FED Pushes On Proverbial String But Commercial Banks Unwilling Or Unable To Attract Borrowers

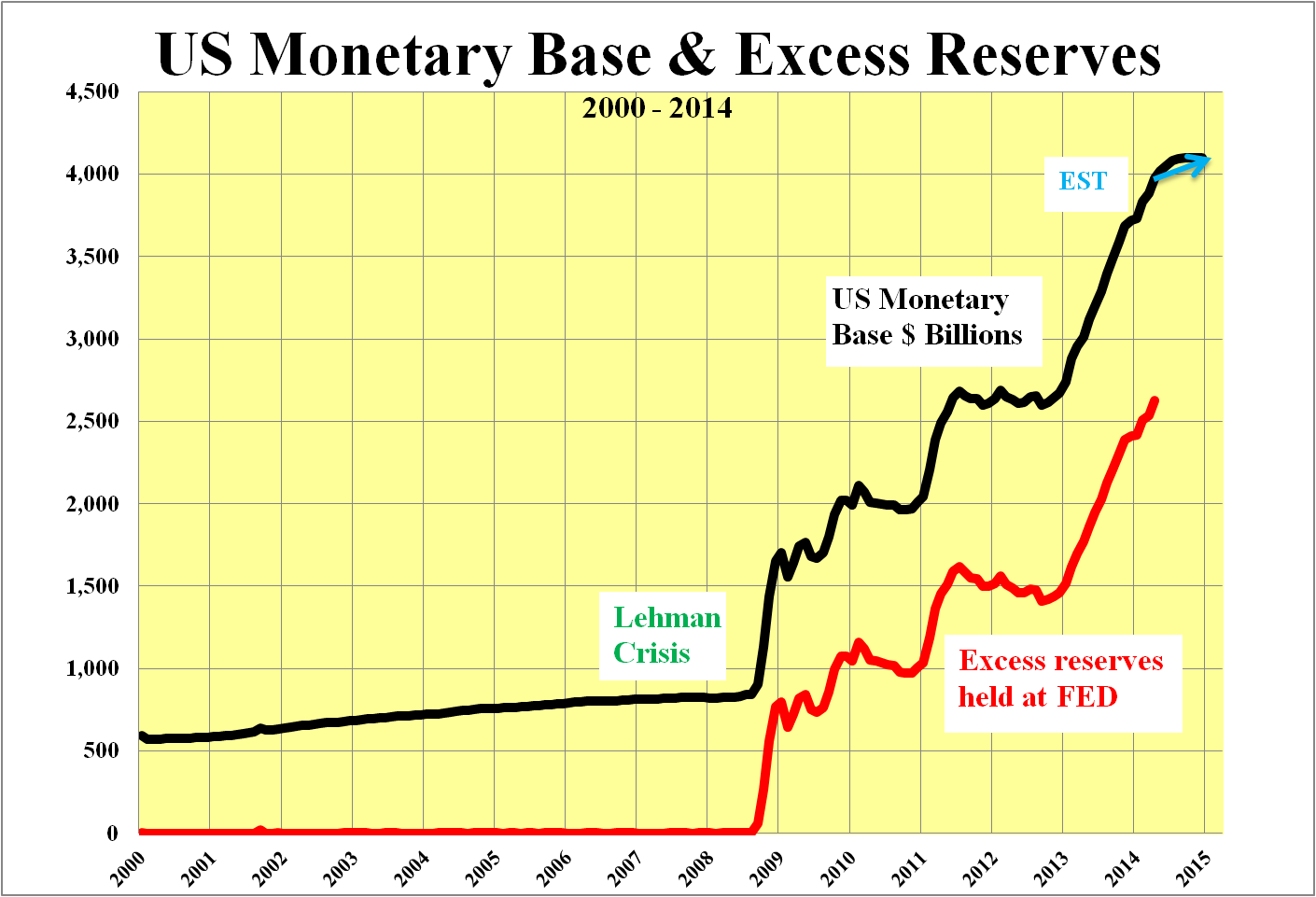

The U.S. monetary base has increased 400% in less than 6 years, from $0.8 trillion in 2008 to almost $4 trillion today. Meanwhile commercial banks have, for the first time, built up huge surplus reserves of $2.6 trillion at the FED. Monetary policy has traditionally been transmitted into the economy through the banks by lending the newly created money to corporations and individuals. The rise in the excess reserves at the FED indicates that this taking a lot longer than it has in the past.

