Following The Money May Have Solved EIA & USDA Data Mystery

Market Analysis

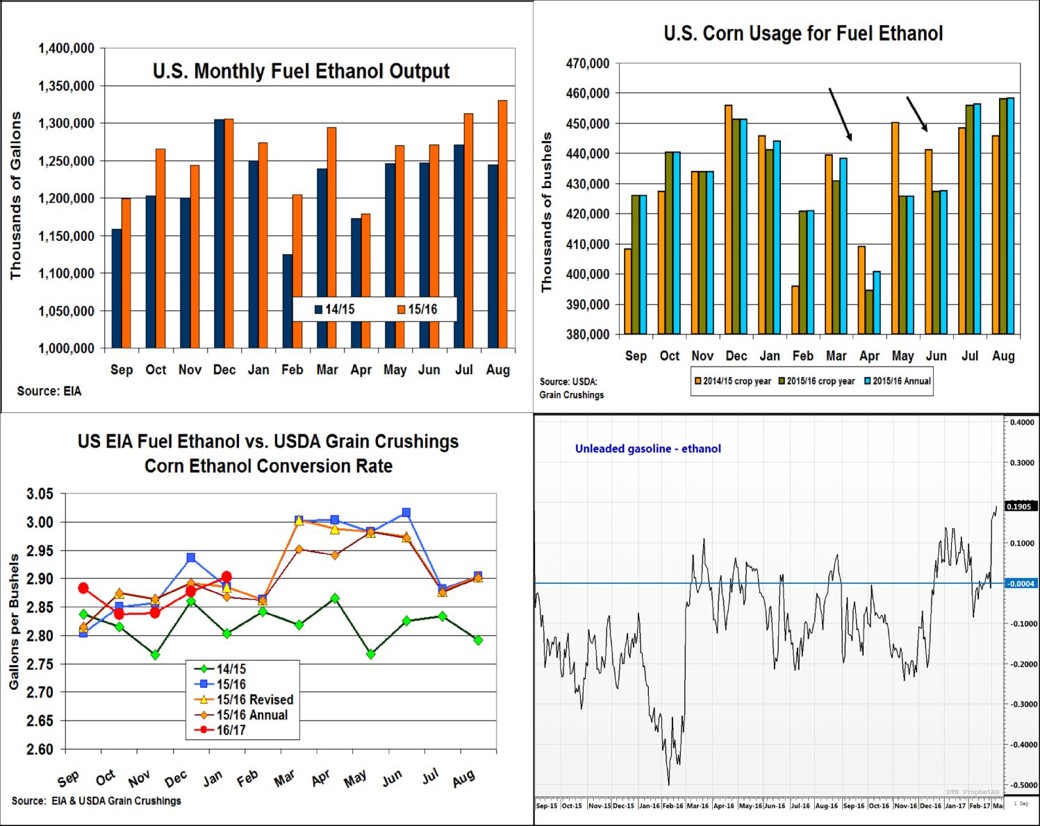

Since its inception in February 2015, the USDA’s Cur-rent Agricultural Industrial Reports has issued a Grain Crushing Report each month providing the breakdown of corn’s various uses within the industrial world of US starch, High Fructose Corn Syrup, alcohol and fuel ethanol. After limited data being available on corn’s industrial demand, this report has been quite useful in monitoring this 6 billion bu. of demand. However, something unusual surfaced when comparing this monthly data to the Energy Information Agency’s (EIA) US fuel ethanol usage.

US ethanol output has been expanding for 33 straight months of year over year higher output according the EIA’s monthly fuel ethanol data. However, the USDA’s Grain Crushing updates didn’t reflect this in its fuel ethanol utilization numbers for corn during the March to June 2016 period. Normally, the industry’s conversion rate for a bushel of corn produces from 2.8 to 2.85 gallon of ethanol. However, dividing EIA’s monthly fuel ethanol utilization levels by the USDA’s fuel ethanol corn feedstock level produced general ethanol conversion levels near 3 gallons per bushel initially over 2016’s spring period. Revisions and a newly released annual review, which upped March and April’s corn fuel ethanol usage levels have softened last spring’s conversion rates modestly. Interestingly, this calculation method has returned 2016/17 conversion levels back towards its more traditional level.

After discussions with industry analysts, biofuel plant people, and the Ag Marketing Resource Center based in Iowa, who also have observed & wrote about the same unusual 4 month period, a combination of events likely occurred. Higher quality corn, lower cost sorghum substitution and 2016’s extended period of gasoline being be-low ethanol prices were the main factors. Given the need to denature ethanol before shipping, the EPA’s stated 2-5% range to use gas for this purpose likely is the biggest.

(Click on image to enlarge)

What’s Ahead

After being 20 to 80 cent premium from 2010 to 2015, US gasoline prices falling below ethanol values in the fall of 2015, hitting a discount of 48 cents in early February and generally staying below for much of 2016 likely encouraged stronger denaturing of US rail ethanol shipments. A 3% higher denaturing level from 2% to 5% will boost a 2.85 gallon conversion rate to 2.94 gallon shipping level alone.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more