DRAM Volatility Reflected In Micron Technology, Inc. (MU) Earnings: Analysts Weigh In

By Evan Goldstein

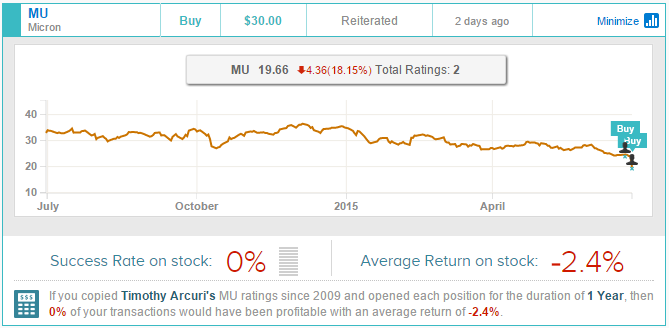

Due to disappointing earnings numbers on June 25, shares of Micron Technology, Inc. (MU) plumeted 18.15%, closing at $19.66 a share on June 26. Analysts estimated that Micron would post earnings per share of $ 0.58 while the actual EPS (non-GAAP) came in at $ 0.54 per share. While seemingly minor, this is a significant downgrade from the company’s EPS of $0.81 per share last quarter. Share prices have actually declined 30% since the beginning of the year and have dropped a further 15% since the earnings report. Furthermore, future guidance revealed an even lower EPS estimate as sales are predicted to fall once again. Thus, the fact that Micron did not meet expectations with an already underweight stock was a fearful prospect for many investors.

Micron is a manufacturer of DRAM, NAND, CMOS, and other semiconductor parts. These parts are needed for the production of PCs, tablets, and mobile devices. The price volatility of DRAM in particular has been a source of worry for investors and is cited as a factor in the underwhelming third quarter.

In fact, the cause of both the off-target estimates and the continuing decline of sales and profit are due to the internal and external problems associated with DRAM. The internal problems have to do with over-supply and the external problems have to with competition and the decreasing demand of personal computers. The price of DRAM has been volatile and has recently dropped, which, combined with a lower sales volume, contributed to Micron’s underwhelming earnings report.

Micron’s stock price has usually been associated with the price of DRAM chips, so anything affecting the chips will impact the stock price. Micron reported a 10% decline in the selling price of DRAM chips and weak sales volume. DRAM chips are essential to Micron’s business and the decline of the DRAM has left Micron vulnerable. Gross margins have been declining as well, limiting free cash flow and thus the growth potential of the company. This has not gone unnoticed by investors.

Yet even with the negative news, the falling share prices, and the difficulties in raising DRAM prices, many analysts remain optimistic. Some feel as though this is part of the life cycle of the DRAM market, and that the low price should not be taken seriously. Evidence for this outlook is found in the observation that Micron’s gross margins have had an enormous range and that a decline in the third quarter is not abnormal for the industry. Therefore, any price fluctuation should be taken with a grain of salt, with the more correct method being to observe the long term averages in instead of the short term fluctuations.

Cowen & Co analyst Timothy Arcuri, who had previously placed a buy rating on Micron, reiterated a buy rating on the stock on June 26. Arucri, who reasoned before the earnings report that Micron was still in the beginning of a “multi-year transformation with respect to execution, partnerships, and market dynamics,” seems to still have the long-term outlook on Micron. Further, Micron has been spending largely on DRAM chips for mobile phones and NAND chips that greatly exceed the capacity of the old ones.

Timothy Arcuri has rated Micron twice this year with no success and a -2.4% average loss per recommendation. Overall, he has a 59% success rate recommending stocks and a +16.0% average return per recommendation.

On the other hand, Joseph Moore of Morgan Stanley maintained an Underweight call on the stock on June 26. He commented, “Price weakness has spread to servers, as we had forecast, but we were surprised by DRAM costs rising in the August quarter, as production continues to be below our estimates due to the product transitions.” Moore desires to stay cautious on the volatile pricing which he believes will go lower in 2016 due to continued over-supply and unexpected high costs.

Joseph Moore has rated Micron six times. He has an average return of 93.1% on the stock while having a 100% success rate. Overall, he has a 53% success rate with an average return of 11.5%.

Disclosure: To see more, visit more