DXY Index Remains In Downtrend, Watch This Level

Video Length: 00:10:01

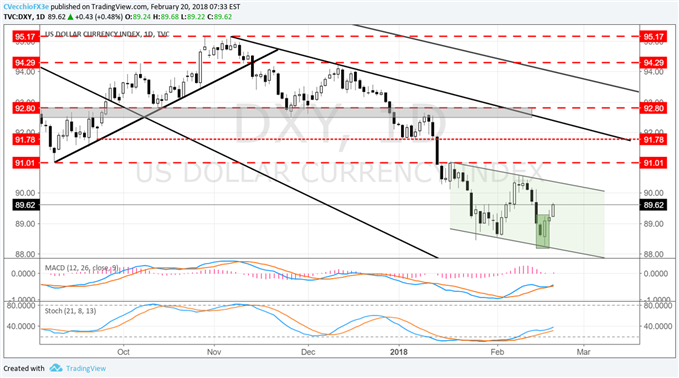

The US Dollar (via the DXY Index) is working on its third consecutive day of gains, building on the bullish daily key reversal seen at the lows on Friday. While it is tempting to call a bottom in the greenback, DXY remains in its downtrend from mid-January and thus price action can be seen simply as a countertrend move - for now.

It would appear that the US Dollar is taking on a bit more of a safe haven role these days (less of a growth currency role), largely mirroring what's been happening in equity markets: the early-February rebound in the DXY coinciding with the sharp fall in US equity markets; and today, with equity futures pointing lower, the US Dollar has rallied. It's worth noting that the VIX has moved back above 21 today as well - another sign that the recent uptick in volatility is a feature, not a bug, of market conditions now.

In the near-term, with the US Treasury set to issue $258 billion of short-term debt this week, US yields have started to push higher again, giving pause to higher yielding currencies and risk-correlated assets. Earlier today, the US Treasury 2-year note yield hit its highest level since September 2008 while the 10-year yield hit its highest level since January 2014.

But as we've discussed previously over the past week, there is a growing body of evidence to suggest markets are going through a regime change now. The old adage of 'higher yields, higher equities, and a stronger dollar' no longer applies. Likewise, there is evidence of a key relationship surrounding Gold breaking down as well.

Price Chart 1: DXY Index Daily Timeframe (September 2017 to February 2018)

Accordingly, ignoring the recent noise, the key level traders still need to watch out for in the DXY Index before a sincere bottom can be called is thus 91.01. The DXY Index put in its 2017 bottom at 91.01 on September 8, and since breaking through said level on January 12, price hasn't looked back. The morning doji star candle cluster that formed between January 15-17 - topping out at 90.98 - proved fruitless.

In an environment where volatility has picked up, it is absolutely imperative that traders adjust their risk management perspective.