Emerging-Market Bonds Led Last Week’s Rebound

Most markets around the world posted gains for the trading week leading up to the Christmas holiday, with emerging-market bonds taking the top spot among the major asset classes, based on a set of proxy ETFs. The generally positive performances for the week through Dec. 23 repaired some of the damage from the Dec. 12-16 rout that dispensed across-the-board losses.

Last week’s biggest gain: a 1.6% increase for Van Eck Vectors JP Morgan Emerging Market Local Currency (EMLC). After suffering sharp losses immediately following Donald Trump’s election, the ETF has been stabilizing lately and inched higher every day last week.

The good news for bonds in emerging markets didn’t extend to stocks in these countries, however. Last week’s biggest loser: Vanguard FTSE Emerging Markets (VWO), which eased 1.3% for the five trading days through Dec. 23, marking the second straightly weekly loss for the ETF.

Last week’s generally rising tide lifted an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights climbed 0.2% for the week.

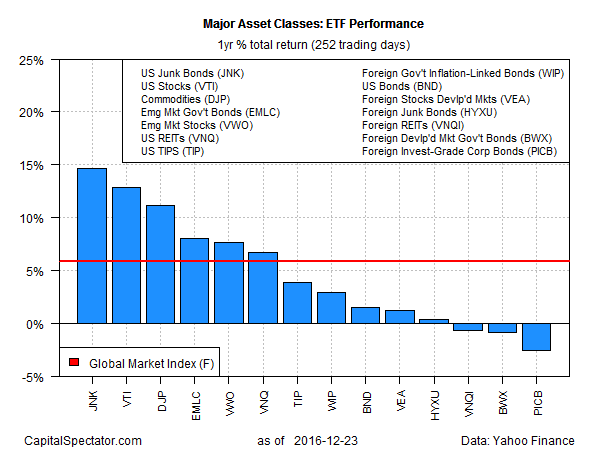

For the one-year column, most of the major classes are in the black, led by US junk bonds. Although interest rates have been rising lately, below-investment-grade fixed income hasn’t been pinched, at least not yet. SPDR Bloomberg Barclays High Yield Bond (JNK) is up 14.8% in total-return terms for the past year.

Meantime, red ink has been spreading in some corners for trailing one-year results, led by foreign corporate investment-grade bonds. The biggest loss for the trailing 12-month period is currently held by PowerShares International Corporate Bond (PICB), which is off 2.2%.

The broad trend for markets, however, remains positive at a moderate pace: GMI.F is up 5.9% over the past 252 trading days through Dec. 23.

Disclosure: None.