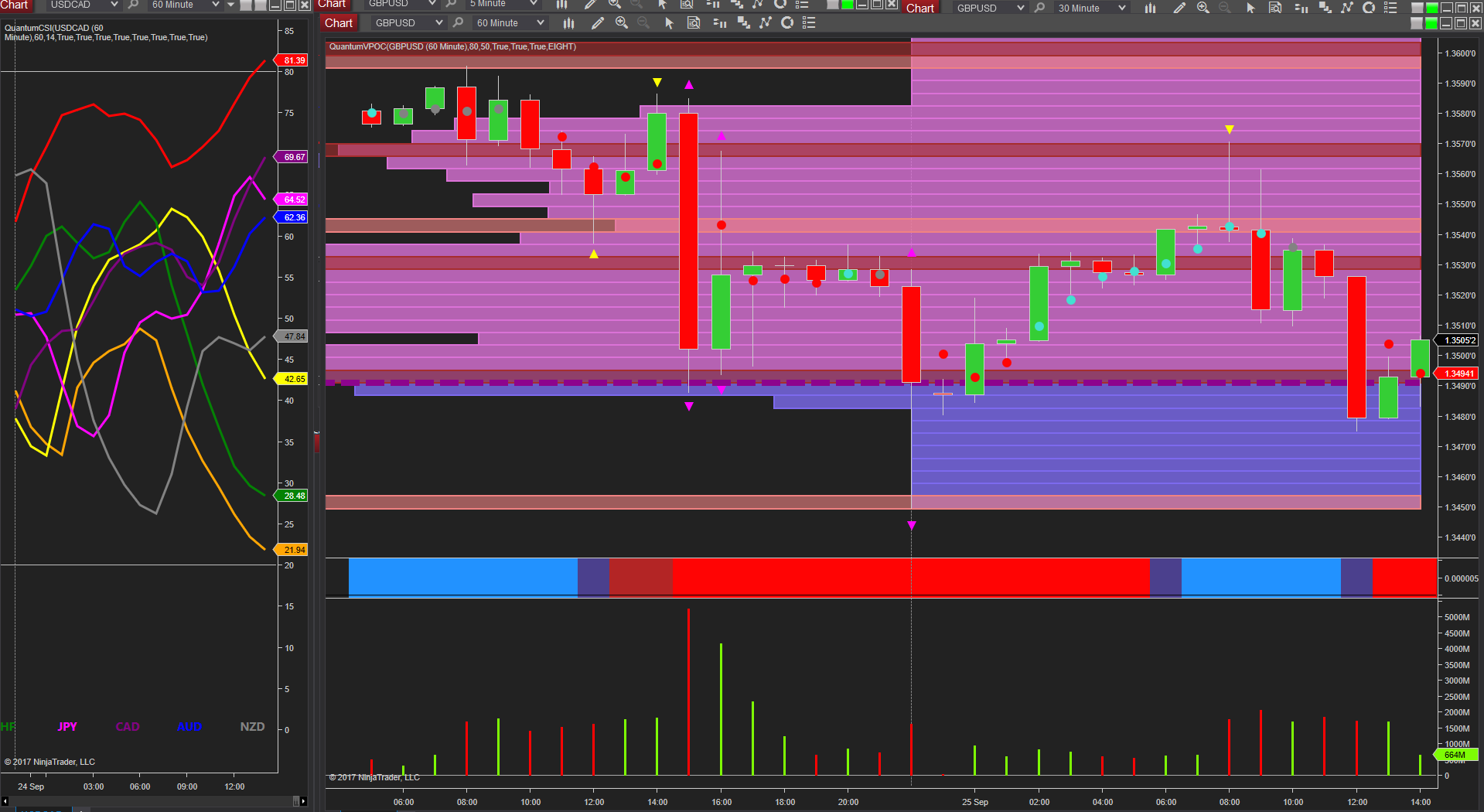

GBPUSD Remains Under Pressure Following Moody

(Click on image to enlarge)

Cable continues to remain pressured on the 60-minute chart following the release of the Moody downgrade for the UK economy which came late on Friday night, and despite a modest rally in Asian and Far East trading, the pound has now started to slide lower. The initial trigger was the London open with volumes rising in line with the new session but closing on a shooting start candle on high volume. This was duly followed by a widespread down candle on increased volume, coupled with a wick to the upper body and confirming further selling of the pound. This weakness has continued throughout the morning session as we move into the US session with the pair trading around the volume point of control at 1.3494.

The 60-minute currency strength indicator confirms the bearish picture for the pair in this timeframe with the GBP falling strongly (yellow line) and the US dollar rising (red line), and with relatively light volume now below on the VPOC, 1.3444 now looks to be the next potential level to be tested.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more