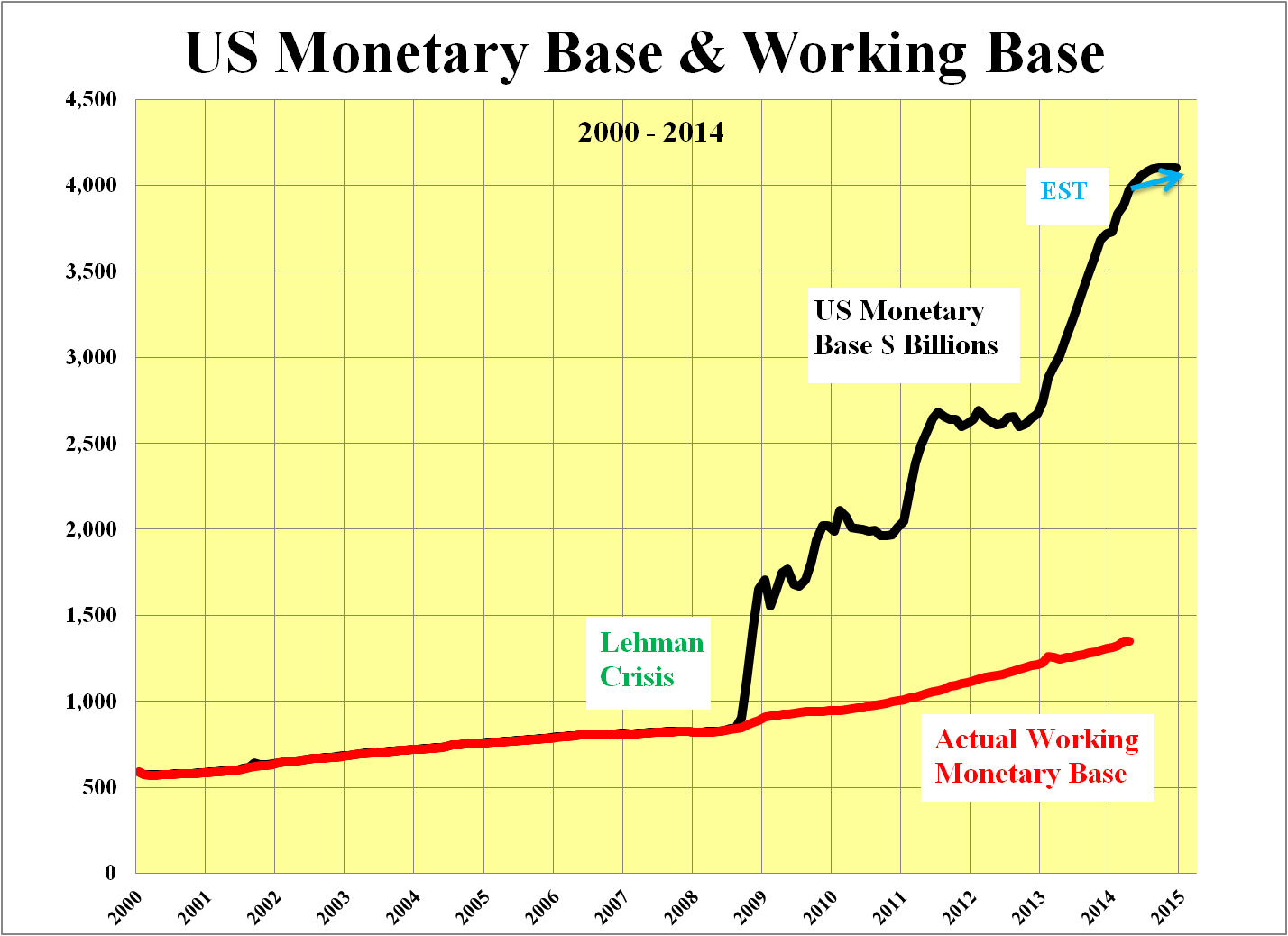

Subtracting the $2.6 trillion excess reserves from the total monetary base leaves only $1.35 trillion that is actually working, a mere 70% more than in 2008. This could well explain the moderate pace of economic recovery, the lack of inflation, and the continuation of low long-term rates. There seems to be a chronic lack of demand for the newly created money, which would explain the build up of the excess reserves as the money has nowhere else to go.

Theory has it that rising money supply should lead to economic recovery, rising inflation and interest rates, as well as a rise in the price of gold and other hard assets. Yet while the expansion of the total monetary base has been unprecedented, none of the aforementioned has increased anywhere close to the same magnitude. The increases that have taken place seem much more in line with the moderate increase in the actual working monetary base.

U.S. corporate balance sheets are flush with cash, recently estimated at $2 trillion. This reduces their need to borrow to meet capital expenditures. It also puts corporations in the position of being able to either raise dividends or buy back shares or acquire other assets in the market place.

On the supply side of the equation, the excess bank reserves at the FED points to there being more than enough money to lend. However, with corporate needs reduced, demand is suppressed.

Demands from individuals for loans and mortgages are also curtailed. This is partially because of moderately higher mortgage rates but also because of much more restrictive banking regulations. The banks are risk averse and so are not making money available to individuals. Proof positive of this is the closure of entire bank mortgage departments.

Furthermore, a large proportion of recent house sales have been for cash. Without money being lent to the housing sector new home construction stands at only 40% of what is required to meet U.S. demographic requirements. This could strangely soon result in further increases in house prices, especially in major urban markets.

