Fully Stuffed Friday – Markets Popping Or Dropping?

What an interesting year it has been.

On the whole, the markets have gone nowhere and it's up to December to either make or break a positive close for 2015. As you can see from Dave Fry's S&P 500 Chart, we had a big "W" pattern that seems to be leading into an "M" pattern that, on the whole will drag us back down to about 2,000 at some point.

That point, however, plus or minus 2 weeks, will make or break the markets in 2016. Brokers need to have a good finish to 2015 or their brochures for 2016 investing won't look attractive enough to get customers to pull their cash off the sidelines – especially in a rising rate environment. At the moment it's "sure bonds were only good for 3% last year but stocks were down" – that's NOT a good way to get baby boomers to cash in their bonds and open a new trading account, is it?

And Americans are saving. After all – it's a Recession. Just because the Government doesn't want to call it a recession and the Corporate Media isn't even allowed to say the word – it doesn't mean it isn't happening and the consumer spending data clearly indicates recessionary behavior has certainly taken hold.

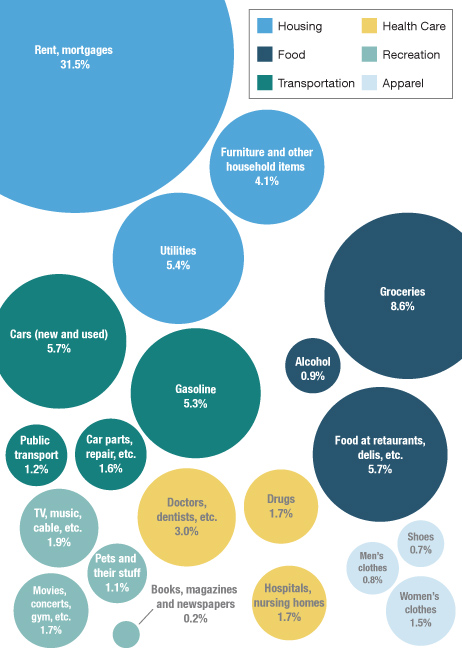

Very sadly, looking at this BLS chart of Consumer Spending, the average family spends more after-tax money than they earn and that really doesn't leave a lot of growth for economic expansion in a country where nearly 70% of our GDP is consumer spending. Savings is not even a category on this chart – for goodness sakes!

As we know, less money has gone to gasoline this year and it was hoped that the savings would flow to other spending but that has not been the case as the average 48 year-old consumer is, of course, a little concerned with all this campaign talk about cutting the Social Security checks they expect to begin collecting in 17 years.

I know this may come as a shock to 9 out of 10 "experts" they trot out on TV to explain things to you but, when you don't raise salaries, then all the consumer can do is spend less of one thing and more of another and, when they are FORCED to spend more money on something like Drugs, Health Care, Education, Utilities, Fuel – then they are forced to cut spending somewhere else.

Choose! Life is all about choices and anyone who pays bills understands that sometimes there just isn't enough to go around and we then have to make decisions but usually those decisions are to put off paying for something – long before we make the decision to stop buying something altogether.

That means those who are waiting for "clear" recessionary signals are likely to be way behind the curve by the time it all becomes obvious. We're cashed out – just in case things are weaker than they seem. Clearly the International scene is weak and of course it hasn't affected us – YET – but that doesn't mean it won't.

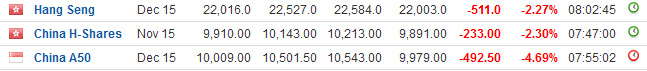

Just this morning we had another sharp drop in China (we're short with FXI) as the Shanghai Composite fell 5%, followed by a 2% decline in the mainland shares. Ostensibly, this is about investigations into rule violatons at some of China's largest brokerage houses including #1 Citic Securities, but the timing of this investigation is suspect as it's main function may be to cover up additional Corporate bond defaults – something we warned about long before the Chinese markets collapsed this summer.

As you can see on this Hang Seng chart, much like the Shanghai, all that has happened is the index has BOUNCED 2,500 points after having fallen 8,000 points (28%) and that is what we call FAILING the Strong Bounce Line at 23,700 and now we're testing the Weak Bounce Line at 22,100 but I doubt that will hold up Monday without some sort of intervention.

For those of you not busy having Thanksgiving Dinner, the Nikkei also took another very profitable plunge from 20,000 back to 19,800 ($1,000 per contract) before bouncing back to 19,900 on the announcement of ANOTHER 3,000,000,000,000 Yen in additional Government stimulus as Abe is getting desperate to do SOMETHING to boost Japan's economy as Household Spending fell another 2.4% in October.

Gold is hitting $1,050 as India shows sliding demand for the metal and silver is following, back to our buy line at $14 but very dangerous down here so very tight stops on /SI Futures below that level. $1,050 is also a good spot to go long on /YG Futures – but also with tight stops if that line doesn't hold.

Nothing really matters other than the Black Friday and Cyber Monday numbers we'll get next week so enjoy your half a day's trading (if you are silly enough to be here) and have yourself a fabulous holiday weekend,

- Phil

more