GBP Awaits Inflation Data

Daily Forex Market Preview, 16/02/2016

With the markets now into their second consecutive day of declining against the US Dollar, there is a broad market pattern that indicates a potential pullback in the US Dollar, giving rise to a short-term bounce/correction in the recent market declines. The British Pound, however, is the exception as the monthly inflation numbers are due for release later today.

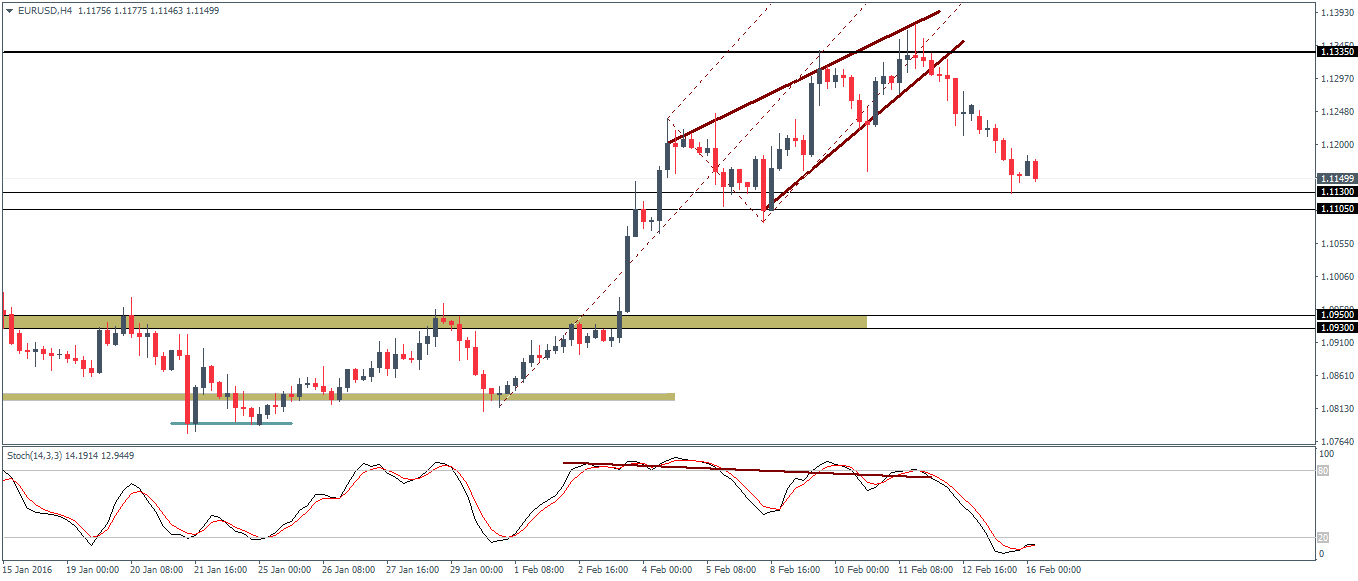

EURUSD Daily Analysis

(Click on image to enlarge)

EURUSD (1.11): EURUSD continued to decline for the second consecutive day closing below the doji low from 10th February at 1.1154. A continuation of this decline is likely to see a test to 1.113 - 1.11 support. A bounce of this support in the near term could keep EURUSD range bound before the support is tested once again. In the event of a break below 1.11, 1.095 - 1.0933 will be the next level of support that could be broken. The upside gains are limited as long as EURUSD trades below 1.1335 resistance.

USDJPY Daily Analysis

(Click on image to enlarge)

USDJPY (114.6): USDJPY closed on a bullish note, breaking to the upside from the inside bar that was formed previously. Prices remain biased to the upside, with a test of 117.25 - 117.0 now being likely to be tested for resistance after the support gave way previously. There is scope for a pullback to this rally with support at 113 - 112.5 being tested on a pullback. Prices could remain range bound for a while, trading below 117.25 - 117.0 and 113 - 112.5 support. This is confirmed by the fact that the Stochastics oscillator has formed a hidden bearish divergence by marking a higher high against price's lower high. A test to 113 - 112.5 will signal the correction ahead of a longer term correction to 117.

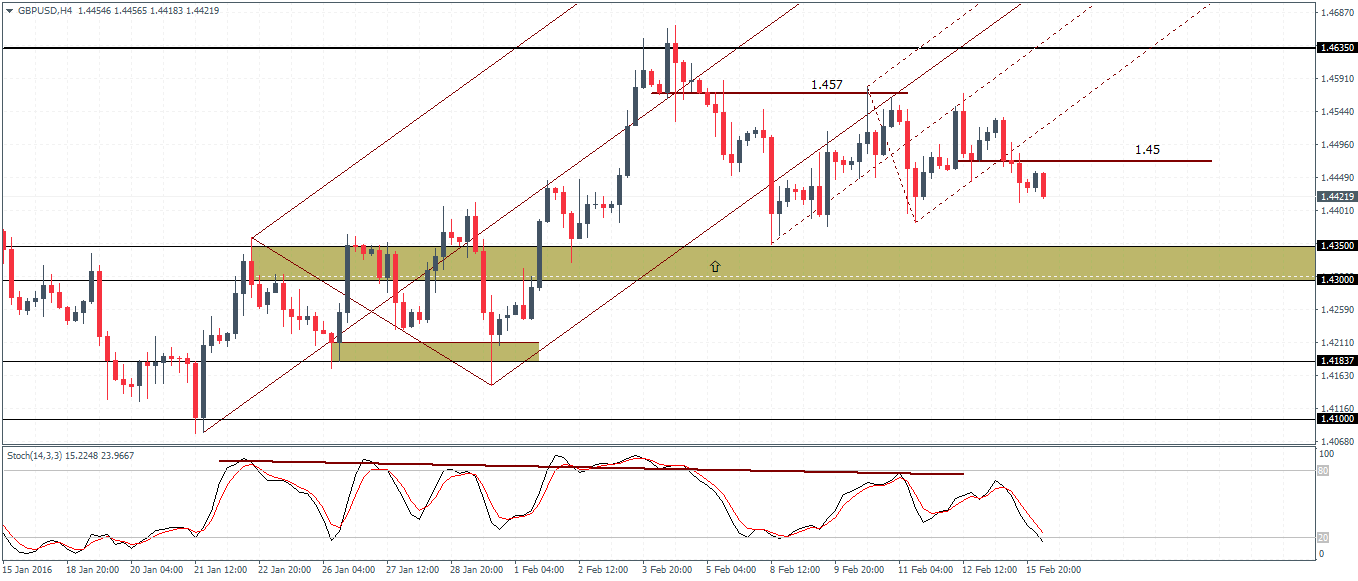

GBPUSD Daily Analysis

(Click on image to enlarge)

GBPUSD (1.44): GBPUSD remains trading sideways but the support near 1.443 is likely to give way sooner than later. Below 1.443 a test to 1.435 - 1.43 is very likely. A decline in the lower support could mark the correction ahead of a move to the upside. The minor median line shows prices breaking out lower following a breakout at 1.45. A retest to this level could signal a short-term correction ahead of a decline down to the identified support level.

Gold Daily Analysis

(Click on image to enlarge)

XAUUSD (1190): Gold prices are into their third day of declines but prices have managed to reach the support at 1190. A modest bounce off this level could signal a move to the upside as the Stochastics oscillator prints a lower low against price's higher low. As long as prices remain below 1250, the bias remains to the downside for a potential test to 1130.

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission ...

more