In addition the U.S. Government budget deficit is shrinking and may soon even be balanced. This reduces further the demand for debt.

Where then can the banks invest money? With more than ample supply and a shortage of demand, the price of money, interest rates, seems set to stay low for some considerable time. This may explain why 30 year T Bond rates are again falling after the surge from 2.45% in August 2102 to almost 4% six months ago, and now under 3.5%.

Bond funds also have fewer places to put their money as the supply of debt is waning, which also points to lower rates and higher bond prices. Perhaps this is why there is now a market for 50 year bonds to lock in low interest rates for a very long time. Retail investors should be wary of buying such securities.

Too Much Money Too Little Demand – The World Awakes

This theme may well be just starting to gain traction as shown in Larry Summer's address yesterday at the 20th International Economic Forum of the Americas in Montreal, Quebec.

Larry Summers said that the problem now faced by the U.S. economy is the lack of demand, which may not be easy to solve. He added that the Federal Reserve’s current monetary policy has done everything it can do to stimulate the demand side. The burden will have to shift to private investments and fiscal policies.

Public spending on infrastructure develop is a crucial step to improve the economy and stimulate strong demand. The access to cheaper credit should stimulate more spending on projects like renovating New York’s JFK International Airport and building oil pipelines between Canada and U.S.

The trick to get the money really flowing into the economy is first to get consensus between all levels of government (fat chance!). It may, however, be more likely come in dribs and drabs from action by the FED following the recent ECB imposition of negative interest rates on overnight money parked at the central bank.

