Emerging Market ETFs Showing Signs Of A Breakout

Emerging market ETFs are once again giving us a reason to pause and take notice of their price momentum relative to the opportunities in the developed investment world. Despite multiple years of sub-par returns, these countries have a variety of attractive characteristics that make them worthy of your attention. Whether you are a value seeker, trend follower, or asset allocator – the wealth of available opportunities in this market makes for a compelling investment case.

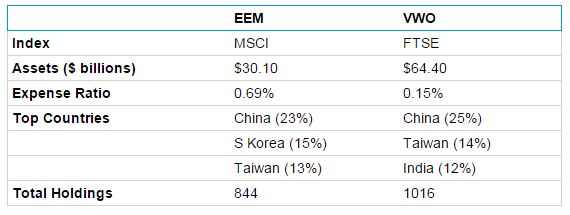

The two largest ETFs in this space are the iShares MSCI Emerging Market ETF (EEM) and the Vanguard FTSE Emerging Market ETF (VWO). Despite their broad-based nature and massive assets, these funds actually have significant differences in their underlying fees, country exposure, and sector dispersion. This makes for a notable variance in the total performance of each strategy, which may ultimately draw investors to owning both funds as a more diversified emerging market allocation.

From a technical perspective, we are seeing both funds break out of a six month range that is primarily being driven by the strength in China. As the top holding in both funds, China has a significant pull on the total return of these strategies and is often a leading indicator of emerging market impetus.

A look at the chart below shows how VWO has also sliced cleanly through its 200-day moving average on the upside.

Continue reading this article here.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in ...

more