Dominion Vs. PPL: Which 4%+ Yielding Dividend Achiever Utility Is Better?

Dominion Resources (D) and PPL Corp. (PPL) have a lot in common. They are both in the utility sector, and both stocks have 4% dividend yields.

Plus, Dominion and PPL are both members of the Dividend Achievers list, a group of 272 stocks with 10+ years of consecutive dividend increases. You can see the full Dividend Achievers List here.

That said, not all utility stocks are created equal.

Dominion and PPL have slightly different business models. While PPL is a pure-play electric utility, Dominion has a large midstream energy transportation business.

That difference could make Dominion a better dividend growth stock moving forward.

This article will compare and contrast these two Dividend Achievers from the utility sector.

Business Overview

Dominion’s assets include 26,000 megawatts of electricity generation, 14,000 miles of natural gas pipelines, and 6,500 miles of electric transmission lines.

Dominion’s exposure to the energy transportation business is through Dominion Midstream (DM). Dominion owns the general partner, and approximately 65% of the limited partner, of Dominion Midstream.

2016 was a good year for both companies. Dominion’s reported, GAAP earnings-per-share increased 7.5% in 2016, to $3.44.

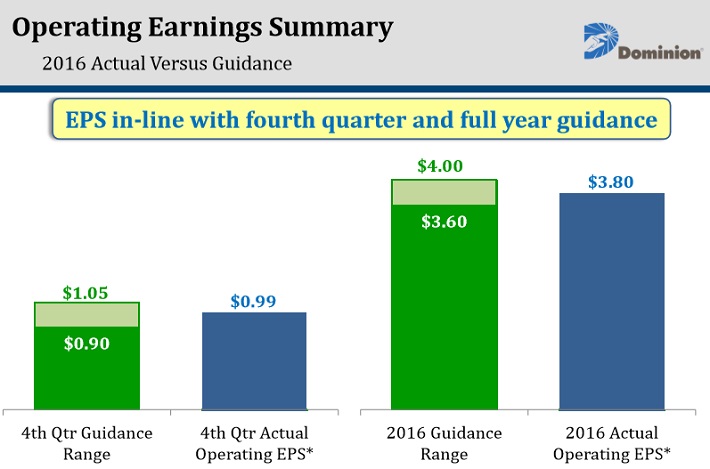

Source: 2016 Earnings Presentation, page 3

Operating earnings-per-share increased 10% to $3.80. Operating earnings-per-share is a non-GAAP which excludes non-recurring charges such as future ash pond and landfill closures.

PPL also had a very good year in 2016. Operating earnings-per-share rose 10% from the previous year. Growth was fueled by its regulated utility businesses.

PPL’s Kentucky and Pennsylvania regulated businesses increased earnings-per-share by 14% and 35%, respectively, in 2016.

In all, this was the seventh year in a row in which PPL exceeded the midpoint of its operating earnings guidance.

One disadvantage for PPL is its geographic focus. As the result of a $5 billion merger with a U.K. electricity distribution company several years ago, PPL has a significant U.K. business.

In fact, 61% of PPL’s operating earnings-per-share were derived from the U.K. regulated business last year. This was its slowest-growth segment in 2016.

Last year’s Brexit vote has resulted in elevated uncertainty and political risk for the European economy. This could be a headwind for PPL going forward.

And, its U.K. business exposes PPL to the strong U.S. dollar. Unfavorable currency effects and weakening economic growth caused PPL’s U.K. business to grow operating earnings by just 3% in 2016.

Growth Prospects

Dominion is likely to take a step back in 2017. Its growth will be limited, due to higher costs at its Millstone power plant.

This is expected to weigh on earnings this year. The company expects operating earnings-per-share to decline 4% at the midpoint of 2017 guidance.

That being said, Dominion expects growth to ramp up again in 2018 and beyond, as its Millstone issues are expected to be resolved this year.

Dominion management forecasts 10% growth in operating earnings-per-share in 2018, and 6%-8% annual growth in 2019 and 2020.

This growth will be driven by Dominion’s energy projects, such as its Cove Point Liquefaction development.

Source: 2016 Earnings Presentation, page 15

Another growth catalyst for Dominion is its Atlantic Coast Pipeline, of which it owns 48%. The Atlantic Coast project is scheduled to begin construction this year.

Source: 2016 Earnings Presentation, page 16

The project is set for completion in 2019, and should add significantly to the company’s cash flow.

For its part, PPL should also enjoy growth going forward, albeit at a lower rate than Dominion. PPL forecasts 5%-6% annual earnings growth from 2017-2020.

The main reason for PPL’s more muted growth forecast is because the company is about to enter a period of accelerated capital investment.

Source: 4Q Earnings Presentation, page 17

PPL intends to spend $16 billion over the next five years to modernize its assets and invest for the future. While this will likely pay off over the long-term, the next few years will likely see slower earnings growth rates.

Aside from internal investment, PPL is exposed to the strong U.S. dollar, which is also limiting its growth potential.

Source: 4Q Earnings Presentation, page 6

This is why PPL expects earnings-per-share to decline 12% in 2017, at the midpoint of its guidance.

Dividend Analysis

Dominion and PPL have similar current dividend yields. PPL has a slight edge over Dominion, 4.4% to 4.1%.

And, both companies have secure and sustainable payouts. Dominion and PPL maintained payout ratios of 79% and 65%, respectively, based on 2016 earnings-per-share.

But going forward, Dominion may have a significant advantage in terms of dividend growth.

Thanks largely to the contribution from Dominion Midstream and its energy growth projects, Dominion expects to raise its dividend by 8% each year in 2018 and beyond.

Meanwhile, before PPL’s recent 4% dividend increase, it had raised its dividend by fairly small amounts in the past several years.

Source: 4Q Earnings Presentation, page 4

By contrast, PPL is targeting 4% annual dividend growth through 2020, which would be roughly half Dominion’s projected dividend growth rate through the end of the decade.

As a result, Dominion could generate more income than PPL over the next several years.

This difference can be shown with yield on cost, which calculates how much income an investor receives each year, based on the original investment.

For example, an investor who buys Dominion and PPL today would receive an initial dividend yield of 4.1% and 4.4%, respectively.

Assuming Dominion lifts its dividend by 8% annually, and PPL increases its payout by 4% each year, each stock would have a yield on cost of 5.2% and 4.9%, respectively, by 2020.

Final Thoughts

Dominion and PPL have similar dividend yields for now, but Dominion could surpass PPL in terms of future dividend growth.

Dominion’s higher-growth midstream business gives its traditionally stodgy electricity business a boost.

Both stocks are attractive picks for income investors, as they each have a dividend yield that more than doubles the average yield in the S&P 500.

But PPL’s future growth could continue to be inhibited by its U.K. operations. And, Dominion’s energy transportation business gives it an added bonus.

In this head-to-head matchup of two industry leaders, Dominion may be the better pick of the two for its higher dividend growth.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more