Extra Space Is A Trusted Brand To Buy When Mr. Market Is Snoozing

As we enter a period of rising interest rates, it's important to begin thinking about which REIT sectors will perform the best. In a recent article, I explained the reasons for staying focused over the next few months:

"... it's a reasonable prediction that volatility will increase - more likely to the downside. That's more reason to be prepared for the time in which a REIT investor can deploy cash, and if downside volatility does materialize, he or she will be better prepared to take advantage of the buying opportunity."

In another recent article, I explained that:

"... companies that do well in periods of rising inflation have a tendency be those with the pricing power to pass along increasing costs to their customers. These characteristics are found among many types of REITs which tend to produce cash flow and dividend growth that significantly exceed the rate of inflation".

So there is little doubt that rates are going to likely move up this year, and that could offer investors with the opportunity to take advantage of the REITs that offer compelling growth, hopefully in the form of rising dividends. As I explained:

"... rising rates mean improved economic drivers for REITs - each sector will perform based upon their own differentiated lease contracts (i.e. hotels and apartments tend to be more cyclical)."

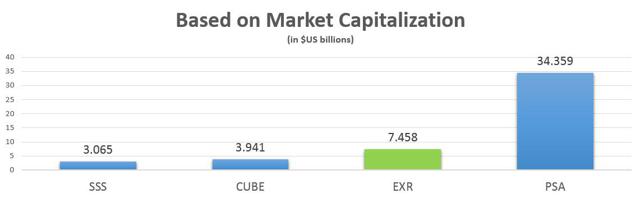

One REIT sector that I believe will do well in 2015 is Self-Storage. Of the 4 publicly traded Self-Storage REITs, Extra Space Storage (NYSE:EXR) is the only REIT I own.

(click to enlarge)

What Led Me To Invest in Extra Space

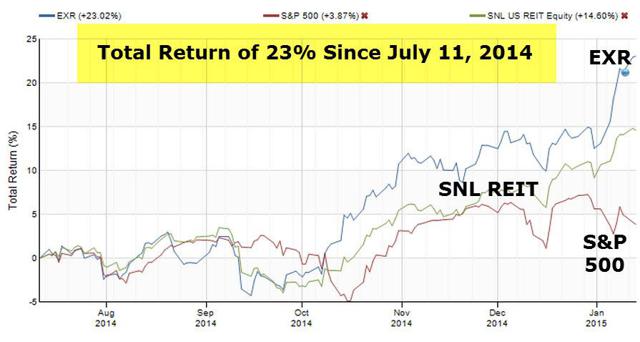

When examining the recent earnings history for Extra Space, it's not hard to understand why I purchased shares last year (on July 11, 2014). Here's a snapshot of my Total Return since I made my initial investment in EXR.

(click to enlarge)

Continue reading this article on Seeking Alpha.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration ...

more