EUR/USD Remains In The Same Range After ECB Press Conference

ECB President Mario Draghi said that the balance of risks is moving to the downside, leading the common currency to go lower. However, the world’s most popular currency pair never went too far. The ECB also announced the end of its bond-buying scheme, which ran for almost four years, and assured to reinvest the proceeds from maturing bonds.

French PMI’s badly disappointed. Manufacturing PMI dropped to 49.7, the services PMI to 49.6. Scores below 50 show future contraction.

Italy and the European Commission are continuing negotiations on the Italian budget. Reportedly, the sides are getting closer, but the gap remains. Concerns about the widespread deficit of the French budget subsided.

Later today, the US releases retail sales numbers for November.

(Click on image to enlarge)

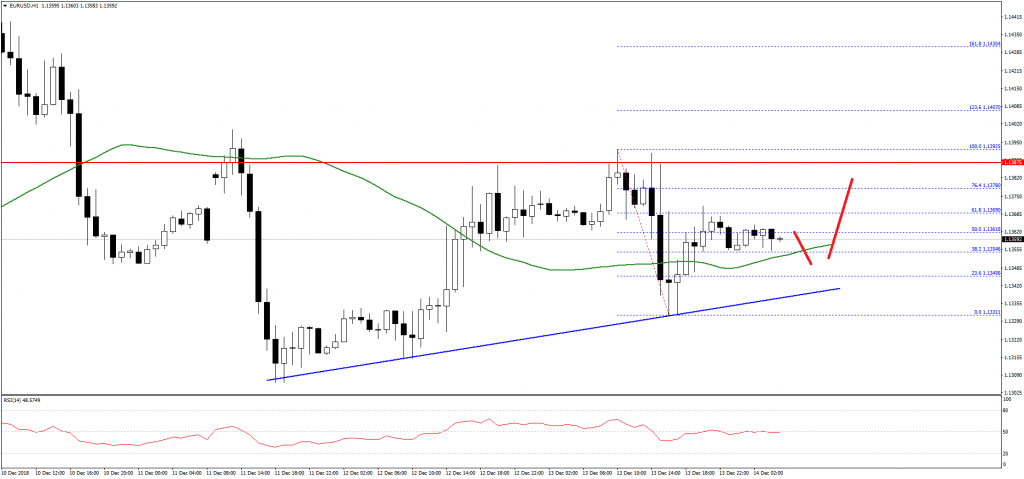

The Euro struggled this week and declined below the 1.1400 and 1.1380 support levels against the US Dollar. The EUR/USD pair traded towards the 1.13000 level and later formed a support near 1.1310.

The pair recently corrected higher above the 1.1350 level and the 50 hourly simple moving average. However, the upside move was capped by the 1.1380-90 resistance area, which was a support earlier.

The pair is currently trading above the 1.1350 level, the 50 hourly SMA, and the 50% Fib retracement level of the last decline from the 1.1392 high to 1.1331 low.

Moreover, there is a major bullish trend line in place with support at 1.1340 on the hourly chart of EUR/USD. Therefore, if the pair dips from the current levels, it could find support near 1.1350 or 1.1340. On the upside, the main resistance is near the 1.1380-90 area.