EUR/USD Struggles Ahead Of ECB Rhetoric- USD/JPY Range Under Pressure

Talking Points:

- EUR/USD Struggles Ahead of ECB Rhetoric- S&P Calls for Larger & Longer QE Program.

- USD/JPY Range Vulnerable to Slowing China, Waning Market Sentiment.

- USDOLLAR Continues to Coil as ADP Employment Boosts NFP Expectations- Fed on Wires.

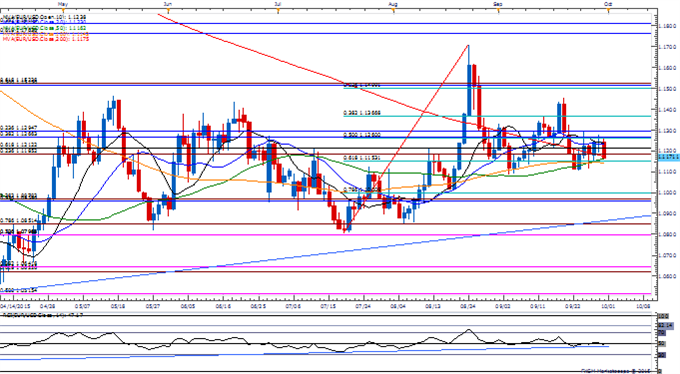

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD struggles to hold its ground ahead of key speeches by the European Central Bank (ECB) officials as Standard & Poor’s (S&P) anticipates the Governing Council to extend its quantitative easing (QE) program until mid-2018, with the non-standard measure increasing the central bank’s balance sheet byEUR 2.4T.

- Despite the dovish tone held by the ECB, may see risk trends continue to drive EUR/USD in October as market participants treat the Euro as a ‘funding-currency;’ may need imminent signs for additional ECB support for the long-term trends to come back into play as the central bank largely endorses a wait-and-see approach.

- DailyFX Speculative Sentiment Index (SSI)shows retail crowd remains net-short EUR/USD since March 9, but the ratio remains off of recent extremes going into October as it sits at -1.29, with 44% of traders long.

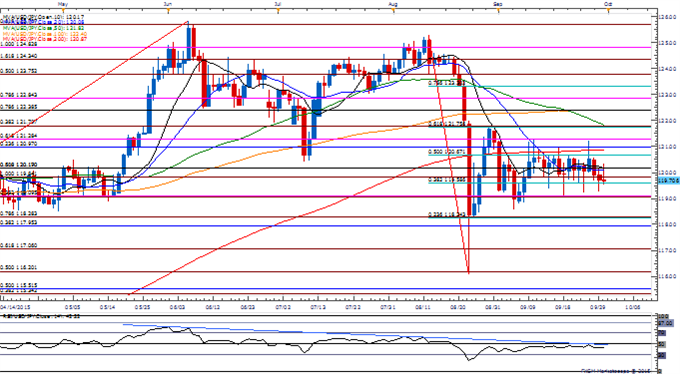

USD/JPY

- With USD/JPY finally posting a closing price below near-term support around 11.90-90 (100% expansion), the pair remains at risk for a further decline in the month ahead especially as the Relative Strength Index (RSI) retains the bearish formation carried over from back in May.

- Even though the Bank of Japan (BoJ) is scheduled to release the Tankan survey, the key prints coming out of China may play a greater role in driving USD/JPY volatility over the next 24-hours of trade as fears surrounding the global economy drags on risk appetite.

- Despite the diverging paths for monetary policy, the BoJ’s wait-and-see approach may open the door for a more meaningful downside correction in the exchange rate amid speculation for additional monetary support at the October 30 interest rate decision.

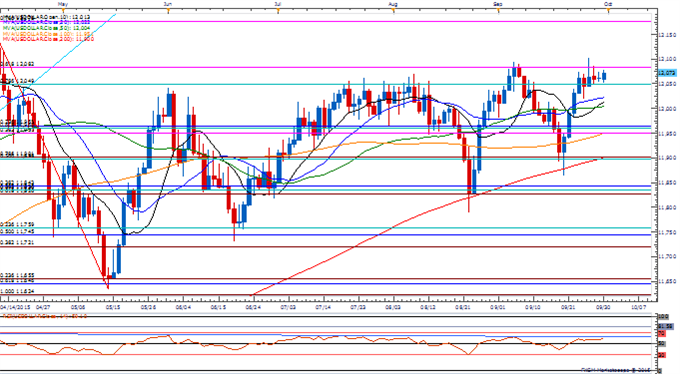

USDOLLAR (Ticker: USDollar):

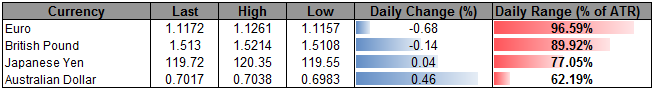

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

12073.31 |

12079.96 |

12051.76 |

0.08 |

58.80% |

Chart - Created Using FXCM Marketscope 2.0

- The Dow Jones-FXCM U.S. Dollar may coil for a move higher as the 200K expansion in ADP Employment boosts expectations for an upbeat Non-Farm Payrolls (NFP) report; waiting for a break of the bearish RSI momentum for conviction/confirmation for a further appreciation in the greenback.

- With Chair Janet Yellen, St Louis Fed President James Bullard and Governor Lael Brainard on tap later today, comments highlight a greater willingness for a 2015 liftoff may heighten the appeal of the greenback as it boosts interest rate expectations.

- Need a close above 12,082 (61.8% expansion) to favor a move into 12,162 (April high) to 12,176 (78.6% expansion).

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!