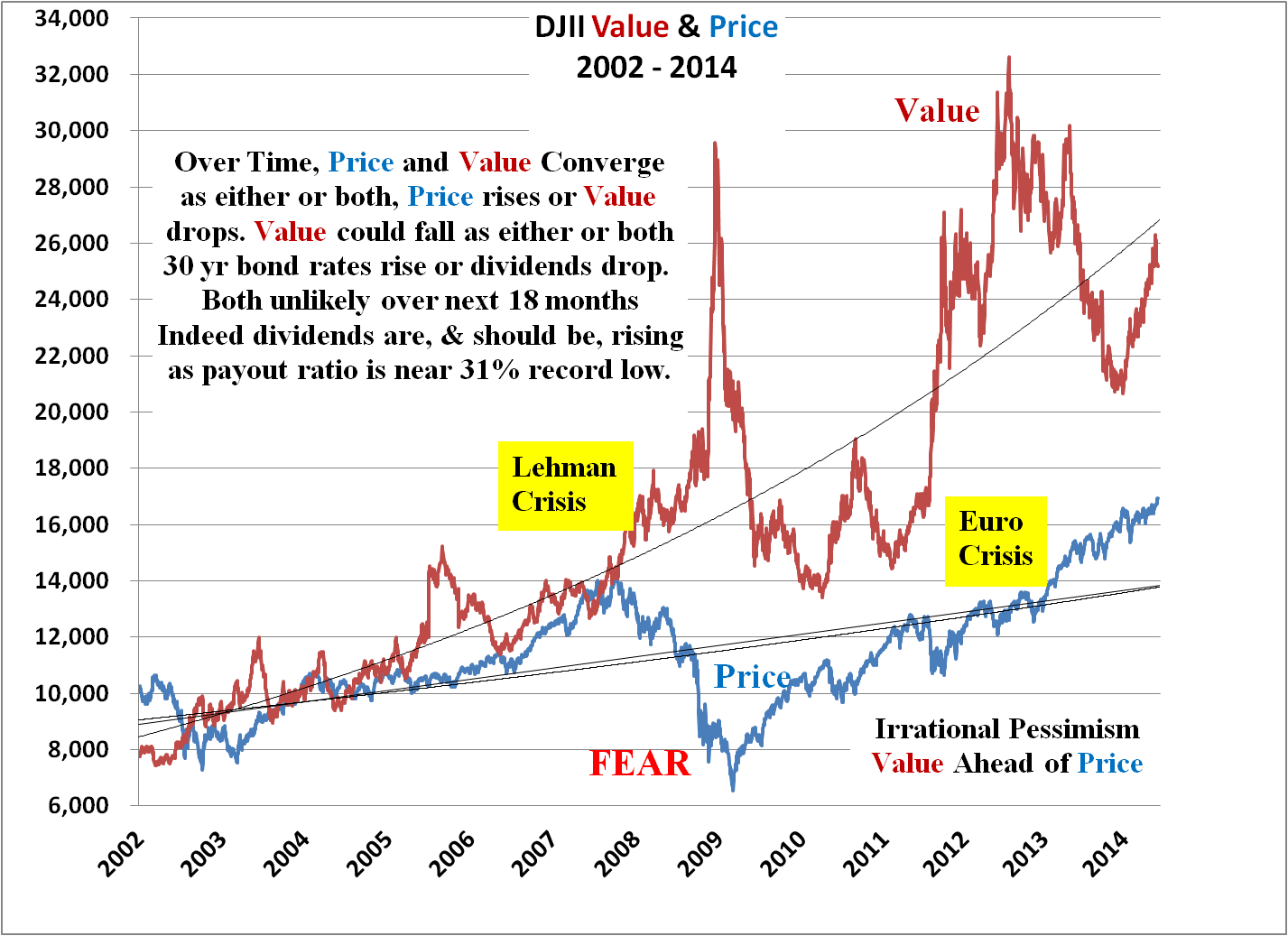

Even if the Fed were to just eliminate the 0.25% interest that it is currently paying the commercial banks on excess reserves there may be some movement into riskier assets such as moving out along the yield curve which might push longer term rates even lower or, perhaps, into equities now the DJII is up well over 10,000 points from the Mar 2009 low.

The DJII continues to move to new record highs as the dividend discount value of the DJII at 25,000 continues to exceed its price of 16.930 by a wide margin ensuring that the pressure on the market remains up, as it has been since the days of Lehman. Perhaps the banks will consider equities at 25,000 and come late to the party yet again?! Plus ça change, plus c'est la même chose!

Basic report plus quarterly updates are available for $100 per annum.

Please contact me by phone or by email.

Tony Hayes CFA

Ashton Consultancy ...

more