Dropbox, Pork And Wine

Of course Dropbox had no way of knowing that their IPO was going to hit the market at such a pivotal time for the global markets.

The cloud storage company managed to raise $756 Million from investors and an additional $100 Million from a private deal with Salesforce. The company is now worth a total of $9.2 Billion, which is a bit of a disappointment since they were evaluated at $10 Billion in 2014.

However, the real test will be when the shares open for trading by the public shortly after the opening bell on Wall Street today.

Today's Highlights

- Pork & Whine

- Dowd is Out

- Ether is testing us

Traditional Markets

The plunge continued yesterday, with many stock indexes now firmly in the red since the beginning of the year.

In addition to what's going on with Facebook and what we mentioned about the value of personal data in yesterday's update, President Trump is also weighing on markets as he pursues the controversial trade war.

Yesterday Trump signed off on $50 Billion worth of tariffs on Chinese Imports claiming that China was stealing between $225 to $600 Billion each year as a result of intellectual property violations.

China has already responded by publishing some counter-tariffs on 128 US products including a 25% tariff on American wine, pork, and recycled aluminum.

More Trump Trouble

Trump sparked further controversy yesterday by firing his national security advisor HR McMaster and replacing him with John Bolton, who has been a tad more aggressive in his rhetoric and who advocates the use of military force against Iran and North Korea.

Things became even more complex when Trump's lawyer John Dowd announced his resignation. Dowd walked out rather abruptly a few days after Trump announced that he is taking on a new lawyer to assist in the Russia investigation. The new lawyer, Joe DiGenova, is known for his theory that the President is being framed by the FBI and the Justice Department.

In other news, the US government has passed a spending bill of $1.3 Trillion, narrowly avoiding a government shutdown by signing the deal just a few hours before the final deadline.

This didn't seem to improve the market sentiment much though. The US Dollar is dropping and Gold is surging as investors seek out safe havens.

(Click on image to enlarge)

Investor Tom Barson (AKA @MrThor7734) points out that adding gold as a hedge against the current market madness has indeed improved his portfolio.

Ethereum is Testing Us

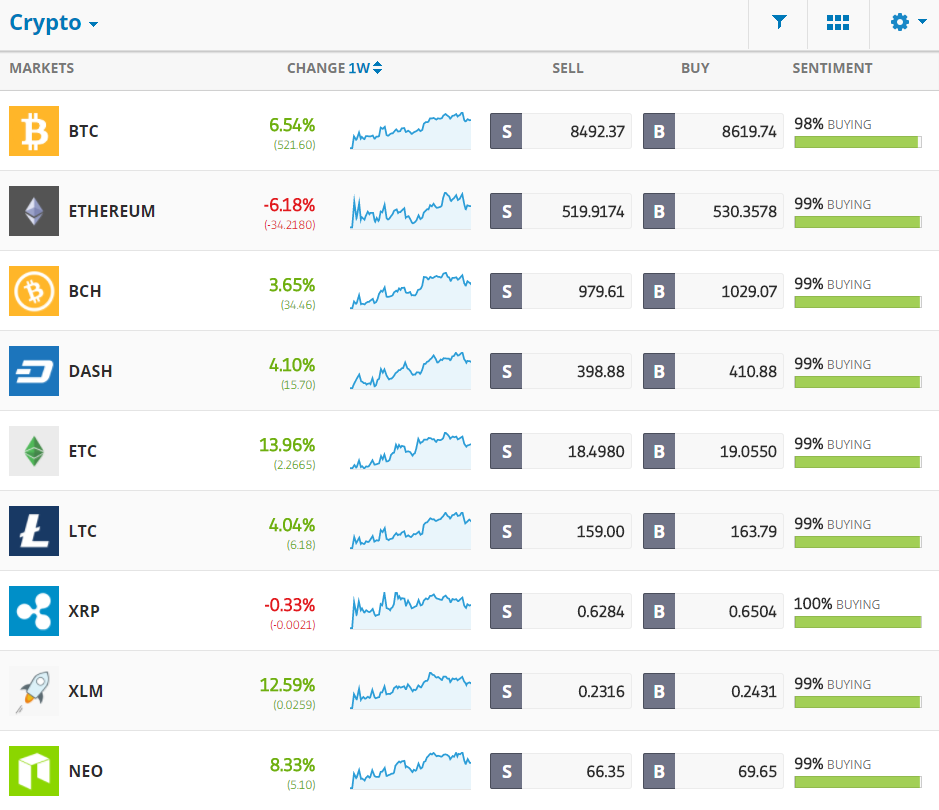

As global governments and regulators continue to take concrete steps towards the regulation and characterization of digital assets, the prices of individual coins remain under pressure.

Despite having one of the most efficient blockchains and the most active usage of any cryptocurrency, Ethereum has been the worst performer of the top cryptos over the last week.

The second larges crypto is now giving a good test of it's major psychological support at $500. In this chart, we can see the significance of this round number. Prices nearly tripled after it broke above this level on December 12thbut since the peak on January 13th, all that value has been given back.

(Click on image to enlarge)

Over the weekend, cryptotraders will be fighting hard to defend this critical level. Let's hope they don't drop it like it's hot.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more